An ad from the 60 Plus Association draws a comparison between Wisconsin, where the ad claims “tough choices” were made to “balance the budget,” and Washington, where Rep. Tammy Baldwin (D) supported the Recovery Act and health care reform. But Gov. Scott Walker’s (R) “balanced” budget relied on delayed payments and didn’t conform to the accounting standards he promised he would use, while the Affordable Care Act reduces the federal deficit and the Recovery Act helped avert an even more devastating recession.

Wisconsin’s “Tough Choices”

Gov. Scott Walker’s Budget Bill Cut Education And Health Care Funding And Trampled Union Rights. From the New Yorker: “The bomb was a ‘budget-repair bill’ that foretold deep cuts in funding for education and health care, and effectively reduced the salaries of teachers and other government employees by an average of nine per cent. Most explosively, Walker proposed to strip public-sector unions of virtually all collective-bargaining rights. Public-safety unions—police, firefighters—were exempted from the new restrictions. (These unions, as many Democrats pointed out, tended to support Republicans.) Walker had campaigned on a platform of tax cuts and budget cuts, but he had never mentioned collective bargaining. Wisconsin, historically, is a strong union state. […] Walker never negotiated, and his budget-repair bill was passed with all its essentials intact.” [New Yorker, 3/5/12]

Short-Term Budget Was “Balanced” By Delaying Payments, Ultimately Costing Taxpayers More. From the Milwaukee Journal Sentinel: “Gov. Scott Walker’s administration released improved budget projections Thursday that would leave the state with a $154.5 million surplus a year from now. Coming less than four weeks before Walker’s June 5 recall election, the projections take the state from a previously estimated $143 million budget deficit in its main account through June 2013 to the surplus. A large chunk of the surplus is realized by delaying payments that will ultimately cost taxpayers more in interest. The budget numbers released Thursday do not account for a sizable shortfall in the state’s health programs for the poor that Walker’s administration says it will deal with through increased efficiencies and spending cuts. […] The projected surplus includes $78 million that was acquired by restructuring debt. A small amount of that comes from getting lower interest rates, but most of it comes from pushing off payments and allowing long-term interest costs to rise, according to the Legislative Fiscal Bureau.” [Milwaukee Journal-Sentinel, 5/10/12]

Walker Promised To Use Generally Accepted Accounting Principles, Not Gimmicks, To Balance Budgets, But His 2011-13 Budget Doesn’t Meet That Standard. From PolitiFact: “In 2010, when he ran to succeed Doyle, Walker made an explicit promise, on his campaign website: To ‘require the use of generally accepted accounting principles (GAAP) to balance every state budget, just as we require every local government and school district to do.’ […] The state budget, under the Wisconsin constitution, must be balanced. But the cash accounting method the state uses allows gimmicks to bring the budget into balance. […] Walker balanced the budget, and in a way that eliminated the state’s structural deficit, under the manner the state has long used. But GAAP, an accrual accounting method, is a tighter standard that counts future liabilities that flow from past budget actions. […] There’s a chart every two years in the state budget demonstrating the bottom line under GAAP. The chart in the Walker administration’s Budget in Brief shows that the 2011-13 budget was not close to balanced by that standard.” [PolitiFact.com, 11/16/11]

Recovery Act Created Millions Of Jobs, Boosted GDP, And Cut Taxes

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact.com, 2/17/10]

Affordable Care Act Savings Do Not ‘Cut’ Medicare Benefits

Affordable Care Act Reduces Future Medicare Spending, But “Does Not Cut That Money From The Program.” According to PolitiFact: “The legislation aims to slow projected spending on Medicare by more than $500 billion over a 10-year period, but it does not cut that money from the program. Medicare spending will increase over that time frame.” [PolitiFact.com, 6/28/12]

- CBO’s July Estimate Updates Medicare Cost Savings To $716 Billion. According to the Congressional Budget Office’s analysis of a bill to repeal the Affordable Care Act, repeal would have the following effects on Medicare spending: “Spending for Medicare would increase by an estimated $716 billion over that 2013–2022 period. Federal spending for Medicaid and CHIP would increase by about $25 billion from repealing the noncoverage provisions of the ACA, and direct spending for other programs would decrease by about $30 billion, CBO estimates. Within Medicare, net increases in spending for the services covered by Part A (Hospital Insurance) and Part B (Medical Insurance) would total $517 billion and $247 billion, respectively. Those increases would be partially offset by a $48 billion reduction in net spending for Part D.” [CBO.gov, 8/13/12]

GOP Plan Kept Most Of The Savings In The Affordable Care Act. According to the Washington Post’s Glenn Kessler: “First of all, under the health care bill, Medicare spending continues to go up year after year. The health care bill tries to identify ways to save money, and so the $500 billion figure comes from the difference over 10 years between anticipated Medicare spending (what is known as ‘the baseline’) and the changes the law makes to reduce spending. […] The savings actually are wrung from health-care providers, not Medicare beneficiaries. These spending reductions presumably would be a good thing, since virtually everyone agrees that Medicare spending is out of control. In the House Republican budget, lawmakers repealed the Obama health care law but retained all but $10 billion of the nearly $500 billion in Medicare savings, suggesting the actual policies enacted to achieve these spending reductions were not that objectionable to GOP lawmakers.” [WashingtonPost.com, 6/15/11, emphasis added]

Affordable Care Act Reduces The Deficit

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

“$2 Trillion” Refers To Approximate Gross Cost Of Insurance Provisions – Not ACA’s Impact On The Deficit

July 2012: CBO’s Updated Estimate For Gross Cost Of ACA Insurance Coverage Provisions Is $1.683 Trillion. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period. That net cost reflects the following: Gross costs of $1,683 billion for Medicaid, CHIP, tax credits, and other subsidies for the purchase of health insurance through the newly established exchanges (and related costs), and tax credits for small employers. […] Those gross costs are offset in part by $515 billion in receipts from penalty payments, the new excise tax on high-premium insurance plans, and other budgetary effects (mostly increases in tax revenues stemming from changes in employer-provided insurance coverage).” [CBO.gov, July 2012, internal citations removed]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

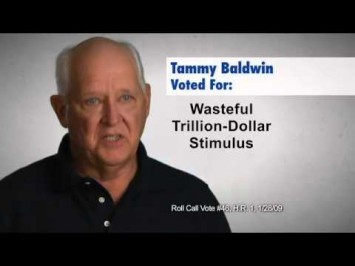

[WOMAN 1:] Wisconsin has been through a great deal the last few years. [MAN 1:] Wisconsin made some tough choices to balance the budget. [MAN 2:] I think we are moving in the right direction. [WOMAN 1:] Washington could learn so much from Wisconsin. [WOMAN 2:] Wisconsin needs to take a good look at Tammy Baldwin. [WOMAN 1:] Look at her record. [MAN 3:] Tammy Baldwin voted for the trillion-dollar stimulus. [MAN 2:] $700 billion in Medicare cuts. [MAN 4:] The health care law that could cost $2 trillion. [WOMAN 3:] Those tax dollars came from my pocket and your pocket. [MAN 4:] Tell Tammy Baldwin to follow Wisconsin’s lead. Stop the wasteful spending. [60 Plus Association via YouTube.com, 8/23/12]