An American Crossroads ad misrepresents Senator Bill Nelson’s (D-FL) voting record to suggest that he’s hurt Florida farmers. Crossroads mischaracterizes two votes as “massive tax hike[s] on Florida farmers,” both of which were votes against repealing the nation’s estate tax, which, in fact, affects less than 50 farms across the country.

Estate Tax Not “A Massive Tax Hike On Florida Farmers” Or Almost Anyone

The ad claims that Sen. Nelson “voted twice for a massive tax hike that would devastate Florida farms and ranches,” citing Vote #109 on March 23, 2007, and Vote #213 on July 21, 2010. Both votes were on proposals sponsored by Sen. Jim DeMint (R-SC) relating to the estate tax.

The Estate Tax Affects Less Than 0.2 Percent Of Estates, Fewer Than 50 Farms Nationally

Tax Policy Center Estimated Fewer Than 50 Small Farms Or Businesses In The Whole Country Would Pay Estate Tax In 2011. From the Tax Policy Center: “The top ten percent of income earners pays virtually all of the tax; over half is paid by the richest 1 in 1,000. Much of the political debate about the estate tax centers around its impact on family farms and small businesses. In fact, very few farms or businesses actually pay the tax. […] Less than 50 small farms and businesses – estates with farm and business assets making up at least half of gross estate and totaling $5 million or less – will pay any estate tax in 2011. Such estates will represent just 1.2 percent of all taxable estate tax returns.” [TaxPolicyCenter.org, accessed 9/20/12]

Less Than 0.2 Percent Of Estates Subject To Estate Tax. From CNNMoney: “This year, under the $5 million exemption level, less than 0.2% of those who die — or 3,600 estates — are likely to be affected by the estate tax, according to estimates from the independent Tax Policy Center.” [Money.CNN.com, 6/1/12]

Estate Tax Only Applies To Estates Over $5 Million. From CNNMoney: “This year, estates under $5 million are exempt from the tax. Amounts above that are taxed up to a top rate of 35%. Next year, barring congressional action, the exemption level falls to $1 million, and the top rate jumps to 55%. There will also be 5% surtax on a portion of very large taxable estates.” [Money.CNN.com, 6/1/12]

Even If Estate Tax Were Applied To All Estates Over $1 Million, Only 2 Percent Would Face Tax. From CNNMoney: “In 2013, if the exemption level falls to $1 million, the Center estimates that just 2% of folks who die that year — or 53,000 estates — would be subject to the estate tax. Combined, the tax on those estates could raise more than $40 billion.” [Money.CNN.com, 6/1/12]

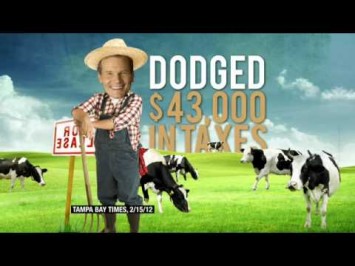

[NARRATOR:] After 40 years in politics, Bill Nelson’s learned how to milk the system. He leased land that he owned for six cows, taking advantage of an agricultural tax loophole that dodged $43,000 in taxes just last year. Then he sold the land for home development, pocketing at least $1.4 million. Worse: Nelson twice voted for a massive tax hike that would devastate Florida farms and ranches. Bill Nelson: tax breaks and big profits for him, higher taxes for the rest of us. American Crossroads is responsible for the content of this advertising. [American Crossroads via YouTube.com, 9/28/12]