The Congressional Leadership Fund attacks Democratic Congressional candidate Shelley Adler (NJ) for raising property taxes on Cherry Hill citizens three times. However, the ad fails to note that the votes in question were for entire township budgets, two of which the council approved unanimously, and that through her tenure Cherry Hill had the lowest tax rate of any municipality in Camden County. Additionally, the tax rate increases were largely attributed to state’s mismanagement of pension funds and the requirement that municipalities contribute additional money to cover the state shortfalls. Lastly, when the mayor attempted to increase the property tax levy by 22 percent in 2008 once the recession had begun, Adler was one of only two members who voted against the proposal.

Tax Claims Without Context: Cherry Hill Property Taxes Remained Lowest In County

To support the claim that “Adler voted to increase property taxes three times,” the ad cites Resolution 2008-1-47, Resolution 2007-1-33, and Resolution 2004-12-9.

Votes Cited By Ad Are Final Adoption Votes For Budgets, Not Specific Votes To Raise Taxes. Two of the budgets were adopted unanimously, according to the resolutions, and the third was passed with only one dissenting vote. [Cherry Hill Township Resolutions 2008-1-47, 2007-1-33, 2004-12-9; CherryHill.com, 1/19/07]

2008 Budget Kept Cherry Hill Tax Levy The Lowest In Camden County. According to CherryHill.com: “The budget was amended to cut about $400,000 as a means to reduce expenses in the township. ‘We tightened our belts by delaying the hiring of personnel, limiting the capital spending plan and garnering new cuts in operating expenses,’ [Mayor Bernie] Platt explained. ‘We also looked for other ways to create better business practices by making township personnel policy similar to the private sector’s policies.’ The 1.4-cent increase in the local purpose tax rate per every $100 of assessed property value will lead to a $19 increase per year for the owner of an average Cherry Hill home assessed at $140,000. Platt said Cherry Hill continues to maintain the lowest municipal tax rate of all 37 communities in Camden County.” [CherryHill.com, 1/25/08]

- Tax Increases Driven By State Mismanagement Of Pension Fund And Demands For Large Increase In Amount Of Money From Municipalities To Cover Shortfall. According to CherryHill.com: “Despite maintaining the lowest tax rate in Camden County, [Mayor Bernie] Platt said having to raise the rate because of the state’s decision to continue demanding more money to support pension shortfalls and cutting state aid to municipalities was disheartening. ‘The state is asking us for another million dollars this year on top of the $2.6 million we are already sending to Trenton for the pension system,’ he said. ‘It’s outrageous that the people of Cherry Hill are paying for what everyone knows was the state’s mismanagement and irresponsible fiscal policies.’” [CherryHill.com, 1/25/08]

Adler One Of Just Two Who Voted Against Raising The Tax Levy 22 Percent For FY 2008-2009 Budget. According to CherryHill.com: “Residents will be asked to pay more in municipal taxes under Town Council’s preliminary tax levy, which was introduced at its last meeting. While the 2008-2009 budget may not be finalized until the fall – when final state aid numbers are released – the increase will appear on July tax bills. The tax rate will increase 22 percent, or 13.6 cents per every $100 of assessed property value, officials said. That equates to approximately $150 more in taxes for the average Cherry Hill homeowner, with a house assessed at $140,000. The new tax rate will be 76.4 cents per every $100 of assessed property value, with the local tax levy jumping from $29 million to $35 million. Cherry Hill’s budget cycle, unlike many other municipalities, is based on a fiscal year rather than a calendar year. The township’s fiscal year begins in July. Township Communications Director Dan Keashen said the preliminary levy could be finalized in November, at which time property tax bills for the second half of the fiscal year could be adjusted. The proposal was passed by a vote of 5-2. Council members Frank Falcone and Shelley Adler cast the dissenting votes.” [CherryHill.com, 6/7/08]

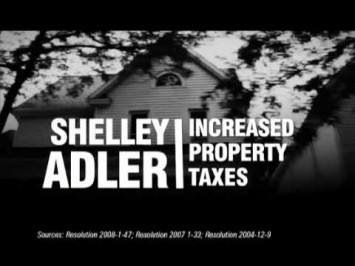

[NARRATOR:] Tax increases. That’s what you’ll get with Shelley Adler. [ADLER:] “If I did vote for increasing taxes, I’m sure it was related to the budget of the town council at the time.” [NARRATOR:] Well, you did Shelley. As a Cherry Hill councilwoman, Adler voted to increase property taxes three times. [ADLER:] “There are times the council has to raise taxes.” [NARRATOR:] Not in this economy, Shelley. Protect your money. Keep Shelley Adler out of Congress. Congressional Leadership Fund is responsible for the content of this advertising. [Congressional Leadership Fund via YouTube.com, 10/22/12]