Eager to capitalize on high gas prices, Crossroads GPS put out an ad that blames President Obama’s policies for rising energy costs. Yet it’s Crossroads that’s ‘deflecting’ the truth about gas prices, which are determined by global market forces beyond the control of the president. Moreover, domestic oil production is at its highest in nearly a decade and American oil exports are at their highest ever, belying Crossroads’ accusation that Obama’s “bad energy policies” are to blame.

Gas Trends Show Obama Isn’t To Blame For Higher Gas Prices

Gas Prices Collapsed During The Recession, And Began To Rise Again Just Before President Obama Took Office. Below is a chart of Energy Information Administration data on average pump prices for a gallon of gasoline since 2006:

[EIA.gov, accessed 2/23/12]

U.S. Gas Prices Have Followed The Same Trend As Global Gas Prices. The following graph from the New York Times illustrates the price per gallon of gasoline in the United States, Britain, Germany, and France between 1996 and October 2011:

[New York Times, 3/17/12]

Domestic Policy Has Little Impact On Gas Prices

Gas Prices Are Determined By Global Markets. From the Wall Street Journal: “U.S. gasoline prices, like prices throughout the advanced economies, are determined by global market forces. It is hard to see how Mr. Obama’s policies can be blamed. […] When Mr. Obama was inaugurated, demand was weak due to the recession. But now it’s stronger, and thus the price is higher. What’s more, producing a lot of oil doesn’t lower the price of gasoline in your country. According to the U.S. Energy Information Administration, Germans over the past three years have paid an average of $2.64 a gallon (excluding taxes), while Americans paid $2.69, even though the U.S. produced 5.4 million barrels of oil per day while Germany produced just 28,000.” [Wall Street Journal, 3/10/12]

Energy Information Administration Head: “Globally Integrated Nature Of The World Oil Market” And Influence Of OPEC Means That Domestic Oil Drilling “Not Have A Large Impact On Prices.” At a hearing of the House Committee on Natural Resources, Richard Newell, Administrator of the U.S. Energy Information Administration, testified: “Long term, we do not project additional volumes of oil that could flow from greater access to oil resources on Federal lands to have a large impact on prices given the globally integrated nature of the world oil market and the more significant long-term compared to short-term responsiveness of oil demand and supply to price movements. Given the increasing importance of OPEC supply in the global oil supply-demand balance, another key issue is how OPEC production would respond to any increase in non-OPEC supply, potentially offsetting any direct price effect.” [EIA.gov, 3/17/11]

Gas Price Expert: Speculators Are Driving Current Rise In Gas Prices. From Businessweek: “Strangely, the current run-up in prices comes despite sinking demand in the U.S. ‘Petrol demand is as low as it’s been since April 1997,’ says Tom Kloza, chief oil analyst for the Oil Price Information Service. ‘People are properly puzzled by the fact that we’re using less gas than we have in years, yet we’re paying more.’ Kloza believes much of the increase is due to speculative money that’s flowed into gasoline futures contracts since the beginning of the year, mostly from hedge funds and large money managers. ‘We’ve seen about $11 billion of speculative money come in on the long side of gas futures,’ he says. ‘Each of the last three weeks we’ve seen a record net long position being taken.’” [Businessweek, 2/14/12]

GOP Economist Holtz-Eakin In 2011: Rising Gas Prices Were “Inevitable” Component Of Recovery From “Massive Global Recession.” On CNN’s State of the Union in March 2011, Republican economist and former Congressional Budget Office director Douglas Holtz-Eakin said: “I think there are three lessons on the oil and gas front. Lesson number one is we have oil at $140 a barrel in 2008. And it went down not because we somehow discovered a lot more oil. No, it went down because we went into a massive global recession. As economies recovered, it was inevitable that prices were going to rise. And this was utterly foreseeable. Second piece is that Libya’s not really the concern. That’s not what markets are pricing. It’s the broader Middle East. Libya is 2% of oil supplies. That’s not our problem. It’s what happens in the rest of the Middle East. And the third is, something like this is always going to happen. There is always some piece of bad news out there. So, the key should be to build an economy that’s growing more robustly, it’s more resilient to bad news that inevitably will happen.” [State of the Union, 3/27/11]

The Keystone Pipeline Wouldn’t Reduce Gas Prices

Amount Of Oil Provided To U.S. Markets By Keystone XL Would Save Consumers Just 3 Cents Per Gallon. From Businessweek: “The gas price argument rests on the bump in supply the Keystone XL will bring to market. Keystone XL would deliver around 830,000 barrels a day. Not all of that would be used in the U.S., however: The pipeline delivers to a tariff-free zone, so there’s a financial incentive to export at least some of this oil. This is especially true because area refineries are primed to produce diesel, for which there’s less stateside demand. But let’s say two-thirds of the capacity—half a million barrels a day—of Keystone oil stays in the U.S. That’s a convenient estimate on which to gauge the impact of Keystone oil, because it’s the supply increase the U.S. Energy Information Administration, which provides independent data on energy markets, expected in a recent study of the expiration of offshore drilling bans. In 2008, it studied what 500,000 barrels more per day would save consumers at the pump: 3¢ a gallon.” [Businessweek, 2/17/12]

TransCanada Itself Says Keystone XL Could Raise Gas Prices For Midwestern U.S. From an op-ed by journalist and environmental activist Bill McKibben in The Hill: “But in the case of the Keystone pipeline, it turns out there’s a special twist. At the moment, there’s an oversupply of tarsands crude in the Midwest, which has depressed gas prices there. If the pipeline gets built so that crude can easily be sent overseas, that excess will immediately disappear and gas prices for 15 states across the middle of the country will suddenly rise. Says who? Says the companies trying to build the thing. Transcanada Pipeline’s rationale for investors, and their testimony to Canadian officials, included precisely this point: removing the ‘oversupply’ and the resulting ‘price discount’ would raise their returns by $2 to $4 billion a year.” [McKibben Op-Ed, The Hill, 2/21/12]

No Enemy Of Energy: Under Obama, U.S. Oil Production And Exports Are Up

U.S. Crude Oil Production Is At Its Highest In A Decade. According to the Energy Information Administration, U.S. field production of crude oil in May 2012 (the latest data available) was 194,227,000 barrels, and it has been over 180 million barrels per month in every month since October 2011. Prior to October 2011, the last time monthly oil production was over 180 million barrels was in March 2003. [EIA.gov, 7/30/12]

Domestic Liquid Fuel Production Is Higher Than At Any Point During The Bush Administration. The following New York Times graphic illustrates the amount of crude oil and other liquid fuels produced during the Bush administration and the Obama administration, in millions of barrels per day:

[New York Times, 3/17/12]

Under Obama, Oil Exports Are At Their Highest Ever. According to data from the U.S. Energy Information Administration (EIA), 110,028,000 barrels of oil were exported from the U.S. in December 2011, the highest number the EIA has in its records. Exports in May 2012, the latest data available, remained higher than at any point prior to the start of the Obama administration at 98,999,000 barrels. The following graph from the EIA depicts the monthly exports of U.S. exports of crude oil and petroleum products since 1981:

[EIA.gov, 7/30/12]

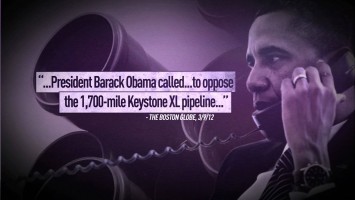

[NARRATOR:] Then and now. The difference? President Obama’s administration restricted oil production in the Gulf, limited development of American oil shale, and Obama personally lobbied to kill a pipeline bringing oil from Canada. Even now, instead of helping– [VIDEO OF REPORTER MAJOR GARRETT:] At the White House for three weeks, the word has been deflector shield on gas prices; put up the deflector shield. [NARRATOR:] The president’s playing politics. Tell President Obama, bad energy policies mean energy prices we can’t afford. Crossroads GPS is responsible for the content of this advertising. [Crossroads GPS via YouTube.com, 3/21/12]