Crossroads GPS attacks Rep. Joe Donnelly (D-IN) for supporting two “trillion-dollar” bills, citing his votes for the Affordable Care Act and the Recovery Act. But the health care law actually reduces deficits, while tax cuts accounted for about one-third of the Recovery Act’s price tag. In addition to creating jobs and helping prevent an even deeper recession, the recovery bill cut taxes for up to 95 percent of working Americans.

Affordable Care Act Reduces The Deficit

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

$1 Trillion Refers To Cost Of Insurance Provisions – Not ACA’s Impact On The Deficit

July 2012: CBO’s Updated Estimate For Cost Of ACA Insurance Coverage Provisions Is $1.168 Trillion. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period. That net cost reflects the following: Gross costs of $1,683 billion for Medicaid, CHIP, tax credits, and other subsidies for the purchase of health insurance through the newly established exchanges (and related costs), and tax credits for small employers. […] Those gross costs are offset in part by $515 billion in receipts from penalty payments, the new excise tax on high-premium insurance plans, and other budgetary effects (mostly increases in tax revenues stemming from changes in employer-provided insurance coverage).” [CBO.gov, July 2012, internal citations removed]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

Recovery Act Created Millions Of Jobs, Boosted GDP, And Cut Taxes

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact.com, 2/17/10]

- Obama Has Cut Taxes For Up To “95 Percent Of Working Families.” According to FactCheck.org: “Obama has lowered taxes for all workers through a 2 percentage point reduction in the Social Security payroll tax that started in 2011 and is scheduled to continue through the end of 2012. The cut is equal to $1,000 this year for a worker making $50,000 a year — or as much as $2,202 to any worker earning at least the maximum taxable level of wages or salary ($110,100 for 2012). Obama had previously signed a tax cut that benefited nearly all working families and was in effect from 2009 through 2010. The ‘Making Work Pay’ tax credit was part of the stimulus bill he signed shortly after taking office. That credit was worth a maximum of $400 per person, or $800 for couples during those years. It phased out at higher income levels, and so its benefit went entirely to individuals making less than $95,000 a year, or couples making less than $190,000. The White House figures it went to ‘95 percent of working families.’ And even allowing for those who are retired or unemployed, it benefited more than 75 percent of all individuals and families, working or not, according to the nonpartisan Tax Policy Center.” [FactCheck.org, 5/17/12]

Failure To Raise The Debt Ceiling Could Have Had Severe Economic Consequences

Debt Ceiling Does Not Determine U.S.’ Debt Level; It Is “A Limit On The Ability Of The Federal Government To Pay Obligations Already Incurred.” According to the Government Accountability Office: “The debt limit does not control or limit the ability of the federal government to run deficits or incur obligations. Rather, it is a limit on the ability to pay obligations already incurred. While debates surrounding the debt limit may raise awareness about the federal government’s current debt trajectory and may also provide Congress with an opportunity to debate the fiscal policy decisions driving that trajectory, the ability to have an immediate effect on debt levels is limited” [GAO.gov, 2/22/11]

Failure To Raise Debt Ceiling Could Have Resulted In Default Or Had Other Severe Economic Consequences. From CNNMoney: “A failure to raise the debt ceiling would likely send shockwaves through the underpinnings of the financial system — and possibly ripple out to individual investors and consumers. The federal government would be forced to prioritize its payments. It would risk defaulting on its financial obligations. And if that happens, credit rating agencies would downgrade U.S. debt.” [Money.CNN.com, 7/21/11]

Debt Limit Has Been Raised Over 90 Times Since 1940. From the Center on Budget and Policy Priorities: “Before World War I, Congress generally had to approve each separate issuance of federal debt. Since then, the limit has evolved into an overall dollar cap on the amount of debt the federal government can incur. Since 1940, Congress has enacted 91 separate increases in the statutory debt limit, an average of one every nine months (though individual increases lasted anywhere from three days to eight years).” [CBPP.org, 7/21/11]

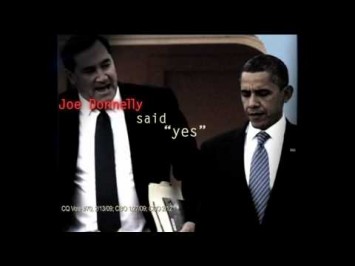

[NARRATOR:] When he went to Washington, Joe Donnelly promised to resist pressure from all sides to increase spending or to increase taxes. But when President Obama needed Donnelly’s vote to pass his trillion-dollar health care bill, Donnelly said ‘yes.’ When Obama needed his vote to pass his trillion-dollar stimulus, Donnelly said ‘yes.’ And five times Donnelly voted to raise the debt limit by $5 trillion. So why would Donnelly vote any different if we gave him a promotion? Crossroads GPS is responsible for the content of this advertising. [Crossroads GPS via YouTube.com, 09/20/12]