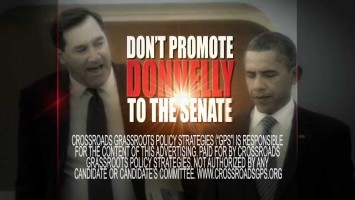

Crossroads GPS attacks Rep. Joe Donnelly (D-IN), who is running for Senate, over his votes in favor of a 2009 budget plan and the Affordable Care Act, which the ad suggests are harmful to small businesses. The non-binding budget resolution Donnelly supported cut taxes for middle- and lower-class Americans while letting the Bush tax cuts expire on top earners, few of whom are small businesses. The Affordable Care Act, meanwhile, contains tax credits for small businesses.

Donnelly Voted For A Plan To Let Tax Breaks For Top Earners Expire

The ad cites CQ Vote #216 on April 29, 2009, in which the House passed a budget plan for fiscal year 2010.

House And Senate Passed Non-Binding Budget Outline Similar To Obama’s Proposal. From the Associated Press: “Acting with unusual speed, the House on Wednesday adopted a $3.4 trillion budget outline that endorses much of President Barack Obama’s ambitious agenda while permitting the national debt to continue to spiral higher. […] The budget measure is a nonbinding outline for follow-up tax and spending legislation. It is Congress’ response to Obama’s $3.6 trillion budget plan released in late February.” [Associated Press via RealClearPolitics.com, 4/29/09]

- Budget Outline Proposed To Let Tax Cuts Expire For Top Earners. From PBS: “The $3.5 trillion plan is a nonbinding guideline for how to spend federal money and where that money will come from. […] The budget includes money for energy, education and includes money for the wars in Iraq and Afghanistan. The plan also raises the tax rate on Americans making more than $200,000 a year, after 2010. It maintains tax cuts for middle class taxpayers put in place by President George W. Bush, according to the Associated Press.” [PBS.org, 10/30/09]

Obama’s 2009 Budget Proposed Using Additional Revenue From Corporations And The Wealthy To Fund New Investment. From the Washington Post: “President Obama delivered to Congress yesterday a $3.6 trillion spending plan that would finance vast new investments in health care, energy independence and education by raising taxes on the oil and gas industry, hedge fund managers, multinational corporations and nearly 3 million of the nation’s top earners. The blueprint, meanwhile, would overhaul programs across the federal bureaucracy to strengthen assistance for millions of people who have borne the consequences of what Obama called ‘an era of profound irresponsibility,’ helping them pay for college, train for better jobs and save for retirement while taking less of their earnings in taxes.” [Washington Post, 2/27/09]

Around Half Of “Tax Hikes” In Obama’s Budget Proposal Came From Letting Bush Tax Cuts Expire On Top Brackets. From the Washington Post: “Of the $1.3 trillion in new taxes Obama proposes to levy over the next decade, about half would be generated by simply letting the Bush tax cuts expire for high earners.” [Washington Post, 3/7/09]

Obama’s Budget Proposal Cut Taxes For Middle And Lower Classes. From USA Today: “President Obama’s sweeping budget outline, released Thursday, would raise taxes on the wealthy as it offers a range of cash-saving initiatives for the middle and lower classes. It touches broadly on the typical household budget — from retirement savings and health care costs to college tuition. The plan ‘means a lot of good news for both middle-class families who have been struggling to keep their heads above water and now are in danger of sinking, as well as working-class and lower-class Americans whose heads haven’t been above water for some time,’ says William Galston senior fellow at the Brookings Institution, a research and public policy institute.” [USA Today, 2/27/09]

Few Top Income Taxpayers Are Actual “Small Businesses”

CBPP: “Only 2.5 Percent Of Small Business Owners Face The Top Two Rates.” According to the Center on Budget and Policy Priorities: “Allowing the top two marginal tax rates to return to pre-2001 levels as scheduled next year would affect very few small businesses, a recent Treasury Department study found. The study shows that only 2.5 percent of small business owners face the top two rates.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

Many Small Businesses Are Eligible For Tax Credits Under The Affordable Care Act

Affordable Care Act Offers Tax Credits To Many Small Businesses. According to a report from Small Business Majority and Families USA: “Congress included in the Affordable Care Act a significant new tax credit for small business owners who provide their workers with health insurance. Under this new tax credit, businesses that have fewer than 25 full-time workers and average wages of less than $50,000 are now eligible to receive a tax credit of up to 35 percent of the cost of the health insurance that they provide for their workers. To qualify for the tax credit, small businesses must cover at least 50 percent of each employee’s health insurance premiums. In 2014, the size of the credit will increase to cover up to 50 percent of the cost of health insurance provided to workers.” [SmallBusinessMajority.org, May 2012]

- More Than 3.2 Million Small Businesses Eligible For ACA Tax Credit. According to a report from Small Business Majority and Families USA: “Our analysis found that more than 3.2 million small businesses, employing 19.3 million workers across the nation, will be eligible for this tax credit when they file their 2011 taxes. In total, these small businesses are eligible for more than $15.4 billion in credits for the 2011 tax year alone, an average of $800 per employee.” [SmallBusinessMajority.org, May 2012]

ACA Requires Businesses With More Than 50 Employees To Provide Affordable Coverage Or Pay A Fee. According to a report from Small Business Majority and FamiliesUSA: “While the Affordable Care Act created this new tax credit to help small business owners and workers, it does not force these small business owners to provide coverage for their workers. There are no employer mandates in the law, and there are no employer responsibility requirements at all for businesses with fewer than 50 workers, which account for 96 percent of all firms in the United States. Starting in 2014, businesses with 50 or more workers that do not offer coverage or that offer only unaffordable coverage to their workers will be assessed a fee if one or more of their workers receives a federal individual premium tax credit to purchase coverage in an exchange.” [SmallBusinessMajority.org, May 2012]

[NARRATOR:] Indiana’s unemployment rate is stuck above the national average. What’s Joe Donnelly’s jobs plan? Donnelly voted for President Obama’s budget, including $1 trillion in tax hikes, higher taxes on small businesses. He voted for Obamacare, saddling small businesses with more job-killing taxes. When we needed him to fight for jobs, Joe Donnelly voted with Barack Obama, so why would he vote any differently if we gave him a promotion? Crossroads GPS is responsible for the content of this advertising. [Crossroads GPS, 10/16/12]