A Crossroads GPS ad attacks Sen. Sherrod Brown (D-OH) by tying him to President Obama’s agenda, in the process leaving viewers with the wrong picture of the deficit-reducing Affordable Care Act and the American Jobs Act, the latter of which would have been financed by a surtax on millionaires. The ad also misleads on Brown’s vote to invoke cloture on an early version of climate change legislation, failing to mention that he was joined by a majority of Senate Republicans and relying on analysis from the conservative Heritage Foundation to represent the bill as a job-killer.

Affordable Care Act Reduces The Deficit

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

FactCheck.org : GOP’s Claim That Obamacare Adds $700 Billion To The Deficit Relies On Faulty “Partisan Analysis.” As FactCheck.org explains, the claim that the Affordable Care Act increases the deficit by $700 billion “relies on a partisan analysis by the House Budget Committee’s Republicans” and depends on false premises:

- It rests largely on a claim that hundreds of billions of dollars in projected Medicare savings are being “double-counted.” But CBO is simply not doing that.

- The GOP’s $700 billion figure also includes more than $200 billion for a permanent “doctor fix” to prevent a cut in Medicare payments to doctors. But that is not even a part of the new law, and many Republicans endorse the “doctor fix” anyway.

- The GOP claims the law will cost $115 billion to administer, but that isn’t true. CBO actually puts those costs at roughly $10 billion to $20 billion over the next 10 years. [FactCheck.org, 1/19/11]

Affordable Care Act Savings Do Not ‘Cut’ Medicare Benefits

When the ad refers to “budget-busting Obamacare,” on-screen text asserts that the Affordable Care Act “cuts $500 billion from Medicare spending.”

Affordable Care Act Reduces Future Medicare Spending, But “Does Not Cut That Money From The Program.” According to PolitiFact: “The legislation aims to slow projected spending on Medicare by more than $500 billion over a 10-year period, but it does not cut that money from the program. Medicare spending will increase over that time frame.” [PolitiFact.com, 6/28/12]

GOP Plan Kept Most Of The Savings In The Affordable Care Act. According to the Washington Post’s Glenn Kessler: “First of all, under the health care bill, Medicare spending continues to go up year after year. The health care bill tries to identify ways to save money, and so the $500 billion figure comes from the difference over 10 years between anticipated Medicare spending (what is known as ‘the baseline’) and the changes the law makes to reduce spending. […] The savings actually are wrung from health-care providers, not Medicare beneficiaries. These spending reductions presumably would be a good thing, since virtually everyone agrees that Medicare spending is out of control. In the House Republican budget, lawmakers repealed the Obama health care law but retained all but $10 billion of the nearly $500 billion in Medicare savings, suggesting the actual policies enacted to achieve these spending reductions were not that objectionable to GOP lawmakers.” [WashingtonPost.com, 6/15/11, emphasis added]

The Tax In The American Jobs Act Only Applied To Millionaires And Would Have Paid To Create Millions Of Jobs

The ad cites CQ Vote #160 on October 11, 2011, in which the Senate voted against proceeding on S. 1660, Senate Democrats’ version of the American Jobs Act of 2011.

The American Jobs Act Contained A Millionaires’ Surtax That Would Have Raised $453 Billion. From The Hill: “The Congressional Budget Office on Friday confirmed that President Obama’s jobs bill would be fully paid for over ten years and also gave its seal of approval to Senate Democrats’ version that includes a surtax on millionaires. […] The Senate Democrats’ bill, which replaces Obama’s taxes on the upper middle class with a 5.6 percent surtax on those with annual incomes above $1 million, raises $453 billion over ten years and reduces deficits by $6 billion. The tax kicks in in 2013.” [The Hill, 10/7/11]

The American Jobs Act Would Have Cut Payroll Taxes Both For Workers And For Employers. From the Congressional Budget Office: “Both bills would reduce payroll taxes for employees and employers. Both bills would also provide businesses with accelerated deductions for the costs of certain investments.” [CBO.gov, 10/7/11]

Zandi: American Jobs Act Would Add Nearly 2 Million Jobs And Boost The Economy 2 Percent. From UPI: “President Barack Obama’s $447 billion job-creation plan would likely add 1.9 million payroll jobs and grow the U.S. economy 2 percent, a leading economist said. The plan, which Obama outlined before a joint session of Congress Thursday, would likely cut the unemployment rate by a percentage point, Moody’s Analytics Chief Economist Mark Zandi said as Obama prepared to tout the plan at Virginia’s University of Richmond.” [UPI.com, 9/9/11]

Macroeconomic Advisers Also Estimated American Jobs Act Would Reduce Unemployment And Increase GDP. According to Macroeconomic Advisers, the American Jobs Act “would give a significant boost to GDP and employment over the near-term. […] The various tax cuts aimed at raising workers’ after-tax income and encouraging hiring and investing, combined with the spending increases aimed at maintaining state & local employment and funding infrastructure modernization, would: Boost the level of GDP by 1.3% by the end of 2012, and by 0.2% by the end of 2013 [and] Raise nonfarm establishment employment by 1.3 million by the end of 2012 and 0.8 million by the end of 2013, relative to the baseline.” [Macroadvisers.Blogspot.com, 9/8/11, emphasis original]

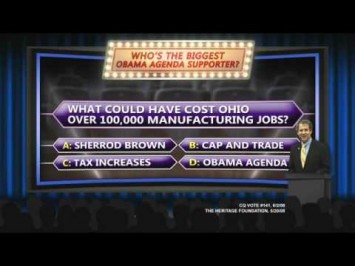

Job-Loss Estimate For Bipartisan Cap-And-Trade Bill Comes From Right-Wing Heritage Foundation

The ad cites CQ Vote #141 on June 2, 2008, in which the Senate agreed to cloture on S. 3036, the Lieberman-Warner Climate Security Act of 2008.

A Majority Of Republican Senators Voted For Cloture On The Climate Security Act. The cloture vote on the Climate Security Act of 2008 passed the Senate 74 to 14, with 32 out of the 49 Republicans in the Senate voting in favor. Only 13 Republicans voted “nay,” and another four didn’t vote. [S. 3036, Vote #141, 6/2/08]

The Ad’s Job-Loss Estimate Is Based On A Heritage Foundation Report. The ad cites a May 20, 2008, Heritage Foundation report that estimates Ohio would lose 111,697 manufacturing jobs under a version of the Lieberman-Warner Climate Security Act. [Heritage.org, 5/20/08]

Analysis Suggests A Cap-And-Trade Policy Would Impact Jobs Far Less Than Other Forces Already At Play. From an Environmental Defense Fund analysis of five models used to predict the impacts of climate change legislation: “We stated that addressing global warming will not be free. What is more surprising is how affordable it will be – even if we take ambitious steps to curb our emissions. The guidance offered by models strongly suggests that the impact of climate policy will be a far less significant factor than other dynamic forces that drive jobs and growth. The bottom line from these economic forecasts is that any drag on the economy from climate policy will be insignificant, and very possibly too small to measure.” [EDF.org, 2008]

CAP: “Climate Security Act Would Create Tens Of Thousands Of New Clean-Energy Jobs” And Protect Current Energy Jobs Against Offshoring. From the Center for American Progress: “The Climate Security Act would create tens of thousands of new clean-energy jobs. In addition to making clean energy more economically attractive, the bill would invest billions of dollars in efficiency and renewables. The bill includes $150 billion for renewable energy investments alone. If this sum were equally divided into $50 billion each for investments in wind, concentrated solar, and geothermal, we estimate that by 2050 it would generate a total of 81 billion kilowatt-hours of wind-powered electricity, which could power approximately 7.7 million homes and create 42,000 jobs; 52 billion kWh of concentrated solar electricity, which could power about 5 million homes and create 5,600 jobs; and 131 billion kWh of geothermal electricity, which could power about 12.4 million homes and create 71,000 jobs. The bill would also protect workers in high carbon-emitting fields from losing their jobs overseas to nations that do not reduce their global warming pollution. The Climate Security Act includes a provision that would require imports from nations that do not have a comparable system of greenhouse gas reductions to pay an excess emissions penalty after 2015.” [AmericanProgress.org, 5/30/08]

[NARRATOR:] It’s time to play “Who’s The Biggest Supporter Of The Obama Agenda In Ohio?” It’s Sherrod Brown! Brown backed Obama’s agenda a whopping 95 percent of the time. He voted for budget-busting Obamacare that adds $700 billion to the deficit, for Obama’s $453 billion tax increase, and even supported cap-and-trade, which could have cost Ohio over 100,000 jobs. Tell Sherrod Brown: For real job growth, stop spending and cut the debt. Support the New Majority Agenda at NewMajorityAgenda.org. [Crossroads GPS via YouTube.com, 7/10/12]