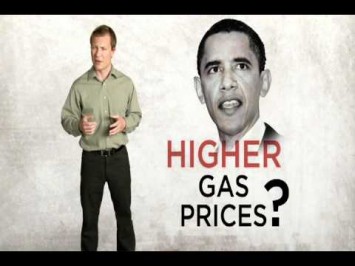

Let Freedom Ring would have you believe President Obama is intentionally raising gas prices, and even implies that if it weren’t for him we’d be seeing pump prices under $2 per gallon. To do so they spin several fictions: that gas prices are determined by presidents and not a global market; that the recession that brought pump prices so low in late 2008 never happened; and that the administration is seeking European price levels for gasoline, when they are not.

Gas Trends Show Obama Isn’t To Blame For Higher Prices

Gas Prices Collapsed During The Recession, And Began To Rise Again Just Before President Obama Took Office. Below is a chart of Energy Information Administration data on average pump prices for a gallon of gasoline since 2006:

[EIA.gov, accessed 2/23/12]

U.S. Gas Prices Have Followed The Same Trend As Global Gas Prices. The following graph from the New York Times illustrates the price per gallon of gasoline in the United States, Britain, Germany, and France between 1996 and October 2011:

[New York Times, 3/17/12]

Gas Prices May Fall Below $3 By Fall 2012. According to USA Today: “The darkening clouds of the slowing economy could provide a bright spot for consumers: gasoline at $3 a gallon — or less — by autumn. Nationally, regular gasoline averages $3.47 a gallon, down 47 cents from this year’s high in April and well below the $5-a-gallon fears fanned earlier this year by energy speculators, Middle East tensions and oil refinery glitches that crimped supplies. Those issues appear to be over, at least for now.” [USA Today, 6/21/12]

Domestic Policy Has Little Impact On Gas Prices

Gas Prices Are Determined By Global Markets. From the Wall Street Journal: “U.S. gasoline prices, like prices throughout the advanced economies, are determined by global market forces. It is hard to see how Mr. Obama’s policies can be blamed. […] When Mr. Obama was inaugurated, demand was weak due to the recession. But now it’s stronger, and thus the price is higher. What’s more, producing a lot of oil doesn’t lower the price of gasoline in your country. According to the U.S. Energy Information Administration, Germans over the past three years have paid an average of $2.64 a gallon (excluding taxes), while Americans paid $2.69, even though the U.S. produced 5.4 million barrels of oil per day while Germany produced just 28,000.” [Wall Street Journal, 3/10/12]

Energy Information Administration Head: “Globally Integrated Nature Of The World Oil Market” And Influence Of OPEC Means That Domestic Oil Drilling “Not Have A Large Impact On Prices.” At a hearing of the House Committee on Natural Resources, Richard Newell, Administrator of the U.S. Energy Information Administration, testified: “Long term, we do not project additional volumes of oil that could flow from greater access to oil resources on Federal lands to have a large impact on prices given the globally integrated nature of the world oil market and the more significant long-term compared to short-term responsiveness of oil demand and supply to price movements. Given the increasing importance of OPEC supply in the global oil supply-demand balance, another key issue is how OPEC production would respond to any increase in non-OPEC supply, potentially offsetting any direct price effect.” [EIA.gov, 3/17/11]

Gas Price Expert: Speculators Are Driving Current Rise In Gas Prices. From Businessweek: “Strangely, the current run-up in prices comes despite sinking demand in the U.S. ‘Petrol demand is as low as it’s been since April 1997,’ says Tom Kloza, chief oil analyst for the Oil Price Information Service. ‘People are properly puzzled by the fact that we’re using less gas than we have in years, yet we’re paying more.’ Kloza believes much of the increase is due to speculative money that’s flowed into gasoline futures contracts since the beginning of the year, mostly from hedge funds and large money managers. ‘We’ve seen about $11 billion of speculative money come in on the long side of gas futures,’ he says. ‘Each of the last three weeks we’ve seen a record net long position being taken.’” [Businessweek, 2/14/12]

GOP Economist Holtz-Eakin In 2011: Rising Gas Prices Were “Inevitable” Component Of Recovery From “Massive Global Recession.” On CNN’s State of the Union in March 2011, Republican economist and former Congressional Budget Office director Douglas Holtz-Eakin said: “I think there are three lessons on the oil and gas front. Lesson number one is we have oil at $140 a barrel in 2008. And it went down not because we somehow discovered a lot more oil. No, it went down because we went into a massive global recession. As economies recovered, it was inevitable that prices were going to rise. And this was utterly foreseeable. Second piece is that Libya’s not really the concern. That’s not what markets are pricing. It’s the broader Middle East. Libya is 2% of oil supplies. That’s not our problem. It’s what happens in the rest of the Middle East. And the third is, something like this is always going to happen. There is always some piece of bad news out there. So, the key should be to build an economy that’s growing more robustly, it’s more resilient to bad news that inevitably will happen.” [State of the Union, 3/27/11]

Obama And Secretary Chu Are Not Trying To Raise Gas Prices

Chu Has Recanted His 2008 Comment About Boosting Gas Prices To European Levels. From USA Today: “Energy secretary has withdrawn a 2008 statement that Republicans have used ever since to bash the administration over high gas prices. The statement: ‘Somehow we have to figure out how to boost the price of gasoline to the levels in Europe.’ During a Senate hearing yesterday, Chu said, ‘I no longer share that view,’ because of the fragile state of the economy.” [USA Today, 3/14/12]

- Chu: “There Are Many, Many Reasons Why We Do Not Want The Price Of Gasoline To Go Up.” From USA Today: “After yesterday’s Senate hearing, Chu himself said: ‘There is a real hardship that Americans are suffering at the gasoline pump. The recovery is fragile. Another spike in gasoline prices could put that recovery at jeopardy. So there are many, many reasons why we do not want the price of gasoline to go up.’” [USA Today, 3/14/12]

Chu’s Original Comment Was About Increasing Prices Over 15 Years To Encourage Energy Efficiency – Not About Rapid Cost Increases. From the Wall Street Journal article in which Chu was originally quoted: “Mr. Chu has called for gradually ramping up gasoline taxes over 15 years to coax consumers into buying more-efficient cars and living in neighborhoods closer to work. ‘Somehow we have to figure out how to boost the price of gasoline to the levels in Europe,’ Mr. Chu, who directs the Lawrence Berkeley National Laboratory in California, said in an interview with The Wall Street Journal in September.” [Wall Street Journal, 12/12/08]

Obama Has Consistently Opposed Raising Gas Taxes. From USA Today: “Chu called for a gradual increase in prices over 15 years. But even before he took office, Obama rejected the idea of increasing the federal gas tax, citing the burden it would put on families. At a news conference this month, Obama noted, ‘No president going into re-election wants gas prices to go up higher.’ He said, ‘I want gas prices lower because I meet folks every day who have to drive a long way to get to work, and them filling up this gas tank gets more and more painful.’” [USA Today, 3/29/12]

[MAN 1:] I wish it were three years ago. Before President Obama took office, gas was only $1.83 a gallon. Today it’s over $3.50 – almost double.

[MAN 2:] President Obama, do you have any idea how much it hurts when it costs over $80 to fill up the tank.

[PRESIDENT OBAMA INTERVIEW CLIP:] Q. So could these high prices help us? Obama: I think that I would’ve preferred a gradual adjustment.

[MAN 1:] Wait. So you want higher gas prices, you just wanna get there more slowly. And your Energy Secretary said that we have to “figure out how to boost the price of gasoline to the levels in Europe”?

[MAN 2:] That would be $9 a gallon, maybe even ten.

[MAN 1:] That could mean $200 to fill up the tank.

[MAN 2:] So…this is your policy?

[MAN 1:] Why Mr. President? Why?

[Let Freedom Ring, 4/19/12]