60 Plus Association: “Why Did We Fire Dan Maffei In 2010?”

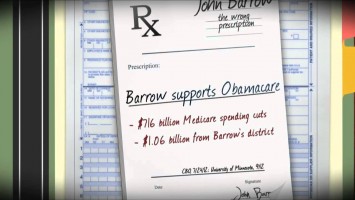

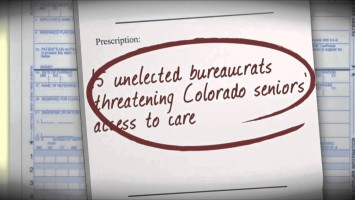

The 60 Plus Association reminds voters of Dan Maffei’s support for the Recovery Act and health care reform prior to his defeat in the 2010 election. They also present those policies in a deeply misleading light, when the facts show the Recovery Act worked and the Affordable Care Act will save us money. As a kicker, 60 Plus attacks Maffei over Medicare spending reductions that his opponent, Rep. Ann Marie Buerkle (R), voted for twice when they were included in GOP budgets.

Read more after the jump.