American Crossroads characterizes Rep. Tammy Baldwin (D-WI) as “extreme,” citing several alleged examples of her voting to take tax dollars “out of Wisconsin to pay for her extreme agenda in Washington.” However, the Bush administration’s bipartisan bailout of the financial sector helped prevent a possible depression; the Affordable Care Act does not raise taxes on most Americans and actually reduces the burden on the middle class; and “failed” Recovery Act not only created jobs but also cut taxes for millions of working American families.

Bipartisan Bank Bailout Helped Avert Possible Depression

Rescue Efforts Helped Avert “Great Depression 2.0.” From Bloomberg: “The U.S. response to the financial crisis probably prevented a depression, slowed a decline in gross domestic product and saved about 8.5 million jobs, economists Alan Blinder and Mark Zandi said. Policies including the government fiscal stimulus, bailouts of financial companies, bank stress tests and the Federal Reserve’s purchase of mortgage-backed securities to lower interest rates ‘probably averted what could have been called Great Depression 2.0,’ Blinder and Zandi said in a report dated yesterday. Without those measures, the U.S. would have deflation, they said.” [Bloomberg, 7/28/10]

On National Television, “President Bush Strongly Urged Lawmakers To Pass His Administration’s $700 Billion Bailout For The Financial Markets” In 2008. As reported by MarketWatch: “President Bush strongly urged lawmakers to pass his administration’s $700 billion bailout for the financial markets on Wednesday, spelling out dire risks to the U.S. economy if Congress doesn’t act quickly. ‘We’re in the midst of a serious financial crisis,’ Bush said in a nationally televised address. ‘Our entire economy is in danger,’ as a result of the credit crunch, he said, and inaction on the plan could result in a ‘long and painful recession.’” [MarketWatch.com, 9/24/08]

- Congress Passed The Bailout With Significant Bipartisan Support. According to the New York Times: “The Senate approved the bailout measure on Oct. 1, 2008, on a bipartisan vote of 74 to 25. The House initially rejected the proposal, but under prodding from the White House and leading members of both parties, House members ultimately voted 263 to 171 for the bill, with 91 Republicans joining 172 Democrats in backing it; 108 Republicans and 63 Democrats voted no.” [New York Times, 7/11/10]

- Bailouts Have Not “Added Significantly To The Debt.” An analysis by FactCheck.org concludes “it’s not the case at all” that the bailouts “added significantly to the debt.” According to the Congressional Budget Office: “CBO estimates that the net cost to the federal government of the TARP’s transactions, including the cost of grants for mortgage programs that have not been made yet, will amount to $32 billion. CBO’s analysis reflects transactions completed, outstanding, and anticipated as of February 22, 2012. That cost stems largely from assistance to American International Group (AIG), aid to the automotive industry, and grant programs aimed at avoiding home foreclosures: CBO estimates a cost of $56 billion for providing those three types of assistance. But not all of the TARP’s transactions will end up costing the government money. The program’s other transactions with financial institutions will, taken together, yield a net gain to the federal government of about $25 billion, in CBO’s estimation.” [FactCheck.org, 6/15/12; Congressional Budget Office, 3/28/12]

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

- Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

Affordable Care Act Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

Affordable Care Act Reduces The Deficit

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

Recovery Act Created Jobs, Boosted GDP, And Cut Taxes

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact.com, 2/17/10]

Recovery Act Cut Taxes For Up To “95 Percent Of Working Families.” According to FactCheck.org: “The ‘Making Work Pay’ tax credit was part of the stimulus bill he signed shortly after taking office. That credit was worth a maximum of $400 per person, or $800 for couples during those years. It phased out at higher income levels, and so its benefit went entirely to individuals making less than $95,000 a year, or couples making less than $190,000. The White House figures it went to ‘95 percent of working families.’ And even allowing for those who are retired or unemployed, it benefited more than 75 percent of all individuals and families, working or not, according to the nonpartisan Tax Policy Center.” [FactCheck.org, 5/17/12]

Baldwin Does Not Want To “Tax Wisconsin Job Creators” – She Wants To End Tax Breaks For The Wealthiest Americans

To support the claim that Baldwin “wants to tax Wisconsin job creators,” the ad cites Vote #647 on December 17, 2010, in which the House passed an extension of all the Bush tax cuts, including those for top income earners.

Bill Extended Tax Cuts For All Income Brackets. From The Hill: “The House gave final approval late on Thursday night to a temporary extension of the George W. Bush-era tax rates, delivering a significant but politically bruising victory to President Obama. The $858 billion legislation now heads to the president’s desk for his signature. It extends the Bush tax cuts across the board for two years, slashes the employee payroll tax by 2 percent for one year, renews the estate tax and extends unemployment insurance benefits for 13 months.” [The Hill, 12/17/10]

Baldwin Voted To Extend Tax Cuts For Income Under $250,000. According to the New York Times: “The House on Wednesday easily approved a one-year extension of all the Bush-era tax cuts set to expire in January, but in the Senate, presidential politics are complicating efforts to extend a tax credit for wind power. The House votes pitted a straight extension of all the expiring Bush tax cuts against a Democratic plan, passed by the Senate, that would allow taxes on income, capital gains and dividends to rise on earnings over $250,000, increasing revenues by around $100 billion. It was not close. The Democratic plan failed 170-257, with 19 Democrats voting no. The Republican plan passed 256-171, again with 19 Democrats throwing in their support.” Baldwin voted for the Democratic plan and against the Republican one. [New York Times, 8/2/12; H.R. 8, Vote #543, 8/1/12; H.R. 8, Vote #545, 8/1/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

Bush Policies And Recession Caused Debt To Skyrocket

Prior To President Obama’s Inauguration, President Bush Had Already Created A Projected $1.2 Trillion Deficit For Fiscal Year 2009. From the Washington Times: “The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn’t enact any new programs. […] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record.” [Washington Times, 1/8/09]

NYT: President Bush’s Policy Changes Created Much More Debt Than President Obama’s. The New York Times published the following chart comparing the fiscal impact of policies enacted under the Bush and Obama administrations:

[New York Times, 7/24/11]

Recession Added Hundreds Of Billions In Deficits By Increasing Spending On Safety Net While Shrinking Tax Revenue. The Center on Budget and Policy Priorities (CBPP) explains: “When unemployment rises and incomes stagnate in a recession, the federal budget responds automatically: tax collections shrink, and spending goes up for programs like unemployment insurance, Social Security, and Food Stamps.” According to CBPP: “The recession battered the budget, driving down tax revenues and swelling outlays for unemployment insurance, food stamps, and other safety-net programs. Using CBO’s August 2008 projections as a benchmark, we calculate that the changed economic outlook alone accounts for over $400 billion of the deficit each year in 2009 through 2011 and slightly smaller amounts in subsequent years. Those effects persist; even in 2018, the deterioration in the economy since the summer of 2008 will account for over $300 billion in added deficits, much of it in the form of additional debt-service costs.” [CBPP.org, 11/18/10; CBPP.org, 5/10/11, citations removed]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CBPP: Bush Tax Cuts And Wars Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

- Baldwin Opposed The 2001 Bush Tax Cuts. Rep. Baldwin voted “nay” on the Economic Growth and Tax Relief Reconciliation Act of 2001. [H.R. 1836, Vote #149, 5/26/01]

- Baldwin Opposed The 2003 Bush Tax Cuts. Rep. Baldwin voted “nay” on the Jobs and Growth Reconciliation Tax Act of 2003. [H.R. 2, Vote #225, 5/23/03]

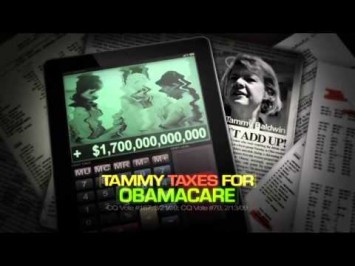

[NARRATOR:] It’s hard to calculate all the tax dollars Tammy Baldwin voted to take out of Wisconsin to pay for her extreme agenda in Washington. Tammy voted to take tax dollars to pay for the Wall Street bailout, for Obamacare, for the failed stimulus. Now Tammy wants to tax Wisconsin job creators. Since Tammy was elected to Congress, we’re $10 trillion deeper in debt. Tammy’s extreme agenda. [BALDWIN CLIP:] “You’re damn right.” [NARRATOR:] It just doesn’t add up. American Crossroads is responsible for the content of this advertising. [American Crossorads via YouTube.com, 10/23/12]