Americans for Tax Reform targets New York congressional candidate Sean Maloney’s (D) support for ending the Bush tax cuts for the wealthy, which the group claims will hurt small businesses and kill jobs. However, conservatives rely on a dubious definition of “small business,” and allowing the top tax bracket to return to its pre-Bush level would not affect many actual employers. In addition, ATR’s charge that phasing out the tax breaks would cause job losses is based on a flawed study that assumes the revenue will not go toward deficit reduction, which is exactly what Maloney and other Democrats have proposed.

Maloney Wants To End The Bush Tax Cuts For The Wealthiest Americans To Help Balance The Budget

Maloney Criticized Nan Hayworth For “Giving Tax Breaks To Multimillionaires.” According to the Times Herald-Record: “Hayworth supports Ryan’s proposal to turn Medicare into a program in which seniors would get vouchers to buy private health insurance — a transformation that she and other Republicans argue is necessary to keep up with ballooning medical costs and an aging population. Maloney strongly opposes the idea, and pairs it with Hayworth’s support for continuing all Bush-era tax cuts to suggest misplaced priorities. He wants to allow the tax cuts to lapse on income over $250,000 when the rates expires [sic] at the end of the year. ‘There are so many places I would go to balance the budget before ending Medicare, and the first place would be, stop giving tax breaks to multimillionaires like Nan Hayworth,’ he said.” [Times Herald-Record, 8/23/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

Few Top Income Taxpayers Are Actual “Small Businesses”

CBPP: “Only 2.5 Percent Of Small Business Owners Face The Top Two Rates.” According to the Center on Budget and Policy Priorities: “Allowing the top two marginal tax rates to return to pre-2001 levels as scheduled next year would affect very few small businesses, a recent Treasury Department study found. The study shows that only 2.5 percent of small business owners face the top two rates.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Ending Upper-Income Tax Cuts Will Reduce Deficits Without Harming The Economy

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

CBPP: Bush Tax Cuts Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

“Killing Jobs” Claim Relies On Flawed Study That Assumes Revenue Will Not Be Used To Reduce Deficits

The ad cites a Washington Post report from July 17, 2012, about an Ernst & Young study commissioned by business groups, including the conservative NFIB and U.S. Chamber of Commerce.

Ernst & Young Study Didn’t Address President’s Proposals. According to economist Jared Bernstein: “First off, E&Y quite conspicuously fail to simulate what it is the President is proposing, so their main findings shouldn’t be considered in evaluating his proposals. Second, when they get a little closer to what he is proposing, they find it adds jobs.” [JaredBernsteinBlog.com, 8/14/12]

Ernst & Young Study Assumes Revenue From Ending Tax Cuts Will Pay For More Spending But Obama Proposed To Use It For Deficit Reduction. From an analysis by the National Economic Council’s Jason Furman via the White House: “The President has proposed to let the high-income tax cuts expire and use the resulting $1 trillion in savings (over 10 years) as part of a balanced plan to reduce deficits and debt and put the nation on a sustainable fiscal course that includes $2.50 of spending cuts for every $1.00 of revenue. But rather than modeling the President’s proposal to reduce the deficit, the headline numbers in the study explicitly assume that the revenue would be used entirely to finance additional spending. In fact, the study explicitly states, ‘Using the additional revenue to reduce the deficit is not modeled.’” [WhiteHouse.gov, 7/17/12, underlining original]

When The Study Models Ending Top-Tier Tax Cuts While Giving Middle Class Cuts, It Projects An Employment Increase. According to economist Jared Bernstein: “But for all of that, they actually find that when they model something that’s closer to what the President is proposing — getting rid of the Bush tax cuts for high-income families, while providing additional tax cuts to the middle-class — employment grows by 0.4%, or almost 600,000 jobs. When they simulate the wrong scenario of new tax revenues used to support higher spending (column 1, table 2), they estimate that employment would fall by 0.5%. But if the revenue was used to finance across-the-board tax cuts, employment grows.” [JaredBernsteinBlog.com, 8/14/12]

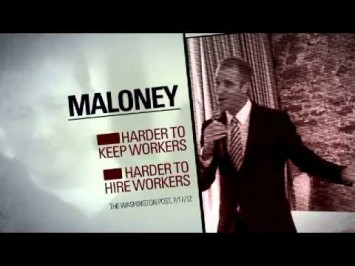

[NARRATOR:] Tax-raising politician Sean Maloney. Maloney supports raising taxes on small businesses, costing jobs and hurting our economy. Maloney’s tax increase will make it harder for small businesses to keep the workers they have, let alone hire new ones. Maloney would raise taxes just when we can least afford it. Sean Maloney: raising taxes, killing jobs, the last guy we should send to Congress. Americans for Tax Reform is responsible for the content of this advertising.” [Americans for Tax Reform via YouTube.com, 10/12/12]