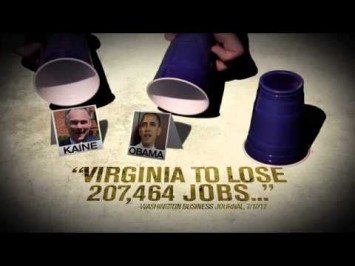

Crossroads GPS doubles up in an ad hitting both President Obama and Tim Kaine for spending, deficits, taxes, and looming defense cuts brought on by the failure of a deficit-reduction super committee to reach a deal. The group also uses an out-of-context quote from Kaine to suggest he blindly supports the president’s policies. In reality, the recession created budget deficits on the state level, while Bush-era Republican policies are largely responsible on the national level. Spending growth is low under Obama, and Kaine cut billions to leave Virginia with a balanced budget. And while both Kaine and Obama supported the debt limit deal that created the super committee and imposed sequester as an incentive for compromise, both support finding a way to avoid the defense cuts.

When Kaine Proposed Spending Virginia’s Pre-Recession Budget Surplus, GOP Wanted To Spend More…

Kaine Proposed Spending Budget Surplus On Roads, Tax Breaks, Education, And Environment. From the Washington Times: “Gov. Timothy M. Kaine, outlining his 2007 budget amendments yesterday, proposed spending $1 billion of the state’s surplus on roads, tax breaks for the working poor, teacher pay raises and cleanup of the Chesapeake Bay watershed. […] The governor’s amendments include a one-time infusion of about $500 million for transportation, a $250 million bond package for upgrading water treatment plants across the Bay watershed and increasing the minimum income tax filing threshold for the state’s poorest workers.” [Washington Times, 12/15/06]

Virginia GOP Wanted Kaine To Borrow Money For More Transportation Spending. From theVirginian-Pilot: “Gov. Timothy M. Kaine’s proposals for spending a $1 billion budget surplus received a lukewarm reaction Friday from top Republicans, who are girding for an election-year battle. Transportation remained the focus of disagreement. The Democratic governor wants to spend half the surplus on road and rail projects. Some Republicans said that is too little and chided Kaine for refusing to borrow money to ease congestion. […] Republicans, under pressure to find consensus on the state’s transportation gridlock, said they are disappointed that Kaine doesn’t want to borrow money for roads. They noted that the governor is backing new debt for sewage plant upgrades and a new prison in Southwest Virginia. […] Kaine said environmental programs and prisons are financed with income and sales taxes, which can be used to pay off debt on capital projects. He said he cannot support borrowing for roads until lawmakers agree on new long-term revenues to pay off the bonds. Virginia relies on gas taxes – a declining source of revenue – to pay for new roads.” [Virginian-Pilot via Nexis, 12/16/06]

Most Taxes Kaine Proposed Were Aimed At Same Transportation Upgrades

Kaine Proposed Taxes To Pay For Transportation Upgrades That GOP Wanted To Finance With Borrowing. From the Washington Times: “While most Virginia governors have enjoyed several weeks to offer amendments, Mr. Kaine was given the tentative budget about 10 days before the end of the fiscal year. The more than 150-day budget deadlock centered on how to generate new money for the state’s overcrowded roads and mass transit system. The House wanted to use part of the state’s projected $1.4 billion surplus and free up additional money in the General Fund through long-term borrowing. The Senate and Mr. Kaine wanted to raise as much as $1 billion a year in new taxes. In the end, the two-year proposal provides $568 million in new money for roads — $339 million of that is contingent upon a long-term revenue source being established before Nov. 1. The General Assembly agreed to take up transportation in a special session this fall.” [Washington Times, 6/27/06]

Largest Of Tax Hikes Kaine Proposed Over His Tenure Were Aimed At Funding Transportation. From PolitiFact: “Kaine led the state from 2006 to 2010. Katie Wright, Allen’s director of communications, sent us a breakdown of supposed tax-increases advanced by Kaine. The largest proposed hikes, from 2006 through 2008, were aimed at raising money for Virginia’s overcrowded roads. […] By our count, Kaine proposed raising about $4 billion in new taxes — $1 billion in 2006, $1.1 billion in 2008 and $1.9 billion in 2009. Of those increases, the 2008 plan represented a second attempt to raise new road funding, and the 2009 proposal would have been partially offset by a $650 million reduction in local car taxes.” [PolitiFact.com, 4/16/11]

When Kaine Left Office, Virginia’s State And Local Tax Burden Was Lower Than When He Took Office – And Lower Than When George Allen’s Gubernatorial Term Ended. According to data from the Tax Foundation, when Kaine began his term as governor in 2006, the total state and local tax burden on Virginians was 9.4 percent. In 2009, the last full year Kaine was in office, Virginia’s state and local tax burden was 9.1 percent. During 1998, George Allen’s last full year as governor, the tax burden was 9.4 percent. [TaxFoundation.org, accessed 8/8/12]

…And When The Recession Devastated Revenues, Kaine Cut Billions To Balance The Budget

Virginia’s Legislature Backed Budget Plan That Increased Spending. From FactCheck.org: “Despite the budget difficulties, however, total state spending went up during Kaine’s tenure — just not as much as the governor and Legislature originally intended. Kaine was governor from January 2006 to January 2010. The operating budget was nearly $32 billion in fiscal year 2006 when he arrived and $37.2 billion in fiscal year 2010 when he left. General fund appropriations — which the governor and state Legislature have the most discretion to spend — did decline from fiscal years 2008 to 2010 by $2.2 billion, as the Joint Legislative Audit and Review Commission noted in a December 2010 report.” [FactCheck.org, 6/21/12]

Shortfalls Caused By The Recession Were Closed By The Time Kaine Left Office. From a FactCheck.org article about a similar ad: “Virginia adopts a new budget every two years, and amendments are added to it in the odd year to square the numbers. There’s no question that Virginia experienced serious budget shortfalls during the recession due to much lower-than-anticipated revenues. But the shortfall was closed by the end of the biennium. The same Virginian-Pilot story in which Kaine talks about a $3.7 billion shortfall, notes that the stimulus provided $1 billion in budget relief, and that lawmakers were forced to cut $2.7 billion to balance the budget, as required by the state constitution. Responding to the ad on Nov. 10, Kaine told WVEC ABC 13: ‘I left office with two balanced budgets that I submitted because you have to, by law, submit balanced budgets.’” [FactCheck.org,11/15/11]

- Kaine Had Proposed Even More Difficult Cuts Before Federal Stimulus Money Came Through. From the Center on Budget and Policy Priorities: “States were seriously considering even more severe cuts than were enacted in such services as health care, education, and public safety prior to passage of federal stimulus legislation. Those cuts very likely would have taken place in the absence of the federal aid. […] In both New York and Virginia, major cuts that had been proposed before the federal assistance was made available were never enacted. Virginia is using the fiscal assistance to keep open three facilities serving persons with mental health needs, reverse a planned cut in Medicaid payments to hospitals, lessen a reduction in aid to universities that almost certainly would have led to large tuition increases, avoid a major education budget cut, and avoid a funding cut that would have resulted in the loss of an estimated 310 deputy sheriffs’ positions. The governor had proposed these cuts before the federal funds became available. […] The legislature likely would have approved the governor’s proposed cuts had recovery act funding not been available. In fact, there is good reason to think it would have gone even further. Between December 2008 (when the governor outlined his proposals) and March 2009, the Virginia revenue forecast was revised downward even further by over $800 million. The legislature also rejected the governor’s proposal to raise the cigarette tax. Thus, the federal recovery funding helped to avert not only the governor’s proposed cuts, but also the additional cuts that would have resulted from the further decline in the revenue forecast and the legislature’s decision not to raise the cigarette tax.” [CBPP.org, 6/29/09]

Bush Policies And Recession Caused Debt To Skyrocket

Prior To President Obama’s Inauguration, President Bush Had Already Created A Projected $1.2 Trillion Deficit For Fiscal Year 2009. From the Washington Times: “The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn’t enact any new programs. […] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record.” [Washington Times, 1/8/09]

NYT: President Bush’s Policy Changes Created Much More Debt Than President Obama’s. The New York Times published the following chart comparing the fiscal impact of policies enacted under the Bush and Obama administrations:

[New York Times, 7/24/11]

Recession Added Hundreds Of Billions In Deficits By Increasing Spending On Safety Net While Shrinking Tax Revenue. The Center on Budget and Policy Priorities (CBPP) explains: “When unemployment rises and incomes stagnate in a recession, the federal budget responds automatically: tax collections shrink, and spending goes up for programs like unemployment insurance, Social Security, and Food Stamps.” According to CBPP: “The recession battered the budget, driving down tax revenues and swelling outlays for unemployment insurance, food stamps, and other safety-net programs. Using CBO’s August 2008 projections as a benchmark, we calculate that the changed economic outlook alone accounts for over $400 billion of the deficit each year in 2009 through 2011 and slightly smaller amounts in subsequent years. Those effects persist; even in 2018, the deterioration in the economy since the summer of 2008 will account for over $300 billion in added deficits, much of it in the form of additional debt-service costs.” [CBPP.org, 11/18/10; CBPP.org, 5/10/11, citations removed]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CBPP: Bush Tax Cuts And Wars Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

Spending Growth Under Obama Is Low

January 2009 (Pre-Obama): Federal Spending Projected To Spike To $3.5 Trillion Without Any Policy Changes. In January 2009, the Congressional Budget Office projected: “Without changes in current laws and policies, CBO estimates, outlays will rise from $3.0 trillion in 2008 to $3.5 trillion in 2009.” [Congressional Budget Office, “The Budget and Economic Outlook: Fiscal Years 2009 to 2019,” January 2009]

Accounting For Inflation And President Obama’s Impact On FY 2009, Spending Will Have Grown By Just 1.7 Percent From 2009 To 2012. According to Michael Linden, Director of Tax and Budget Policy at the Center for American Progress:

[I]n January 2009, before President Obama had even taken office, the Congressional Budget Office projected that federal spending would exceed $3.5 trillion for fiscal year 2009, half a trillion more than the government spent in 2008. Again, that was BEFORE President Obama event took office. It’s reasonable to use that number as our best guess at what spending would have been in FY2009 under ANY president. […]

Of course, the CBO’s projections aren’t perfect. They change as the economy changes and as laws change. Fortunately, CBO also tells us in subsequent reports how and why its previous estimates have changed. We can use that to understand how much of the total federal spending in fiscal year 2009 was attributable to legislative changes that occurred AFTER President Obama took office.

The answer is that out of a total of $3.5 trillion actually spent in FY09, only $165 billion, less than 5 percent, was the result of policy changes signed into law by President Obama.

In other words, probably the best baseline against which to judge spending under Obama is $3.5 trillion (the amount actually spent in 2009) minus $165 billion (the added amount Obama himself actually approved): $3.35 trillion. This year, the CBO expects that the federal government will spend $3.6 trillion. After accounting for inflation, that’s a growth rate of just 1.7 percent. By comparison, and using the exact same methodology, spending in President Bush’s first term was up nearly 15 percent. [ThinkProgress.org, 5/25/12]

PolitiFact: Spending Growth Under Obama Is “Second-Slowest” In Recent History. According to PolitiFact: “Obama has indeed presided over the slowest growth in spending of any president [in recent history] using raw dollars, and the growth on his watch was the second-slowest if you adjust for inflation.” [PolitiFact.com, 5/23/12]

Republicans Have Opposed President Obama’s Deficit-Reduction Efforts

September 2011: Obama Proposed $3 Trillion In Deficit Reduction; “Republicans Swiftly Responded … With Opposition.” According to the Los Angeles Times: “President Obama on Monday made an aggressive pitch for his $3-trillion deficit-reduction strategy, promising to veto any proposal that fails to raise revenues by asking wealthy Americans to ‘pay their fair share.’ […] His plan for lopping $3 trillion from the deficit is on top of the approximately $1 trillion in spending cuts that he signed into law in August, after reaching a deal with Republican congressional leaders to lift the nation’s debt ceiling. On Monday, Republicans swiftly responded to the president’s proposal with opposition. [Los Angeles Times, 9/19/11]

April 2011: GOP Rejected Obama Proposal To Reduce Deficits By $4 Trillion. According to the Boston Globe: “President Obama pledged yesterday to pare the projected deficit by $4 trillion in the next 12 years, vowing to protect the nation’s most vulnerable while pushing again for higher taxes for its richest citizens. […] His call for the end of the Bush tax cuts for incomes above $250,000 for couples reignites a ferocious debate from the fall midterm elections. That element of the speech triggered the most vociferous and immediate opposition from Republicans.” [Boston Globe, 4/14/11]

President Obama Has Cut Taxes

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “”Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy. Of that $288 billion, the stimulus has resulted in $119 billion worth of tax breaks so far.” [PolitiFact.com, 2/17/10]

Obama Has Cut Taxes For Up To “95 Percent Of Working Families.” According to FactCheck.org: “Obama has lowered taxes for all workers through a 2 percentage point reduction in the Social Security payroll tax that started in 2011 and is scheduled to continue through the end of 2012. The cut is equal to $1,000 this year for a worker making $50,000 a year — or as much as $2,202 to any worker earning at least the maximum taxable level of wages or salary ($110,100 for 2012). Obama had previously signed a tax cut that benefited nearly all working families and was in effect from 2009 through 2010. The ‘Making Work Pay’ tax credit was part of the stimulus bill he signed shortly after taking office. That credit was worth a maximum of $400 per person, or $800 for couples during those years. It phased out at higher income levels, and so its benefit went entirely to individuals making less than $95,000 a year, or couples making less than $190,000. The White House figures it went to ‘95 percent of working families.’ And even allowing for those who are retired or unemployed, it benefited more than 75 percent of all individuals and families, working or not, according to the nonpartisan Tax Policy Center.” [FactCheck.org, 5/17/12]

Under Obama, Federal Tax Burden Hit 30-Year Low. According to the Washington Post: “Americans paid the lowest tax rates in 30 years to the federal government in 2009, in part because of tax cuts President Obama sought to combat the Great Recession, congressional budget analysts said Tuesday. […] The tax burden — which includes all forms of federal levies, including income, payroll and corporate taxes — lightened for households across the board, the result in part of Obama’s signature ‘Making Work Pay’ tax credit and other tax cuts passed as part of the 2009 economic stimulus package, the CBO said.” [Washington Post, 7/10/12]

Obama Struck Compromise With GOP To Extend All Bush Tax Cuts In Exchange For Extending Jobless Benefits, Cutting Payroll Taxes. From the New York Times: “President Obama announced a tentative deal with Congressional Republicans on Monday to extend the Bush-era tax cuts at all income levels for two years as part of a package that would also keep benefits flowing to the long-term unemployed, cut payroll taxes for all workers for a year and take other steps to bolster the economy. […] In addition, the agreement provides for a 13-month extension of jobless aid for the long-term unemployed. Benefits have already started to run out for some people, and as many as seven million people would potentially lose assistance within the next year, officials said. Congressional Republicans in recent days have blocked efforts by Democrats to extend the jobless aid, saying they would insist on offsetting the $56 billion cost with spending cuts elsewhere. White House officials said they feared a long standoff that would see benefits end for millions of Americans over the holiday season and in the months ahead. But Mr. Obama made substantial concessions to Republicans. In addition to dropping his opposition to any extension of the current income tax rates on income above $250,000 for couples and $200,000 for individuals, he agreed to a deal on the federal estate tax that infuriated many Democrats. The deal would ultimately set an exemption of $5 million per person and a maximum rate of 35 percent — a higher exemption and far lower rate than many Democrats wanted.” [New York Times, 12/6/10]

Kaine And Obama Both Supported Deal To Prevent Default But Want To Avoid Sequester

The Federal Budget Control Act Was A Last-Minute Deal To Raise The Debt Ceiling That Also Created The Deficit Reduction Super Committee. From PolitiFact: “Last year, the United States government was reaching its legal debt limit, which meant Congress had to authorize a higher level for borrowing. Raising the debt limit (also called the debt ceiling) was in some ways symbolic: Congress has the power of the purse, and the decisions to spend the money had already been made. In prior administrations, Congress approved higher debt limits with some partisan sniping (including from then-Sen. Obama against President George W. Bush) but without too much fuss. But in the summer of 2011, House Republicans insisted that actual spending cuts go along with an increase to the debt limit. House Speaker John Boehner led negotiations with the Obama White House, and at first the two sides seemed to be moving toward a wide-ranging overhaul of the federal budget, referred to in the media as a ‘grand bargain.’ The closed-door negotiations fell apart, though. […] Republicans and Democrats came to a less ambitious agreement to raise the debt limit through the Budget Control Act of 2011. The law found approximately $1.2 trillion in budget cuts spread over 10 years. But it also directed Congress to find another $1.2 trillion through a Joint Select Committee on Deficit Reduction. This 12-member committee became known as ‘the super-committee.’” [PolitiFact.com, 9/21/12]

- Debt Ceiling Deal Imposed Harsh Defense Cuts Triggered By Super Committee’s Failure As Incentive For Success. From the Associated Press: “The deal between House Republicans, the Democratic-controlled Senate and the OK of the White House, came hours before the deadline for raising the amount of money the government can borrow. As an incentive, the agreement prescribes draconian cuts both parties would find unpalatable — $487 billion to defense over 10 years plus $492 billion in automatic cuts if a bipartisan congressional ‘super committee’ [failed to come up] with $1.2 trillion in savings. The committee failed.” [Associated Press via SFGate.com, 7/24/12]

- Failure To Raise Debt Ceiling Could Have Resulted In Default Or Had Other Severe Economic Consequences. From CNNMoney: “A failure to raise the debt ceiling would likely send shockwaves through the underpinnings of the financial system — and possibly ripple out to individual investors and consumers. The federal government would be forced to prioritize its payments. It would risk defaulting on its financial obligations. And if that happens, credit rating agencies would downgrade U.S. debt.” [Money.CNN.com, 7/21/11]

White House Supported Deal But Wants To Avoid Sequestration

White House Suggested Using Sequestration To Force Negotiations. From PolitiFact: “Woodward’s reporting shows clearly that defense sequestration was an idea that came out of Obama’s White House. But the intention was to force Republicans to negotiate, not to actually put the cuts into effect. Woodward summarizes the thoughts of the Obama team: ‘There would be no chance the Republicans would want to pull the trigger and allow the sequester to force massive cuts to Defense.’ Democrats, meanwhile, didn’t want to see their favorite domestic programs cut.” [PolitiFact.com, 10/24/12]

White House: Defense Cuts “Never Meant To Be Implemented.” From the Wall Street Journal: “White House press secretary Jay Carney said looming spending cuts slated to begin in January were ‘never meant to become policy’ and ‘never meant to be implemented.’ Mr. Carney was responding to reporters’ questions about President Barack Obama’s statement during Monday night’s presidential debate that the cuts ‘will not happen.’ […] The cuts—referred to in Washington as the sequester—were designed to be so objectionable they would pressure a congressional ‘super committee’ to reach a deficit-reduction agreement last year. The committee failed. ‘It’s a designed trigger, a forcing mechanism to compel Congress to make the difficult decisions required to reach a balanced deficit-reduction package,’ Mr. Carney said. […] ‘The president is confident that Congress will take the appropriate action to achieve a balanced deficit-reduction package in order to avoid these onerous cuts in both defense and non-defense discretionary spending that were written into the law by Congress,’ Mr. Carney said.” [Wall Street Journal, 10/23/12]

Kaine Supported Raising Debt Ceiling But Thinks Defense Cuts Can Be Avoided

Kaine Supported Debt Ceiling Deal But Believes We Can Still Find A Way To Avoid Defense Cuts. From the Associated Press: “Republican former Sen. George Allen is airing a new ad that deftly fosters a false impression that his Democratic opponent, Tim Kaine, supports potential deep military spending cuts under a debt-reduction compromise. The ad is rooted in Saturday’s debate between the candidates, when Allen attacked Kaine for supporting a bipartisan compromise in August that allowed Congress to increase the nation’s debt ceiling. […] In the weekend debate, Allen tried to graft the national tactic into his neck-and-neck Senate race against Kaine, claiming that Virginia — home to the Pentagon and the world’s largest U.S. Navy base in Norfolk — could lose more than 200,000 defense-related jobs. ‘George, the deal was the right thing to do — as Eric Cantor said, as Gov. Bob McDonnell said, as the U.S. Chamber of Commerce said,’ Kaine replied when Allen made the charge during the debate. But Kaine was clear in his reply that his endorsement of last August’s stopgap did not extend to approving of the super committee’s failure or of the continued partisan gridlock between House Republicans and Senate Democrats that jeopardizes a deal by year’s end. ‘This is a time when we really have to elevate what we do because the challenges are significant,’ Kaine said in his response. ‘We need people who will come together and try to find a deal and I believe Congress can still find a deal to avoid the need for cuts that are going to jeopardize our nation’s defense.’” [Associated Press via SFGate.com, 7/24/12]

- Kaine’s Opponent, George Allen, Opposed Debt Deal Because Cuts Weren’t Deep Enough. From the Associated Press: “Like Kaine, Republican House Majority Leader Eric Cantor and Gov. Bob McDonnell also backed the August compromise that kept the government from defaulting on its debts for the first time and defused a global financial meltdown. Allen opposed the compromise, saying the cuts would not have been deep enough.” [Associated Press via SFGate.com, 7/24/12]

Kaine: Sequestration Involves “The Wrong Cuts.” From the Suffolk News Herald: “Kaine said he is concerned about the prospect of sequestration, the mandatory, across-the-board cuts the military faces if Congress cannot come to a budget agreement by January. ‘I think I know how to make cuts the right way,’ he said, adding that sequestration would be ‘the wrong cuts.’” [Suffolk News Herald,4/12/12]

Kaine Supports Compromise Deal To Avoid Defense Cuts While Allen Has Stated He Will Not Support Any Compromise Involving Tax Increases. From the Richmond Times-Dispatch’s Virginia Politics blog: “On Monday, Democratic U.S. Senate candidate Timothy M. Kaine laid out his views on how to avoid looming defense cuts, part of the sequestration resulting from the failure of a so-called deficit reduction super-committee. […] In a conference call with reporters, Kaine said congress should create a new plan that would add $1 in new revenue for every $3 in spending cuts. He said that should be coupled with an expiration of Bush-era tax cuts on households earning $500,000 or more, which he said would create more than $500 billion in new revenue to offset cuts. ‘We cannot solve our deficit and debt challenges through cuts alone,’ he said, criticizing GOP rival George Allen’s position, stated in a recent debate, that he would not support any tax increase, even if every $1 of revenue was matched with $10 in cuts. Kaine called that ‘a position that makes compromise impossible and a position that, frankly, also makes solving the deficit also impossible.’” [TimesDispatch.com, 7/30/12]

The Deficit Panel Failed Because Conservative Lawmakers Refused To Compromise

Deficit-Reduction Committee Failed After Republican Members Refused To Budge On Tax Cuts For The Wealthiest Americans. According to the Los Angeles Times: “The committee faced a Wednesday deadline to vote on a proposal to slash the nation’s deficits by $1.5 trillion over the decade. The panel that was brought into existence as a result of the summer debt ceiling fight spent three months in mostly secret negotiations. A deal needed to be posted by Monday evening to provide a 48-hour review. But Republicans and Democrats were unable to compromise on the tax and spending issues that have divided Congress all year, punting the debate to next year’s presidential and congressional campaigns. Republicans refused to substantially raise taxes and wanted to cut federal deficits largely by reducing spending on Medicare and other domestic programs. Democrats wanted a more equal balance of new taxes and spending cuts — a level of taxation the GOP could not accept. A focal point in final days became the George W. Bush-era tax cuts, which are scheduled to expire in December 2012. Republicans wanted to extend those tax breaks for the wealthy and other Americans, rather than carve into that source of new revenue. Most Republican members of Congress have signed an anti-tax pledge with conservative activist Grover Norquist, and were hesitant to agree to new taxes. [Los Angeles Times, 11/21/11]

Ad Takes Kaine Quote Out Of Context

Kaine Said He’d Stay On As DNC Chairman If The President Wanted Him – Not That He’d Blindly Support Obama. From a transcript of ABC’s This Week on October 24, 2010:

CHRISTIANE AMANPOUR (ABC NEWS)

(Off-camera) And finally, what will happen after the election? Will you remain DNC chairman?

TIM KAINE (CHAIRMAN OF DEMOCRATIC NATIONAL COMMITTEE)

Well, I’m doing what the President wants me to do. And I’ve not had any conversation with him or the White House to suggest they want me to do anything different. So it’s full speed ahead. It’s been a tremendous honor to serve this president in this way. [ABC News’ This Week via Nexis, 10/24/10]

[NARRATOR:] Barack Obama or Tim Kaine? Which one ran up spending, blowing massive holes in the budget? Which one supported higher taxes on middle-class families? Which one pushed devastating defense cuts that could kill over 200,000 Virginia jobs? The answer is: Obama and Kaine. [KAINE CLIP:] “I’m doing what the president wants me to do.” [NARRATOR:] How can Kaine fix the mess in Washington when he helped create it? Crossroads GPS is responsible for the content of this advertising. [Crossroads GPS via YouTube.com, 10/30/12]