Crossroads GPS attempts to take Virginia Senate candidate Tim Kaine to task for both ‘soaring spending’ and ‘devastating’ cuts to spending on higher education during Kaine’s tenure as the state’s governor. But the budgetary reality of Kaine’s tenure was largely determined by the foibles of the global economy, which saw Kaine into office during a period of strength before enduring a massive recession that devastated state revenues and forced the governor and the legislature to make tough decisions about cuts. Ultimately, Kaine balanced every budget during his tenure.

When Kaine Proposed Spending Virginia’s Pre-Recession Budget Surplus, GOP Wanted To Spend More…

Kaine Proposed Spending Budget Surplus On Roads, Tax Breaks, Education, And Environment. From the Washington Times: “Gov. Timothy M. Kaine, outlining his 2007 budget amendments yesterday, proposed spending $1 billion of the state’s surplus on roads, tax breaks for the working poor, teacher pay raises and cleanup of the Chesapeake Bay watershed. […] The governor’s amendments include a one-time infusion of about $500 million for transportation, a $250 million bond package for upgrading water treatment plants across the Bay watershed and increasing the minimum income tax filing threshold for the state’s poorest workers.” [Washington Times, 12/15/06]

Virginia GOP Wanted Kaine To Borrow Money For More Transportation Spending. From the Virginian-Pilot: “Gov. Timothy M. Kaine’s proposals for spending a $1 billion budget surplus received a lukewarm reaction Friday from top Republicans, who are girding for an election-year battle. Transportation remained the focus of disagreement. The Democratic governor wants to spend half the surplus on road and rail projects. Some Republicans said that is too little and chided Kaine for refusing to borrow money to ease congestion. […] Republicans, under pressure to find consensus on the state’s transportation gridlock, said they are disappointed that Kaine doesn’t want to borrow money for roads. They noted that the governor is backing new debt for sewage plant upgrades and a new prison in Southwest Virginia. […] Kaine said environmental programs and prisons are financed with income and sales taxes, which can be used to pay off debt on capital projects. He said he cannot support borrowing for roads until lawmakers agree on new long-term revenues to pay off the bonds. Virginia relies on gas taxes – a declining source of revenue – to pay for new roads.” [Virginian-Pilot via Nexis, 12/16/06]

…And When The Recession Devastated Revenues, Kaine Cut Billions To Balance The Budget

Virginia’s Legislature Backed A Budget Plan That Increased Spending. From FactCheck.org: “Despite the budget difficulties, however, total state spending went up during Kaine’s tenure — just not as much as the governor and Legislature originally intended. Kaine was governor from January 2006 to January 2010. The operating budget was nearly $32 billion in fiscal year 2006 when he arrived and $37.2 billion in fiscal year 2010 when he left. General fund appropriations — which the governor and state Legislature have the most discretion to spend — did decline from fiscal years 2008 to 2010 by $2.2 billion, as the Joint Legislative Audit and Review Commission noted in a December 2010 report.” [FactCheck.org, 6/21/12]

Shortfalls Caused By The Recession Were Closed By The Time Kaine Left Office. From a FactCheck.org article about a similar ad: “Virginia adopts a new budget every two years, and amendments are added to it in the odd year to square the numbers. There’s no question that Virginia experienced serious budget shortfalls during the recession due to much lower-than-anticipated revenues. But the shortfall was closed by the end of the biennium. The same Virginian-Pilot story in which Kaine talks about a $3.7 billion shortfall, notes that the stimulus provided $1 billion in budget relief, and that lawmakers were forced to cut $2.7 billion to balance the budget, as required by the state constitution. Responding to the ad on Nov. 10, Kaine told WVEC ABC 13: ‘I left office with two balanced budgets that I submitted because you have to, by law, submit balanced budgets.’” [FactCheck.org, 11/15/11]

- Kaine Had Proposed Even More Difficult Cuts Before Federal Stimulus Money Came Through. From the Center on Budget and Policy Priorities: “States were seriously considering even more severe cuts than were enacted in such services as health care, education, and public safety prior to passage of federal stimulus legislation. Those cuts very likely would have taken place in the absence of the federal aid. […] In both New York and Virginia, major cuts that had been proposed before the federal assistance was made available were never enacted. Virginia is using the fiscal assistance to keep open three facilities serving persons with mental health needs, reverse a planned cut in Medicaid payments to hospitals, lessen a reduction in aid to universities that almost certainly would have led to large tuition increases, avoid a major education budget cut, and avoid a funding cut that would have resulted in the loss of an estimated 310 deputy sheriffs’ positions. The governor had proposed these cuts before the federal funds became available. […] The legislature likely would have approved the governor’s proposed cuts had recovery act funding not been available. In fact, there is good reason to think it would have gone even further. Between December 2008 (when the governor outlined his proposals) and March 2009, the Virginia revenue forecast was revised downward even further by over $800 million. The legislature also rejected the governor’s proposal to raise the cigarette tax. Thus, the federal recovery funding helped to avert not only the governor’s proposed cuts, but also the additional cuts that would have resulted from the further decline in the revenue forecast and the legislature’s decision not to raise the cigarette tax.” [CBPP.org, 6/29/09]

Kaine Proposed Tax Increases To Pay For Transportation Upgrades That Virginia’s GOP House Wanted To Finance With More Borrowing

Kaine’s Proposal Raise Taxes To Pay For Transportation Upgrades Contrasted GOP-Controlled Virginia House’s Idea To Borrow Money. From the Washington Times article Crossroads cites to support its claim that Kaine sought a tax hike: “While most Virginia governors have enjoyed several weeks to offer amendments, Mr. Kaine was given the tentative budget about 10 days before the end of the fiscal year. The more than 150-day budget deadlock centered on how to generate new money for the state’s overcrowded roads and mass transit system. The House wanted to use part of the state’s projected $1.4 billion surplus and free up additional money in the General Fund through long-term borrowing. The Senate and Mr. Kaine wanted to raise as much as $1 billion a year in new taxes. In the end, the two-year proposal provides $568 million in new money for roads — $339 million of that is contingent upon a long-term revenue source being established before Nov. 1. The General Assembly agreed to take up transportation in a special session this fall.” [Washington Times, 6/27/06]

- Largest Of Tax Increases Kaine Proposed Over His Tenure Were Aimed At Funding Transportation. From PolitiFact: “Kaine led the state from 2006 to 2010. Katie Wright, Allen’s director of communications, sent us a breakdown of supposed tax-increases advanced by Kaine. The largest proposed hikes, from 2006 through 2008, were aimed at raising money for Virginia’s overcrowded roads. […] By our count, Kaine proposed raising about $4 billion in new taxes — $1 billion in 2006, $1.1 billion in 2008 and $1.9 billion in 2009. Of those increases, the 2008 plan represented a second attempt to raise new road funding, and the 2009 proposal would have been partially offset by a $650 million reduction in local car taxes.” [PolitiFact.com, 4/16/11]

When Kaine Left Office, Virginia’s State And Local Tax Burden Was Lower Than When He Took Office – And Lower Than When George Allen’s Gubernatorial Term Ended. According to data from the Tax Foundation, when Kaine began his term as governor in 2006, the total state and local tax burden on Virginians was 9.4 percent. In 2009, the last full year Kaine was in office, Virginia’s state and local tax burden was 9.1 percent. During 1998, George Allen’s last full year as governor, the tax burden was 9.4 percent. [TaxFoundation.org, accessed 8/8/12]

GOP House Also Approved Education Cuts Necessitated By Recession

Rising Tuition Is A National Trend. From PolitiFact: “Sure enough, tuition did go up during Kaine’s term. The average costs for in-state tuition and instructional fees at four-year institutions — not including room and board — rose from $3,812 in the 2005-2006 school year to $5,003 in 2009-2010. That’s a 31.2 percent increase. Adjusted for inflation, it’s about a 19 percent rise. The average cost for tuition and instructional fees at Virginia’s community colleges rose from $2,182 in the 2005-06 school year to $2,716 in 2009-10. That’s a 24.5 percent increase. Adjsuted for inflation, it’s about a 13 percent rise. Virginia’s experience was not unique; tuition and fees for in-state students at four-year public universities rose across the nation during Kaine’s term. The U.S. Department of Education said the national average increased by 23 percent during that span, the College Board says they rose by 29 percent.” [PolitiFact.com, 4/4/12]

PolitiFact: By “Purest Measurement,” Kaine Endorsed Higher Education Cuts Of Less Than 6 Percent. From PolitiFact.com: “Kaine entered the governor’s mansion half way through fiscal 2006, inheriting a $1.45 billion budget for higher education costs. That rose to $1.76 billion in 2008. Kaine’s final budget proposal called for funding to hit a low point of $1.37 billion in fiscal 2012. So if you compare the proposed 2012 valley to the 2008 peak, Kaine endorsed a 22.1 percent cut to higher education spending — close to the Republicans’ number. But if you compare Kaine’s proposed 2012 funding to the level six years earlier when he came into office, the reduction is only 5.7 percent. […] We think the purest measurement comes from comparing the 2006 budget Kaine essentially inherited to his farewell proposal that offered a spending plan through 2012. That shows Kaine endorsed budgets that reduced higher education spending by 5.7 percent over six years.” [PolitiFact.com, 4/4/12]

College Spending Cuts Were Approved By Virginia’s GOP-Controlled House. From PolitiFact.com: “Is it fair to blame Kaine for the cuts to the colleges? All of the spending levels Kaine recommended for colleges and universities — within a few dollars — were in state budgets that were approved with overwhelming bipartisan support in the Republican-controlled House of Delegates. […] Brandi Hoffine, a spokeswoman for the Kaine, said the former governor had to cut nearly every part of the state budget to cope with the deep recession.” [PolitiFact.com, 4/4/12]

“Failed” Recovery Act Created Millions Of Jobs, Boosted GDP, And Cut Taxes

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact.com, 2/17/10]

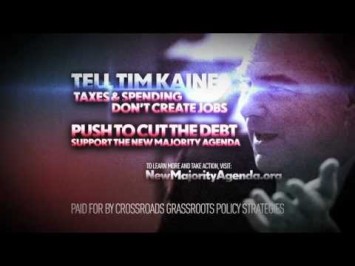

[NARRATOR:] When Tim Kaine was governor, spending soared, blowing holes in the budget every year. Kaine backed massive tax hikes every year. His reckless spending was followed by devastating cuts to higher education, tuition costs exploded, and in Washington Kaine pushed the failed stimulus, which wasted even more. Kaine’s failed solutions: Tax hikes, wasteful spending. Tell him that doesn’t create jobs. Push to cut the debt. Support the New Majority Agenda at NewMajorityAgenda.org. [Crossroads GPS via YouTube.com, 8/8/12]