The U.S. Chamber of Commerce’s argument against Wisconsin’s Tammy Baldwin (D) distorts her record on health care, energy, and tax policy. The insurance-industry-funded Chamber attacks Baldwin for supporting a health care bill that included a public option, ignoring consistent popular support for the proposal. Baldwin’s opposition to the Bush tax cuts for the wealthy does not amount to raising taxes on small businesses (a claim the Chamber supports by citing a biased report on a flawed study commissioned by the Chamber itself). And, finally, Baldwin opposed Republican energy legislation that would have stymied efforts to make offshore drilling safer.

Baldwin Supported A Public Health Insurance Option To Compete With Private Plans

The ad cites Baldwin’s vote on H.R.3962 on November 7, 2009, to support its claim that she “voted for government-run health care.”

Bill Included A Public Option Competing With Private Insurance And Expected To Be “A Relatively Small Player” Covering Just 6 Million Americans. From the Washington Post: “Under the House bill, 36 million uninsured Americans would become eligible for coverage. About 15 million of the poorest children and adults would enroll in Medicaid. An additional 21 million would purchase coverage on a new national insurance exchange, where private plans would compete with a ‘public option’ backed by the federal government. An analysis of the House bill released late Thursday by the nonpartisan Congressional Budget Office estimated that 6 million people would choose a public plan, making it a relatively small player, despite the issue’s outsize role in the health-care debate.” [Washington Post, 10/30/09]

Polls Consistently Found Popular Support For The Public Option

June 2009: NYT/CBS News Poll Found 72 Percent Support For Public Option. From the New York Times: “Americans overwhelmingly support substantial changes to the health care system and are strongly behind one of the most contentious proposals Congress is considering, a government-run insurance plan to compete with private insurers, according to the latest New York Times/CBS News poll. […] The national telephone survey, which was conducted from June 12 to 16, found that 72 percent of those questioned supported a government-administered insurance plan — something like Medicare for those under 65 — that would compete for customers with private insurers. Twenty percent said they were opposed.” [New York Times, 6/20/09]

September 2009: SurveyUSA Poll Found 77 Percent Support For Public Option. According to the Huffington Post: “More than three out of every four Americans feel it is important to have a ‘choice’ between a government-run health care insurance option and private coverage, according to a public opinion poll released on Thursday. A new study by SurveyUSA puts support for a public option at a robust 77 percent, one percentage point higher than where it stood in June.” [Huffington Post, 9/20/09]

October 2009: WaPo-ABC Poll Found 57 Percent Support For Public Option. According to the Washington Post: “A new Washington Post-ABC News poll shows that support for a government-run health-care plan to compete with private insurers has rebounded from its summertime lows and wins clear majority support from the public. […] If a public plan were run by the states and available only to those who lack affordable private options, support for it jumps to 76 percent. Under those circumstances, even a majority of Republicans, 56 percent, would be in favor of it, about double their level of support without such a limitation.” [Washington Post, 10/20/09]

November 2009: Reuters Poll Finds 60 Percent Support For Public Option. From Reuters: “Just under 60 percent of those surveyed said they would like a public option as part of any final healthcare reform legislation, which Republicans and a few Democrats oppose. Here are some of the results of the telephone survey of 2,999 households called from November 9-17 as part of the Thomson Reuters PULSE Healthcare Survey: Believe in public option: 59.9 percent yes, 40.1 percent no.” [Reuters, 12/3/09]

2009 Mt. Sinai School Of Medicine Poll: 63% Of Doctors Favor Public Option. From NPR: “When polled, ‘nearly three-quarters of physicians supported some form of a public option, either alone or in combination with private insurance options,’ says Dr. Salomeh Keyhani. She and Dr. Alex Federman, both internists and researchers at Mount Sinai School of Medicine in New York, conducted a random survey, by mail and by phone, of 2,130 doctors. They surveyed them from June right up to early September. Most doctors — 63 percent — say they favor giving patients a choice that would include both public and private insurance. That’s the position of President Obama and of many congressional Democrats. In addition, another 10 percent of doctors say they favor a public option only; they’d like to see a single-payer health care system. Together, the two groups add up to 73 percent. When the American public is polled, anywhere from 50 to 70 percent favor a public option. So that means that when compared to their patients, doctors are bigger supporters of a public option.” [NPR.org, 9/14/09]

2010: Indiana University Poll Found Majority Of Those Who Favored Repeal Also Supported Public Option. According to the Indiana University Center for Health Policy and Professionalism Research: “When asked how important they thought it was for Congress to work on ‘establishment of a public option that would give individuals a choice between government provided health insurance or private health insurance,’ 67 percent of Americans rated this as an important topic to address. This finding is even more striking given the fact that 59 percent of those in favor of repealing the health care reform legislation rated the public option as important to pursue.” [CHPPR.IUPUI.edu, April 6-10, 2010]

Health Insurers Poured Money Into Chamber To Attack Reform

Health Insurance Industry Gave Chamber Over $100 Million To Fight Health Care Reform. From the National Journal: “The nation’s leading health insurance industry group gave more than $100 million to help fuel the U.S. Chamber of Commerce’s 2009 and 2010 efforts to defeat President Obama’s signature health care reform law, National Journal’s Influence Alley has learned. During the final push to kill the bill before its March 2010 passage, America’s Health Insurance Plans gave the chamber $16.2 million. With the $86.2 million the insurers funneled to the business lobbying powerhouse in 2009, AHIP sent the chamber a total of $102.4 million during the health care reform debate, a number that has not been reported before now. The backchannel spending allowed insurers to publicly stake out a pro-reform position while privately funding the leading anti-reform lobbying group in Washington. The chamber spent tens of millions of dollars bankrolling efforts to kill health care reform.” [NationalJournal.com, 6/13/12]

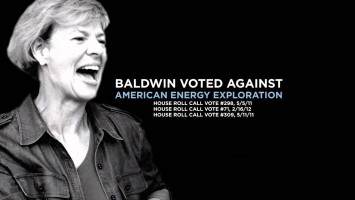

Baldwin Opposed GOP Measure That Would Have Halted Efforts To Make Offshore Drilling Safer Just One Year After The Deepwater Horizon Oil Spill

The ad cites Baldwin’s votes against the Restarting American Offshore Leasing Now Act and the Putting The Gulf Of Mexico Back To Work Act.

“Restarting American Offshore Leasing Now Act” Would Have Ended Push For Revised Safety And Environmental Procedures Around Offshore Drilling. From the New York Times: “Opponents of the measure said that the Republican-sponsored bill, titled the Restarting American Offshore Leasing Now Act, reflected ‘amnesia’ about the dangers of offshore drilling barely a year after the Deepwater Horizon blowout killed 11 people and spewed about 200 million gallons of oil into the gulf. […] The House bill that was approved on Thursday sets specific deadlines for lease sales in the gulf and off the Virginia coast and deems existing environmental reviews for the tracts to be adequate. The Obama administration has said it would make those areas available for drilling only after new environmental impact statements are prepared and certain safety measures adopted by the industry.” [New York Times, 5/5/11]

“Putting The Gulf Of Mexico Back To Work Act” Would Have Deemed Any Offshore Drilling Lease Granted If Interior Department Took More Than 60 Days To Review. From the Washington Post: “The bill calls on the Interior Department to act within 30 days on any drilling permits in the Gulf and provides for two extensions of 15 days. If the department does not act within that 60-day window, the application automatically would be deemed approved. House Republicans, who have dubbed the bill the ‘Putting the Gulf of Mexico Back to Work Act,’ argued that the measure will help alleviate soaring gas prices by maximizing domestic energy production. Democrats countered that the measure would not have an immediate effect on energy prices and accused Republicans of ignoring the lessons of last year’s Deepwater Horizon oil spill disaster in the Gulf.” [Washington Post, 5/11/12]

Baldwin Opposed Bill That Would Have Forced Approval Of Keystone XL Pipeline Despite High Environmental Risks, Low Economic Rewards

The ad cites Baldwin’s vote against H.R.3408 on February 16, 2012.

House Bill Centered On Taking Keystone XL Approval Out Of Hands Of The White House. From Reuters: “The U.S. House of Representatives passed an energy bill on Thursday that would wrest control of a permit for the controversial Keystone XL oil pipeline away from President Barack Obama, who has put the project on hold. The bill, part of a broader House Republican effort to fund highways and infrastructure projects, would also expand offshore oil drilling and open up parts of the Arctic National Wildlife Refuge to drilling. While approval of the Keystone measure by the House was widely expected, what happens with a similar proposal in the Democratic-controlled Senate is not yet clear.” [Reuters, 2/17/12]

Keystone Pipeline Would Not Lower Gas Prices Or Create Many Jobs

Amount Of Oil Provided To U.S. Markets By Keystone XL Would Save Consumers Just 3 Cents Per Gallon. From Businessweek: “The gas price argument rests on the bump in supply the Keystone XL will bring to market. Keystone XL would deliver around 830,000 barrels a day. Not all of that would be used in the U.S., however: The pipeline delivers to a tariff-free zone, so there’s a financial incentive to export at least some of this oil. This is especially true because area refineries are primed to produce diesel, for which there’s less stateside demand. But let’s say two-thirds of the capacity—half a million barrels a day—of Keystone oil stays in the U.S. That’s a convenient estimate on which to gauge the impact of Keystone oil, because it’s the supply increase the U.S. Energy Information Administration, which provides independent data on energy markets, expected in a recent study of the expiration of offshore drilling bans. In 2008, it studied what 500,000 barrels more per day would save consumers at the pump: 3¢ a gallon.” [Businessweek, 2/17/12

TransCanada Itself Says Keystone XL Could Raise Gas Prices For Midwestern U.S. From an op-ed by journalist and environmental activist Bill McKibben in The Hill: “But in the case of the Keystone pipeline, it turns out there’s a special twist. At the moment, there’s an oversupply of tarsands crude in the Midwest, which has depressed gas prices there. If the pipeline gets built so that crude can easily be sent overseas, that excess will immediately disappear and gas prices for 15 states across the middle of the country will suddenly rise. Says who? Says the companies trying to build the thing. Transcanada Pipeline’s rationale for investors, and their testimony to Canadian officials, included precisely this point: removing the ‘oversupply’ and the resulting ‘price discount’ would raise their returns by $2 to $4 billion a year.” [McKibben Op-Ed, The Hill, 2/21/12]

State Department Estimates Keystone Would Create Just 20 Permanent Jobs. From Businessweek: “Clearly, the construction of the pipe, most of it below ground, will be a huge undertaking. The estimated number of people it will employ in the process, however, has fluctuated wildly, with TransCanada raising the number from 3,500, to 4,200, to 20,000 temporary positions and suggesting the line will employ several hundred on an on-going basis. The U.S. State Department, which made its own assessment because the pipeline crosses the U.S.-Canada border, estimates the line will create just 20 permanent jobs. One advantage of a pipeline, after all, is that it’s automated.” [Businessweek, 2/17/12]

Keystone Would Create Fewer Than 25,000 Total Jobs Per Year For Just Two Or Three Years. From a Cornell University Global Labor Institute study of KXL’s economic impacts: “[W]e calculate that the actual spending relevant to the US economy, and the figure from which US new job creation projections should be calculated, is around $3 to $4 billion, not $7 billion. […] Fortunately, the job projections submitted by developers of other major pipeline projects provide a useful guide for estimating potential impacts for KXL. On this basis, for the purposes of estimating total employment impacts, it is reasonable to assume a multiplier of approximately 11 person-years per $1 million pipeline project capital costs. […] Given a multiplier of 11 person-years per $1 million, this translates into total employment impacts of 33,000 to 44,000 person-years. So a reasonable estimate of the total incremental US jobs from KXL construction is about one-third of the figure estimated in the Perryman study and used by industry to advocate for the construction of KXL. Moreover, any job impacts associated with KXL construction would be spread over 2 and more likely 3 years. So the annual impacts are at most about 22,000 person-years of employment per year, for two years. But the annual impacts could also be as low as 11,000 person-years per year, for three years.” [“Pipe Dreams? Jobs Gained, Jobs Lost By The Construction Of Keystone XL,” Cornell University Global Labor Institute, September 2011, internal citations removed]

Keystone Pipeline Could Threaten The Environment

Keystone XL Would Pump Heavy Crude Mixed With Toxic Chemicals Over One Of Largest Aquifers In U.S. From NPR: “The difference between Canadian Tar Sands oil and Oklahoma light sweet crude is like the difference between Coca-Cola and cake batter. So to make it easier for Canadian oil to flow thousands of miles south to Cushing, it has to be mixed with chemicals to thin out. ‘They won’t tell us what’s in the oil to make it flow,’ says Randy Thompson, a Nebraskan cattle rancher who’s opposed Keystone XL. He’s successfully spearheaded a campaign to halt the construction of Keystone XL through the ecologically sensitive Sandhills of Nebraska that lie atop one of America’s largest underground aquifers. ‘We know they’re toxic chemicals. So this is a severe concern for a lot of us people out here,’ Thompson says. ‘A lot of us people out here, we gotta drink this water. Be nice to know what the hell they’re pumping through it.’ TransCanada claims that its proposed Keystone XL line will be the safest of its kind ever built. ‘I believe we can absolutely build pipelines with new technology that are getting closer and closer to being leak free,’ Jones says.” [NPR.org, 2/26/12]

- Despite Decline In Incidents, Still Over 100 “Significant Spills” Per Year From U.S. Pipelines. From the New York Times: “Federal records show that although the pipeline industry reported 25 percent fewer significant incidents from 2001 through 2010 than in the prior decade, the amount of hazardous liquids being spilled, though down, remains substantial. There are still more than 100 significant spills each year — a trend that dates back more than 20 years. And the percentage of dangerous liquids recovered by pipeline operators after a spill has dropped considerably in recent years.” [New York Times, 9/9/11]

- Over 5,600 Incidents Releasing 110 Million Gallons From Pipelines Since 1990. From the New York Times: “Since 1990, more than 5,600 incidents were reported involving land-based hazardous liquid pipelines, releasing a total of more than 110 million gallons of mostly crude and petroleum products, according to analysis of federal data. The pipeline safety agency considered more than half — at least 100 spills each year — to be ‘significant,’ meaning they caused a fire, serious injury or fatality or released at least 2,100 gallons, among other factors.” [New York Times, 9/9/11]

Baldwin Opposed Bush Tax Cuts For The Wealthy, Supports Tax Relief For The Middle Class

To support the claim that Baldwin “voted to raise taxes on small businesses,” the ad cites Roll Votes #182 and #225 in 2003, Vote #621 in 2005, and Vote #510 in 2006. In those votes, the House passed and extended the Bush tax cuts.

Baldwin Opposed Bush Tax Cuts Because They Were “Weighted Toward The Very Wealthy” And “Fiscally Irresponsible.” According to the Wisconsin State Journal: “She also opposed income-tax cuts pushed by then-President George W. Bush in 2001 and 2003 that she said added $1 trillion each to the deficit and were ‘heavily weighted toward the very wealthy.’ ‘When I came to Congress, we had a budget that was balanced — in fact it was in surplus,’ Baldwin said. ‘When did we go from budget surplus to budget deficit? It was right after the 2001 Bush tax cuts were passed and implemented. It was doubled down in 2003 with those tax cuts … I thought they were fiscally irresponsible.’” [Wisconsin State Journal, 10/26/12]

Baldwin Supported Extension Of Bush Tax Cuts For Income Up To $250,000. From Baldwin’s House website: “Families continue to struggle in this economy. With persistently high unemployment, continued weakness in the housing market and limited access to credit for small businesses, I believe that a tax increase on working families would slow our economic recovery. Therefore, I supported extension of the Bush era tax cuts on income up to $250,000.” [TammyBaldwin.House.gov, accessed 9/18/12]

- In August, Baldwin Voted To Extend Bush-Era Tax Cuts For Income Up To $250,000. [H.R. 8, Vote #543, 8/1/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

Few Top Income Taxpayers Are Actual “Small Businesses”

CBPP: “Only 2.5 Percent Of Small Business Owners Face The Top Two Rates.” According to the Center on Budget and Policy Priorities: “Allowing the top two marginal tax rates to return to pre-2001 levels as scheduled next year would affect very few small businesses, a recent Treasury Department study found. The study shows that only 2.5 percent of small business owners face the top two rates.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Chamber Misleadingly Cites Heritage Report On Chamber-Commissioned Study

The ad also cites a Heritage Foundation post from July 18, 2012, which touts an Ernst & Young study purporting to find that President Obama’s tax proposals “would kill 710,000 jobs.”

Ernst & Young Study Commissioned By Chamber & Other Business Groups. From the July 2012 Bloomberg article with that headline: “The U.S. would lose 710,000 jobs and economic output would decline by 1.3 percent, or $200 billion, if tax cuts for high earners are allowed to lapse, said a report prepared for the U.S. Chamber of Commerce and other supporters of the tax breaks. The study by Ernst & Young LLP supports Republican efforts to extend all of the George W. Bush-era tax cuts set to expire at the end of the year. President Barack Obama called on Congress last week to pass a one-year extension of tax cuts for married couples making less than $250,000 a year while letting rates rise for higher earners. […] In addition to the Chamber of Commerce, the largest U.S. business lobby, the report was issued on behalf of the Independent Community Bankers of America, the National Federation of Independent Business and the S Corporation (SCI) Association.” [Bloomberg, 7/17/12]

Ernst & Young Study Didn’t Address President’s Proposals. According to economist Jared Bernstein: “First off, E&Y quite conspicuously fail to simulate what it is the President is proposing, so their main findings shouldn’t be considered in evaluating his proposals. Second, when they get a little closer to what he is proposing, they find it adds jobs.” [JaredBernsteinBlog.com, 8/14/12]

Ernst & Young Study Assumes Revenue From Ending Tax Cuts Will Pay For More Spending, But Obama Proposed To Use It For Deficit Reduction. From an analysis by the National Economic Council’s Jason Furman via the White House: “The President has proposed to let the high-income tax cuts expire and use the resulting $1 trillion in savings (over 10 years) as part of a balanced plan to reduce deficits and debt and put the nation on a sustainable fiscal course that includes $2.50 of spending cuts for every $1.00 of revenue. But rather than modeling the President’s proposal to reduce the deficit, the headline numbers in the study explicitly assume that the revenue would be used entirely to finance additional spending. In fact, the study explicitly states, ‘Using the additional revenue to reduce the deficit is not modeled.’” [WhiteHouse.gov, 7/17/12, underlining original]

When The Study Models Ending Top-Tier Tax Cuts While Giving Middle Class Cuts, It Projects An Employment Increase. According to economist Jared Bernstein: “But for all of that, they actually find that when they model something that’s closer to what the President is proposing — getting rid of the Bush tax cuts for high-income families, while providing additional tax cuts to the middle-class — employment grows by 0.4%, or almost 600,000 jobs. When they simulate the wrong scenario of new tax revenues used to support higher spending (column 1, table 2), they estimate that employment would fall by 0.5%. But if the revenue was used to finance across-the-board tax cuts, employment grows.” [JaredBernsteinBlog.com, 8/14/12]

[NARRATOR:] Congresswoman Tammy Baldwin: A serious threat to jobs. Rated the most liberal member of Congress, twice. A record of failure: Baldwin voted for government-run health care, Baldwin voted against American energy exploration, and Baldwin voted to raise taxes on small businesses. No wonder Baldwin scored a measly 13 percent with the U.S. Chamber of Commerce. Even Nancy Pelosi scored better. Enough. Defeat Tammy Baldwin. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube, 10/27/12]