The U.S. Chamber of Commerce claims that Julia Brownley cast three votes to raise energy costs for California businesses. But those three bills were about how to spend money that will be raised by a cap-and-trade system that’s already law in the California. The deception doesn’t end there, as the ad falsely suggests Brownley’s support for the Affordable Care Act and Democratic efforts to end the Bush tax cuts for the wealthiest will harm job creation.

U.S. Chamber Ad Cites California Chamber’s Misleading Depiction Of Three State Bills As Proof Of Brownley’s Votes To “Increase Energy Costs”

The Chamber’s ad cites the California Chamber of Commerce’s website, which on various pages describes the three bills cited by the Chamber ad – AB 1186, AB 1532, and SB 535 – as job-killing laws that will raise energy costs.

The California Chamber Of Commerce Is A Member Of the U.S. Chamber. [USChamber.com, accessed 10/1/12]

AB 1186 Set Rules For Spending Cap-And-Trade Revenue. From the Sacramento Bee: “Lobbyists for the California Chamber of Commerce and other business groups blocked or neutralized more than 80 percent of the bills on the chamber’s ‘job killer’ list in the just-concluded 2012 legislative session, and would score even higher if Gov. Jerry Brown rejects any of the four measures that reached his desk. […] Three of the survivors, Assembly Bills 1186 and 1532 and Senate Bill 535, set parameters for spending what could be billions of dollars in fees from the state’s new ‘cap-and-trade’ program of curbing greenhouse gas emissions.” [Sacramento Bee, 9/6/12]

AB 1532 Directs Cap-And-Trade Revenue To Clean Energy And Clean Air Projects. From the Sacramento Bee: “AB 1532 would apply to an estimated $1 billion expected to be generated from cap-and-trade auctions in 2012-13. Revenues are expected to grow significantly in future years. AB 1532 would authorize funds generated by the auction of ‘cap and trade’ credits to be spent on projects promoting clean energy, low-carbon transportation, natural resource protection, and for research, development and deployment of innovative technologies to promote cleaner air. Pérez’s legislation also would require the state Air Resources Board to develop an investment plan for the auction revenues every three years. The Legislature would review and could change the ARB plan before adoption.” [Sacramento Bee, 5/29/12]

SB 1572 Allows Cap-And-Trade Revenue To Be Spent On Energy Efficiency And Clean Energy Projects In 2013. From California Energy & Climate Report: “California lawmakers this week advanced legislation that allows the state to spend next year $250 million in estimated revenue from the state’s greenhouse gas (GHG) cap-and-trade program. The bill includes spending on school and home energy-savings programs, activities to reduce vehicle travel in regions, clean-energy technologies to help specific industries comply with the climate regulation, among other uses. […] Specifically, SB 1572 requires the funds to be allocated into several categories, with conditions: $89 million for K-12 school energy projects; $20 million for public university projects, such as energy efficiency upgrades; $30 million for cleaner energy technology at industrial facilities regulated under the program; $10 million for residential energy efficiency; $4 million for clean energy projects at agriculture facilities; $30 million to reduce transportation-related emissions through land-use planning changes; $12 million to reduce GHG emissions tied to ‘goods movement’; $5 million to lower emissions from school buses; and $30 million for clean-vehicle rebates.” [California Energy & Climate Report via Nexis, 7/8/12]

California Global Warming Solutions Act Of 2006 Already Allows Cap-And-Trade Revenue To Be Collected. According to Forbes.com: “Barring last-minute lawsuits or administrative delays, California’s cap-and-trade program launches on January 1, 2013. The state’s carbon market will be the world’s second largest, after the European Emissions Trading System, and is tasked with supplying 20% of the emissions reductions mandated under the Global Warming Solutions Act of 2006, or AB 32. The market launch will be preceded, on November 14, by the first of three state-run auctions scheduled for California’s 2012-13 fiscal year. The countdown to the first emissions allowance auction, and the non-trivial amount of revenue expected to be raised, has grabbed the attention of lawmakers and the governor. The budget plan released by Governor Jerry Brown, in January, projected auction revenues of $1 billion in 2012-13.” [Forbes.com, 4/25/12]

- CA Assembly Speaker: AB 1532 Does Not Carry New Costs For Businesses. From the Sacramento Bee: “Republicans blasted AB 1532 as a new blow to California businesses that have been hit hard by a rocky economy. […] Added Assemblyman Dan Logue, R-Marysville: ‘We have to stop looking at our businesses and job creators as a bottomless piggy bank.’ [California Assembly Speaker John A.] Pérez countered that the state already is committed to cap and trade to reduce greenhouse gases, so AB 1532 does not impose new economic pressures on businesses but simply regulates the spending of revenues generated from pollution auctions and gives lawmakers more control over future projects.” [Sacramento Bee, 5/29/12]

California Chamber Of Commerce Bases Criticism Of Bills On The Premise That California’s Global Warming Law Is An “Illegal Tax.” From the California Chamber Of Commerce’s CAJobKillers.com website: “AB 1186 (Skinner; D-Berkeley)/AB 1532 (John A. Pérez; D-Los Angeles)/ AB 2404 (Fuentes; D-Los Angeles)/ SB 535 (De León; D-Los Angeles)/ SB 1572 (Pavley; D-Agoura Hills) Illegal Tax Increase — Increases energy costs, including fuel prices, on consumers and businesses by allocating funds from an illegal tax to various programs that are not necessary to cost-effectively implement the market-based trading mechanism under AB 32.” [CAJobKillers.com, accessed 10/1/12, emphasis original]

Independently Vetted Study: California’s Economy Will Add Jobs Under Cap-And-Trade Law. From the Los Angeles Times: “California’s overall economy will not suffer, and many parts of it will prosper under the state’s landmark global warming law, according to an analysis by the California Air Resources Board that rebuts an industry-led ballot effort to suspend the regulations. The 103-page report, to be released Wednesday, comes after earlier projections were criticized as flimsy. It was vetted by a panel of independent academics and policy experts. […] A group that includes the California Chamber of Commerce, the California Manufacturers & Technology Assn. and various companies issued a report ahead of Wednesday’s release saying that implementing the climate law could cost the state 485,000 jobs by 2020, a sharp contrast to the air board’s finding that the law would yield a net increase of 10,000 jobs.” [Los Angeles Times, 3/24/12]

Study: Northeast Regional Greenhouse Gas Initiative Has Added $1.6 Billion To Regional Economy. From the Analysis Group:

In a new report, ‘The Economic Impacts of the Regional Greenhouse Gas Initiative on Ten Northeast and Mid-Atlantic States,’ Analysis Group researchers have quantified the economic benefits from implementation of a multistate regional greenhouse gas initiative. […]

Key findings include:

- The regional economy gains more than $1.6 billion in economic value added (reflecting the difference between total revenues in the overall economy, less the cost to produce goods and services)

- Customers save nearly $1.1 billion on electricity bills, and an additional $174 million on natural gas and heating oil bills, for a total of $1.3 billion in savings over the next decade through installation of energy efficiency measures using funding from RGGI auction proceeds to date

- 16,000 jobs are created region wide

- Reduced demand for fossil fuels keeps more than $765 million in the local economy

- Power plant owners experience $1.6 billion in lower revenue over time, although they overall had higher revenues than costs as a result of RGGI during the 2009-2011 period

[AnalysisGroup.com, 11/15/11]

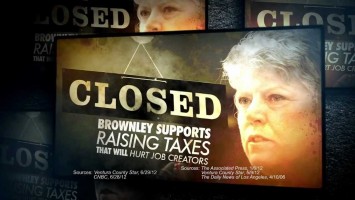

Chamber Claims Ending Bush Tax Cuts For Top Earners Means Taxing Job Creators

To support its claim that Brownley “supports raising taxes…that will hurt job creators,” the Chamber’s ad cites a Ventura County Star article in which she states her opposition to the Bush tax cuts.

Brownley Applauded Senate’s Vote To Extend Bush-Era Tax Rates For Middle Class, Criticized GOP Efforts To Extend Bush Tax Cuts For The Wealthiest. From Brownley’s Twitter account: “Today, the Senate did the right thing and voted to extend tax cuts for the recovering middle class. I urge the House to do the same.” In a press release, Brownley the Republican budget for “Rais[ing] taxes on the middle class while making permanent the Bush tax cuts for the wealthy and continues tax breaks for big corporations who ship jobs overseas.” [Twitter.com, 7/25/12; Brownley Release, 8/16/12]

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

Bloomberg: “Give The Wealthiest Americans A Tax Cut And History Suggests They Will Save The Money Rather Than Spend It.” As reported by Bloomberg: “Give the wealthiest Americans a tax cut and history suggests they will save the money rather than spend it. Tax cuts in 2001 and 2003 under President George W. Bush were followed by increases in the saving rate among the rich, according to data from Moody’s Analytics Inc. When taxes were raised under Bill Clinton, the saving rate fell. The findings may weaken arguments by Republicans and some Democrats in Congress who say allowing the Bush-era tax cuts for the wealthiest Americans to lapse will prompt them to reduce their spending, harming the economy.” [Bloomberg, 9/14/10]

Few Top Income Taxpayers Are “Small Businesses”

CBPP: “Only 2.5 Percent Of Small Business Owners Face The Top Two Rates.” According to the Center on Budget and Policy Priorities: “Allowing the top two marginal tax rates to return to pre-2001 levels as scheduled next year would affect very few small businesses, a recent Treasury Department study found. The study shows that only 2.5 percent of small business owners face the top two rates.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Conservative Portrayal Of Affordable Care Act As Job-Destroying Is Inaccurate

FactCheck.org: “Job-Killing” Claim Is “Health-Care Hooey.” From FactCheck.org: “The exaggerated Republican claim that the new health care law ‘kills jobs’ was high on our list of the ‘Whoppers of 2011.’ But the facts haven’t stopped Republicans and their allies from making the ‘job-killing’ claim a major theme of their campaign 2012 TV ads. […]All of this is health-care hooey, aimed at exploiting public concern over continuing high unemployment, with little basis in fact. As we’ve said before (a few times), experts project that the law will cause a small loss of low-wage jobs — and also some gains in better-paid jobs in the health care and insurance industries. It’s also expected that more workers will decide to retire earlier, or work fewer hours, when they no longer need employer-sponsored insurance and can obtain it on their own with help from federal subsidies. But that just means fewer people willing to work — and it will free up jobs for those who want them. If anything, that could reduce the jobless rate.” [FactCheck.org, 2/21/12]

- AP: Republicans Misuse CBO Statistics To Support “Job-Killing” Claim About Health Care Overhaul. From the Associated Press: “A recent report by House GOP leaders says ‘independent analyses have determined that the health care law will cause significant job losses for the U.S. economy.’ It cites 650,000 lost jobs as Exhibit A, and the nonpartisan Congressional Budget Office as the source of the analysis behind that estimate. But the budget office, which referees the costs and consequences of legislation, never produced that number. What CBO actually said is that the impact of the health care law on supply and demand for labor would be small. Most of the lost jobs would come from people who no longer have to work, or can downshift to less demanding employment, because insurance will be available outside the job. ‘The legislation, on net, will reduce the amount of labor used in the economy by a small amount — roughly half a percent— primarily by reducing the amount of labor that workers choose to supply,’ budget office number crunchers said in a report last year.” [Associated Press via USA Today, 1/24/10]

Health Care Reform Made Tax Credits Available To Over Four Million Small Businesses In 2010. According a report from Families USA and Small Business Majority: “Starting this year, businesses with fewer than 25 workers and average wages of less than $50,000 will be eligible to receive a tax credit for the health insurance that they provide for their employees. The value of the credit this year (and until 2014) is up to 35 percent of the employer’s costs for employee coverage (and up to 25 percent of the costs for nonprofit employers). The smallest firms with the lowest wages—those that employ 10 or fewer workers who earn an average wage of less than $25,000—are eligible for the full 35 percent tax credit (or 25 percent for nonprofits). From there, the size of the credit will phase out on a sliding scale. […] More than 4 million (4,015,300) small businesses will be eligible to receive a tax credit for the purchase of employee health insurance in 2010. That’s 83.7 percent of all small businesses in the country.” [Families USA, July 2010, emphasis original]

Health Insurers Poured Money Into Chamber To Attack Reform

Health Insurance Industry Gave Chamber Over $100 Million To Fight Health Care Reform. From the National Journal: “The nation’s leading health insurance industry group gave more than $100 million to help fuel the U.S. Chamber of Commerce’s 2009 and 2010 efforts to defeat President Obama’s signature health care reform law, National Journal’s Influence Alley has learned. During the final push to kill the bill before its March 2010 passage, America’s Health Insurance Plans gave the chamber $16.2 million. With the $86.2 million the insurers funneled to the business lobbying powerhouse in 2009, AHIP sent the chamber a total of $102.4 million during the health care reform debate, a number that has not been reported before now. The backchannel spending allowed insurers to publicly stake out a pro-reform position while privately funding the leading anti-reform lobbying group in Washington. The chamber spent tens of millions of dollars bankrolling efforts to kill health care reform.” [NationalJournal.com, 6/13/12]

Consumer Demand Is The Key To Job Growth

Wall Street Journal: “Scant Demand, Rather Than Uncertainty Over Government Policies,” Is “The Main Reason” For Slow Recovery In Jobs Market. From the Wall Street Journal: “The main reason U.S. companies are reluctant to step up hiring is scant demand, rather than uncertainty over government policies, according to a majority of economists in a new Wall Street Journal survey. […] In the survey, conducted July 8-13 and released Monday, 53 economists—not all of whom answer every question—were asked the main reason employers aren’t hiring more readily. Of the 51 who responded to the question, 31 cited lack of demand (65%) and 14 (27%) cited uncertainty about government policy. The others said hiring overseas was more appealing.” [Wall Street Journal, 7/18/11]

McClatchy: “Little Evidence” To Support Blaming “Excessive Regulation And Fear Of Higher Taxes For Tepid Hiring.” As reported by McClatchy: “Politicians and business groups often blame excessive regulation and fear of higher taxes for tepid hiring in the economy. However, little evidence of that emerged when McClatchy canvassed a random sample of small business owners across the nation. ‘Government regulations are not ‘choking’ our business, the hospitality business,” Bernard Wolfson, the president of Hospitality Operations in Miami, told The Miami Herald. ‘In order to do business in today’s environment, government regulations are necessary and we must deal with them. The health and safety of our guests depend on regulations. It is the government regulations that help keep things in order.’” [McClatchy, 9/1/11]

Wall Street Journal: Businesses Need “A Burst In Demand Strong Enough To Propel Hiring.” As reported by the Wall Street Journal: “Forecasting firm Macroeconomic Advisers, which sees growth at a 2.3% pace in the second half of this year and 2.8% in 2012, expects firms to keep banking strong profits. But even if businesses remain strong enough to make it through a slowdown, they may have to wait longer for a burst in demand strong enough to propel hiring. ‘The biggest problem is that their order books are thin,’ said Macroeconomic Advisers chairman Joel Prakken. ‘They need fat order books to add people. They need fat order books to buy machines.’” [Wall Street Journal, 8/29/11]

CBO Director Elmendorf: “Primary Reason” For Persistent Unemployment Is “Slack Demand For Goods And Services.” From a blog post by Doug Elmendorf on CBO.gov: “Slack demand for goods and services (that is, slack aggregate demand) is the primary reason for the persistently high levels of unemployment and long-term unemployment observed today, in CBO’s judgment. However, when aggregate demand ultimately picks up, as it eventually will, so-called structural factors—specifically, employer-employee mismatches, the erosion of skills, and stigma—may continue to keep unemployment and long-term unemployment higher than normal.” [CBO.gov, 2/16/12]

AP: “Most Economists Believe There Is A Simpler Explanation” For Slow Job Growth: “There Isn’t Enough Consumer Demand.” From the Associated Press; “Is regulation strangling the American entrepreneur? Several Republican presidential candidates say so. The numbers don’t. […] Labor Department data show that only a tiny percentage of companies that experience large layoffs cite government regulation as the reason. Since Barack Obama took office, just two-tenths of 1 percent of layoffs have been due to government regulation, the data show. Businesses frequently complain about regulation, but there is little evidence that it is any worse now than in the past or that it is costing significant numbers of jobs. Most economists believe there is a simpler explanation: Companies aren’t hiring because there isn’t enough consumer demand.” [Associated Press,10/12/11, emphasis added]

[Darlene Miller:] “Well I want to hire more people, but we don’t know what our tax rates are gonna be. We don’t know what our health care is gonna be, or our energy costs. When you go in that voting booth, you need to know who you’re voting for.” [Narrator:] Sadly, we know about Julia Brownley’s record of failure with California businesses. Brownley voted to increase energy costs. Brownley also supports raising taxes and the health care law that will hurt job creators. Protect jobs. Defeat Julia Brownley. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube, 9/28/12]