An ad from the U.S. Chamber of Commerce features a business owner suggesting that she is unable to hire more people because of uncertainty associated with federal policies, even though ample evidence suggests that consumer demand has the greatest impact on business hiring. The ad then attacks Rep. Jerry McNerney (D-CA) for voting for a cap-and-trade bill that would boost the economy at minimal cost to consumers, and the Affordable Care Act, which doesn’t “cut” Medicare benefits, as the ad suggests, but rather finds savings by reducing future Medicare spending.

Clean Energy Legislation Would Have Boosted The Economy At Minimal Cost To Consumers

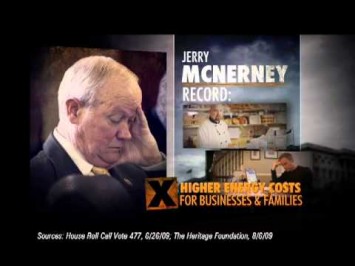

The ad cites Vote #477 on June 26, 2009, in which the House passed the American Clean Energy and Security Act, to support the claim that Rep. McNerney voted for “higher energy costs for small businesses and California families.”

Reuters: Experts Say House-Passed Clean Energy Bill Would Have “Only A Modest Impact On Consumers.” According to Reuters: “A new U.S. government study on Tuesday adds to a growing list of experts concluding that climate legislation moving through Congress would have only a modest impact on consumers, adding around $100 to household costs in 2020. Under the climate legislation passed by the House of Representatives in June, electricity, heating oil and other bills for average families will rise $134 in 2020 and $339 in 2030, according to the Energy Information Administration, the country’s top energy forecaster. The EIA estimate was in line with earlier projections from the nonpartisan Congressional Budget Office which said average families would pay about $175 extra annually by 2020, and the Environmental Protection Agency, which said families would pay at most an extra $1 per day.” [Reuters, 8/5/09]

- CBO Estimated Cost Of ACES In 2020 Would Be $175 Per Household Per Year. From the Congressional Budget Office: ‘”Although the analysis examines the effects of the bill as it would apply in 2020, those effects are described in the context of the current economy that is, the costs that would result if the policies set for 2020 were in effect in 2010. On that basis, CBO estimates that the net annual economywide cost of the cap-and-trade program in 2020 would be $22 billion or about $175 per household.” [CBO.gov, 6/20/09]

- CBO: Energy Costs Would Actually Decrease For Low-Income Households. According to the Congressional Budget Office’s analysis of the American Clean Energy and Security Act, if the bill were implemented, “households in the lowest income quintile would see an average net benefit of about $40 in 2020, while households in the highest income quintile would see a net cost of $245.” [CBO.gov, 6/19/09]

Study: Clean Energy Legislation Would Create Jobs, Boost GDP. According to an analysis by the University of California, Berkley: “Comprehensive clean energy and climate protection legislation, like the American Clean Energy and Security Act (ACES) that was passed by the House of Representatives in June, would strengthen the U.S. economy by establishing pollution limits and incentives that together will drive large-scale investments in clean energy and energy efficiency. These investments will result in stronger job growth, higher real household income, and increased economic output than the U.S. would experience without the bill. New analysis by the University of California shows conclusively that climate policy will strengthen the U.S. economy as a whole. Full adoption of the ACES package of pollution reduction and energy efficiency measures would create between 918,000 and 1.9 million new jobs, increase annual household income by $487-$1,175 per year, and boost GDP by $39 billion-$111 billion. These economic gains are over and above the growth the U.S. would see in the absence of such a bill.” [University of California, Berkeley, accessed 5/14/12]

Affordable Care Act Savings Do Not ‘Cut’ Medicare Benefits

Affordable Care Act Reduces Future Medicare Spending, But “Does Not Cut That Money From The Program.” According to PolitiFact: “The legislation aims to slow projected spending on Medicare by more than $500 billion over a 10-year period, but it does not cut that money from the program. Medicare spending will increase over that time frame.” [PolitiFact.com, 6/28/12]

- CBO’s July Estimate Updates Medicare Cost Savings To $716 Billion. According to the Congressional Budget Office’s analysis of a bill to repeal the Affordable Care Act, repeal would have the following effects on Medicare spending: “Spending for Medicare would increase by an estimated $716 billion over that 2013–2022 period. Federal spending for Medicaid and CHIP would increase by about $25 billion from repealing the noncoverage provisions of the ACA, and direct spending for other programs would decrease by about $30 billion, CBO estimates. Within Medicare, net increases in spending for the services covered by Part A (Hospital Insurance) and Part B (Medical Insurance) would total $517 billion and $247 billion, respectively. Those increases would be partially offset by a $48 billion reduction in net spending for Part D.” [CBO.gov, 8/13/12]

GOP Plan Kept Most Of The Savings In The Affordable Care Act. According to the Washington Post’s Glenn Kessler: “First of all, under the health care bill, Medicare spending continues to go up year after year. The health care bill tries to identify ways to save money, and so the $500 billion figure comes from the difference over 10 years between anticipated Medicare spending (what is known as ‘the baseline’) and the changes the law makes to reduce spending. […] The savings actually are wrung from health-care providers, not Medicare beneficiaries. These spending reductions presumably would be a good thing, since virtually everyone agrees that Medicare spending is out of control. In the House Republican budget, lawmakers repealed the Obama health care law but retained all but $10 billion of the nearly $500 billion in Medicare savings, suggesting the actual policies enacted to achieve these spending reductions were not that objectionable to GOP lawmakers.” [WashingtonPost.com, 6/15/11, emphasis added]

Consumer Demand Is The Key To Job Growth

Wall Street Journal: “Scant Demand, Rather Than Uncertainty Over Government Policies,” Is “The Main Reason” For Slow Recovery In Jobs Market. From the Wall Street Journal: “The main reason U.S. companies are reluctant to step up hiring is scant demand, rather than uncertainty over government policies, according to a majority of economists in a new Wall Street Journal survey. […] In the survey, conducted July 8-13 and released Monday, 53 economists—not all of whom answer every question—were asked the main reason employers aren’t hiring more readily. Of the 51 who responded to the question, 31 cited lack of demand (65%) and 14 (27%) cited uncertainty about government policy. The others said hiring overseas was more appealing.” [Wall Street Journal, 7/18/11]

McClatchy: “Little Evidence” To Support Blaming “Excessive Regulation And Fear Of Higher Taxes For Tepid Hiring.” As reported by McClatchy: “Politicians and business groups often blame excessive regulation and fear of higher taxes for tepid hiring in the economy. However, little evidence of that emerged when McClatchy canvassed a random sample of small business owners across the nation. ‘Government regulations are not ‘choking’ our business, the hospitality business,’ Bernard Wolfson, the president of Hospitality Operations in Miami, told The Miami Herald. ‘In order to do business in today’s environment, government regulations are necessary and we must deal with them. The health and safety of our guests depend on regulations. It is the government regulations that help keep things in order.’” [McClatchy, 9/1/11]

Wall Street Journal: Businesses Need “A Burst In Demand Strong Enough To Propel Hiring.” As reported by the Wall Street Journal: “Forecasting firm Macroeconomic Advisers, which sees growth at a 2.3% pace in the second half of this year and 2.8% in 2012, expects firms to keep banking strong profits. But even if businesses remain strong enough to make it through a slowdown, they may have to wait longer for a burst in demand strong enough to propel hiring. ‘The biggest problem is that their order books are thin,’ said Macroeconomic Advisers chairman Joel Prakken. ‘They need fat order books to add people. They need fat order books to buy machines.’” [Wall Street Journal, 8/29/11]

CBO Director Elmendorf: “Primary Reason” For Persistent Unemployment Is “Slack Demand For Goods And Services.” From a blog post by Doug Elmendorf on CBO.gov: “Slack demand for goods and services (that is, slack aggregate demand) is the primary reason for the persistently high levels of unemployment and long-term unemployment observed today, in CBO’s judgment. However, when aggregate demand ultimately picks up, as it eventually will, so-called structural factors—specifically, employer-employee mismatches, the erosion of skills, and stigma—may continue to keep unemployment and long-term unemployment higher than normal.” [CBO.gov, 2/16/12]

AP: “Most Economists Believe There Is A Simpler Explanation” For Slow Job Growth: “There Isn’t Enough Consumer Demand.” From the Associated Press; “Is regulation strangling the American entrepreneur? Several Republican presidential candidates say so. The numbers don’t. […] Labor Department data show that only a tiny percentage of companies that experience large layoffs cite government regulation as the reason. Since Barack Obama took office, just two-tenths of 1 percent of layoffs have been due to government regulation, the data show. Businesses frequently complain about regulation, but there is little evidence that it is any worse now than in the past or that it is costing significant numbers of jobs. Most economists believe there is a simpler explanation: Companies aren’t hiring because there isn’t enough consumer demand.” [Associated Press,10/12/11, emphasis added]

[DARLENE MILLER:] Well I want to hire more people, but we don’t know what our tax rates are going to be. We don’t know what our health care is going to be, or our energy costs. When you go in that voting booth, you need to know who you’re voting for. [NARRATOR:] Congressman McNerney’s record: higher energy costs for small businesses and California families, and $716 billion in Medicare cuts. Stop Congressman McNerney. California can’t afford him anymore. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube.com, 9/28/12]