The U.S. Chamber of Commerce criticizes U.S. House candidate Brad Schneider (D-IL) for supporting “government-mandated health care” and accuses him of wanting “to hit our small businesses with higher taxes.” However, the Chamber relies on the false argument that ending the Bush tax cuts for the wealthiest Americans would have a significant impact on small businesses, when in fact it would reduce the deficit without harming the economy. The Chamber’s broader argument that taxes and regulations are holding back the economy is misleading, as the real key to job creation is increasing consumer demand.

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

- Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

Affordable Care Act Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

Health Insurers Poured Money Into Chamber To Attack Reform

Health Insurance Industry Gave Chamber Over $100 Million To Fight Health Care Reform. From the National Journal: “The nation’s leading health insurance industry group gave more than $100 million to help fuel the U.S. Chamber of Commerce’s 2009 and 2010 efforts to defeat President Obama’s signature health care reform law, National Journal’s Influence Alley has learned. During the final push to kill the bill before its March 2010 passage, America’s Health Insurance Plans gave the chamber $16.2 million. With the $86.2 million the insurers funneled to the business lobbying powerhouse in 2009, AHIP sent the chamber a total of $102.4 million during the health care reform debate, a number that has not been reported before now. The backchannel spending allowed insurers to publicly stake out a pro-reform position while privately funding the leading anti-reform lobbying group in Washington. The chamber spent tens of millions of dollars bankrolling efforts to kill health care reform.” [NationalJournal.com, 6/13/12]

Schneider Wants To End Bush Tax Cuts For The Wealthy – Not “Hit Our Small Businesses With Higher Taxes”

To support the claim that Schneider “wants to hit our small businesses with higher taxes,” the ad cites the Heritage Foundation and Schneider’s campaign website.

Schneider: “We Should Allow The bush Tax Cuts For Income Above $250,000 To Expire.” According to Brad Schneider’s campaign website: “In Congress, I will focus on investments that will provide future security for our families and our nation. Out of the gate, we should allow the Bush tax cuts for income above $250,000 to expire, returning to the Clinton-era rates, to begin addressing our deficits. We should also end the unnecessary tax subsidies for oil corporations and stop tax breaks for companies that ship American jobs overseas. Balancing our budget is vitally important, but we cannot keep trying to do it on the backs of the most vulnerable.”[SchneiderForCongress.com, accessed 10/1/12]

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

Few Top Income Taxpayers Are Actual “Small Businesses”

CBPP: “Only 2.5 Percent Of Small Business Owners Face The Top Two Rates.” According to the Center on Budget and Policy Priorities: “Allowing the top two marginal tax rates to return to pre-2001 levels as scheduled next year would affect very few small businesses, a recent Treasury Department study found. The study shows that only 2.5 percent of small business owners face the top two rates.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

Consumer Demand Is The Key To Job Growth

Wall Street Journal: “Scant Demand, Rather Than Uncertainty Over Government Policies,” Is “The Main Reason” For Slow Recovery In Jobs Market. From the Wall Street Journal: “The main reason U.S. companies are reluctant to step up hiring is scant demand, rather than uncertainty over government policies, according to a majority of economists in a new Wall Street Journal survey. […] In the survey, conducted July 8-13 and released Monday, 53 economists—not all of whom answer every question—were asked the main reason employers aren’t hiring more readily. Of the 51 who responded to the question, 31 cited lack of demand (65%) and 14 (27%) cited uncertainty about government policy. The others said hiring overseas was more appealing.” [Wall Street Journal, 7/18/11]

McClatchy: “Little Evidence” To Support Blaming “Excessive Regulation And Fear Of Higher Taxes For Tepid Hiring.” As reported by McClatchy: “Politicians and business groups often blame excessive regulation and fear of higher taxes for tepid hiring in the economy. However, little evidence of that emerged when McClatchy canvassed a random sample of small business owners across the nation. ‘Government regulations are not ‘choking’ our business, the hospitality business,’ Bernard Wolfson, the president of Hospitality Operations in Miami, told The Miami Herald. ‘In order to do business in today’s environment, government regulations are necessary and we must deal with them. The health and safety of our guests depend on regulations. It is the government regulations that help keep things in order.’” [McClatchy, 9/1/11]

Wall Street Journal: Businesses Need “A Burst In Demand Strong Enough To Propel Hiring.” As reported by the Wall Street Journal: “Forecasting firm Macroeconomic Advisers, which sees growth at a 2.3% pace in the second half of this year and 2.8% in 2012, expects firms to keep banking strong profits. But even if businesses remain strong enough to make it through a slowdown, they may have to wait longer for a burst in demand strong enough to propel hiring. ‘The biggest problem is that their order books are thin,’ said Macroeconomic Advisers chairman Joel Prakken. ‘They need fat order books to add people. They need fat order books to buy machines.’” [Wall Street Journal, 8/29/11]

CBO Director Elmendorf: “Primary Reason” For Persistent Unemployment Is “Slack Demand For Goods And Services.” From a blog post by Doug Elmendorf on CBO.gov: “Slack demand for goods and services (that is, slack aggregate demand) is the primary reason for the persistently high levels of unemployment and long-term unemployment observed today, in CBO’s judgment. However, when aggregate demand ultimately picks up, as it eventually will, so-called structural factors—specifically, employer-employee mismatches, the erosion of skills, and stigma—may continue to keep unemployment and long-term unemployment higher than normal.” [CBO.gov, 2/16/12]

AP: “Most Economists Believe There Is A Simpler Explanation” For Slow Job Growth: “There Isn’t Enough Consumer Demand.” From the Associated Press; “Is regulation strangling the American entrepreneur? Several Republican presidential candidates say so. The numbers don’t. […] Labor Department data show that only a tiny percentage of companies that experience large layoffs cite government regulation as the reason. Since Barack Obama took office, just two-tenths of 1 percent of layoffs have been due to government regulation, the data show. Businesses frequently complain about regulation, but there is little evidence that it is any worse now than in the past or that it is costing significant numbers of jobs. Most economists believe there is a simpler explanation: Companies aren’t hiring because there isn’t enough consumer demand.” [Associated Press,10/12/11, emphasis added]

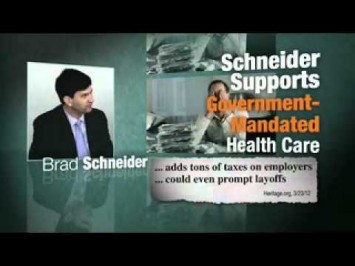

[DARLENE MILLER:] Well I want to hire more people, but we don’t know what our tax rates are going to be. We don’t know what our health care is going to be, or our energy costs. When you go in that voting booth, you need to know who you’re voting for. [NARRATOR:] Brad Schneider – he supports government-mandated health care, a scheme that will raise taxes and hurt job creators. And he wants to hit our small businesses with higher taxes, preventing them from creating new jobs. Enough. Schneider won’t get Illinois working again. [U.S. Chamber of Commerce via YouTube, 9/28/12]