A U.S. Chamber of Commerce ad attacks Senate candidate Rep. Martin Heinrich (D-NM) over his votes against the Regulatory Accountability Act, against the Keystone Pipeline, for the American Clean Energy and Security Act, for Wall Street reform, and for the health care law. The Chamber implies that Heinrich’s votes killed jobs, created red tape, or harmed Medicare, misleading voters about the bills.

Regulatory Accountability Act Would Hinder Rulemaking Process

The ad’s claim that Heinrich “voted against reducing job-killing regulations” cites Roll Call Vote #888 on December 2, 2011, in which the House passed the “Regulatory Accountability Act.”

“Regulatory Accountability Act” Would Make It More Difficult To Enact New Regulations. According to the Washington Post: “For months, Republican lawmakers have targeted specific regulations they want to repeal or block, all in the name of saving jobs. Next up: remaking the entire process for government rulemaking. A handful of bills on Capitol Hill would add new layers of congressional involvement to the rulemaking process, in addition to dozens more criteria for agencies when they analyze a rule’s impact on the economy. The net effect, consumer groups say, is that the already slow process for implementing regulations would get even slower. […] The RAA takes on a 65-year-old statute, the Administrative Procedure Act, that is the bedrock of how agencies implement regulations passed by Congress. Experts estimate there are at least 100 requirements that agencies have to fulfill; for instance, agencies have to consider the impact of a rule on small businesses and the environment. The RAA, which may see a vote Friday in the House, would add roughly 60 new requirements.” [Washington Post, 11/30/11]

Critics Argued “Radical” RAA Would Allow “Powerful Special Interests To Dominate” The Regulatory Process. According to OMB Watch: “The Regulatory Accountability Act (RAA), announced by Sens. Rob Portman (R-OH), Mark Pryor (D-AR), and Susan Collins (R-ME) and Reps. Lamar Smith (R-TX) and Collin Peterson (D-MN) on Sept. 22, is a radical overhaul of the federal rulemaking process that would result in a system that allows powerful special interests to dominate. It would seriously undermine public protections by slowing down the regulatory process, sparking endless litigation, and tilting regulatory outcomes in favor of moneyed interests. The bill would cast aside public health, worker safety, and environmental quality goals that are the basis of so many public protections and make estimated costs to businesses and the economy the most important consideration in rulemaking.” [OMBWatch.org, 9/30/11]

- OMB Watch: “The Bill Would Supplant More Than 60 Years Of Case Law.” According to OMB Watch: “The RAA establishes new procedures for rulemaking by all federal agencies, including independent regulatory agencies, which have traditionally preserved a certain level of independence from the executive branch. It adds special additional procedures for ‘major’ and ‘high-impact’ rules. The bill makes these changes through substantial modification of the 1946 Administrative Procedure Act (APA), even though there has not been a single hearing in the Senate this year on the need for modifying the APA. The bill would supplant more than 60 years of case law and administrative procedure.” [OMBWatch.org, 9/30/11]

GOP Rhetoric About “Job-Killing Regulations” Is Not Supported By Evidence

Gallup Poll Of Small Business Owners Found “Government Regulations” Low On The List Of Obstacles To Hiring. According to Gallup Economy:

U.S. small-business owners who aren’t hiring — 85% of those surveyed — are most likely to say the reasons they are not doing so include not needing additional employees; worries about weak business conditions, including revenues; cash flow; and the overall U.S. economy. Additionally, nearly half of small-business owners point to potential healthcare costs (48%) and government regulations (46%) as reasons. One in four are not hiring because they worry they may not be in business in 12 months.

[Gallup.com, 2/15/12]

National Association For Business Economics Economic Policy Survey: 80 Percent Of Members Say Current Regulatory Environment “Good” For Businesses. From the NABE’s August 2011 Economic Policy Survey: “Regulatory activity has gained a lot of attention, with many groups suggesting that American businesses are overregulated by the current administration. With that said, 80 percent of survey respondents felt that the current regulatory environment was ‘good’ for American businesses and the overall economy.” [NABE.com, August 2011]

Washington Post: Economists Find “Little Evidence” That Regulations Have A Significant Impact On Overall Employment. According to the Washington Post: “Economists who have studied the matter say that there is little evidence that regulations cause massive job loss in the economy, and that rolling them back would not lead to a boom in job creation.” [Washington Post, 10/19/11]

McClatchy: “Little Evidence” To Support Blaming “Excessive Regulation And Fear Of Higher Taxes For Tepid Hiring.” As reported by McClatchy: “Politicians and business groups often blame excessive regulation and fear of higher taxes for tepid hiring in the economy. However, little evidence of that emerged when McClatchy canvassed a random sample of small business owners across the nation. ‘Government regulations are not ‘choking’ our business, the hospitality business,’ Bernard Wolfson, the president of Hospitality Operations in Miami, told The Miami Herald. ‘In order to do business in today’s environment, government regulations are necessary and we must deal with them. The health and safety of our guests depend on regulations. It is the government regulations that help keep things in order.’” [McClatchy, 9/1/11]

- McClatchy: “Some Pointed To The Lack Of Regulation In Mortgage Lending As A Principal Cause Of The Financial Crisis.” As reported by McClatchy: “McClatchy reached out to owners of small businesses, many of them mom-and-pop operations, to find out whether they indeed were being choked by regulation, whether uncertainty over taxes affected their hiring plans and whether the health care overhaul was helping or hurting their business. Their response was surprising. None of the business owners complained about regulation in their particular industries, and most seemed to welcome it. Some pointed to the lack of regulation in mortgage lending as a principal cause of the financial crisis that brought about the Great Recession of 2007-09 and its grim aftermath.” [McClatchy, 9/1/11]

ProPublica: “Mostly, [Regulations] Just Shift Jobs Within The Economy.” As reported by ProPublica: “But is the claim that regulation kills jobs true? We asked experts, and most told us that while there is relatively little scholarship on the issue, the evidence so far is that the overall effect on jobs is minimal. Regulations do destroy some jobs, but they also create others. Mostly, they just shift jobs within the economy. ‘The effects on jobs are negligible. They’re not job-creating or job-destroying on average,’ said Richard Morgenstern, who served in the EPA from the Reagan to Clinton years and is now at Resources for the Future, a nonpartisan think tank.” [ProPublica, 9/21/11]

Regulatory Expert: “Current Rhetoric About Regulation Killing Jobs Is Nothing More Than Not Letting A Good Crisis Go To Waste.” From ProPublica: “‘The issue in regulation always should be whether it delivers benefits that justify the cost,’ said [Roger] Noll[, co-director of the Program on Regulatory Policy at the Stanford Institute for Economic Policy Research]. ‘The effect of regulation on jobs has nothing to do with the mess we’re in. The current rhetoric about regulation killing jobs is nothing more than not letting a good crisis go to waste.’” [ProPublica, 9/21/11]

Former Reagan Adviser: “Regulatory Uncertainty Is A Canard Invented By Republicans” And Unsupported By The Facts. According to former Reagan adviser Bruce Bartlett: “These constraints have led Republicans to embrace the idea that government regulation is the principal factor holding back employment. They assert that Barack Obama has unleashed a tidal wave of new regulations, which has created uncertainty among businesses and prevents them from investing and hiring. No hard evidence is offered for this claim; it is simply asserted as self-evident and repeated endlessly throughout the conservative echo chamber. […] In my opinion, regulatory uncertainty is a canard invented by Republicans that allows them to use current economic problems to pursue an agenda supported by the business community year in and year out. In other words, it is a simple case of political opportunism, not a serious effort to deal with high unemployment.” [New York Times, 10/4/11]

Keystone Pipeline Would Threaten Environment But Wouldn’t Create Many Jobs

The ad’s claim that Heinrich “voted against the Keystone pipeline” cites Roll Call Vote #71 on February 16, 2012, and Roll Call Vote #650 on July 26, 2011.

Keystone XL Would Pump Heavy Crude Mixed With Toxic Chemicals Over One Of Largest Aquifers In U.S. From NPR: “The difference between Canadian Tar Sands oil and Oklahoma light sweet crude is like the difference between Coca-Cola and cake batter. So to make it easier for Canadian oil to flow thousands of miles south to Cushing, it has to be mixed with chemicals to thin out. ‘They won’t tell us what’s in the oil to make it flow,’ says Randy Thompson, a Nebraskan cattle rancher who’s opposed Keystone XL. He’s successfully spearheaded a campaign to halt the construction of Keystone XL through the ecologically sensitive Sandhills of Nebraska that lie atop one of America’s largest underground aquifers. ‘We know they’re toxic chemicals. So this is a severe concern for a lot of us people out here,’ Thompson says. ‘A lot of us people out here, we gotta drink this water. Be nice to know what the hell they’re pumping through it.’ TransCanada claims that its proposed Keystone XL line will be the safest of its kind ever built. ‘I believe we can absolutely build pipelines with new technology that are getting closer and closer to being leak free,’ Jones says.” [NPR.org, 2/26/12]

- Despite Decline In Incidents, Still Over 100 “Significant Spills” Per Year From U.S. Pipelines. From the New York Times: “Federal records show that although the pipeline industry reported 25 percent fewer significant incidents from 2001 through 2010 than in the prior decade, the amount of hazardous liquids being spilled, though down, remains substantial. There are still more than 100 significant spills each year — a trend that dates back more than 20 years. And the percentage of dangerous liquids recovered by pipeline operators after a spill has dropped considerably in recent years.” [New York Times, 9/9/11]

- Over 5,600 Incidents Releasing 110 Million Gallons From Pipelines Since 1990. From theNew York Times: “Since 1990, more than 5,600 incidents were reported involving land-based hazardous liquid pipelines, releasing a total of more than 110 million gallons of mostly crude and petroleum products, according to analysis of federal data. The pipeline safety agency considered more than half — at least 100 spills each year — to be ‘significant,’ meaning they caused a fire, serious injury or fatality or released at least 2,100 gallons, among other factors.” [New York Times, 9/9/11]

Keystone Pipeline Would Not Lower Gas Prices Or Create Many Jobs

Amount Of Oil Provided To U.S. Markets By Keystone XL Would Save Consumers Just 3 Cents Per Gallon. From Businessweek: “The gas price argument rests on the bump in supply the Keystone XL will bring to market. Keystone XL would deliver around 830,000 barrels a day. Not all of that would be used in the U.S., however: The pipeline delivers to a tariff-free zone, so there’s a financial incentive to export at least some of this oil. This is especially true because area refineries are primed to produce diesel, for which there’s less stateside demand. But let’s say two-thirds of the capacity—half a million barrels a day—of Keystone oil stays in the U.S. That’s a convenient estimate on which to gauge the impact of Keystone oil, because it’s the supply increase the U.S. Energy Information Administration, which provides independent data on energy markets, expected in a recent study of the expiration of offshore drilling bans. In 2008, it studied what 500,000 barrels more per day would save consumers at the pump: 3¢ a gallon.” [Businessweek, 2/17/12]

- TransCanada Itself Says Keystone XL Could Raise Gas Prices For Midwestern U.S. From an op-ed by journalist and environmental activist Bill McKibben in The Hill: “But in the case of the Keystone pipeline, it turns out there’s a special twist. At the moment, there’s an oversupply of tarsands crude in the Midwest, which has depressed gas prices there. If the pipeline gets built so that crude can easily be sent overseas, that excess will immediately disappear and gas prices for 15 states across the middle of the country will suddenly rise. Says who? Says the companies trying to build the thing. Transcanada Pipeline’s rationale for investors, and their testimony to Canadian officials, included precisely this point: removing the ‘oversupply’ and the resulting ‘price discount’ would raise their returns by $2 to $4 billion a year.” [McKibben Op-Ed, The Hill, 2/21/12]

State Dept. Estimates Keystone Would Create Just 20 Permanent Jobs. From Businessweek: “Clearly, the construction of the pipe, most of it below ground, will be a huge undertaking. The estimated number of people it will employ in the process, however, has fluctuated wildly, with TransCanada raising the number from 3,500, to 4,200, to 20,000 temporary positions and suggesting the line will employ several hundred on an on-going basis. The U.S. State Department, which made its own assessment because the pipeline crosses the U.S.-Canada border, estimates the line will create just 20 permanent jobs. One advantage of a pipeline, after all, is that it’s automated.” [Businessweek, 2/17/12]

Keystone Would Create Fewer Than 25,000 Total Jobs Per Year For Just Two Or Three Years. From a Cornell University Global Labor Institute study of KXL’s economic impacts: “[W]e calculate that the actual spending relevant to the US economy, and the figure from which US new job creation projections should be calculated, is around $3 to $4 billion, not $7 billion. […] Fortunately, the job projections submitted by developers of other major pipeline projects provide a useful guide for estimating potential impacts for KXL. On this basis, for the purposes of estimating total employment impacts, it is reasonable to assume a multiplier of approximately 11 person-years per $1 million pipeline project capital costs. […] Given a multiplier of 11 person-years per $1 million, this translates into total employment impacts of 33,000 to 44,000 person-years. So a reasonable estimate of the total incremental US jobs from KXL construction is about one-third of the figure estimated in the Perryman study and used by industry to advocate for the construction of KXL. Moreover, any job impacts associated with KXL construction would be spread over 2 and more likely 3 years. So the annual impacts are at most about 22,000 person-years of employment per year, for two years. But the annual impacts could also be as low as 11,000 person-years per year, for three years.” [“Pipe Dreams? Jobs Gained, Jobs Lost By The Construction Of Keystone XL,” Cornell University Global Labor Institute, September 2011, internal citations removed]

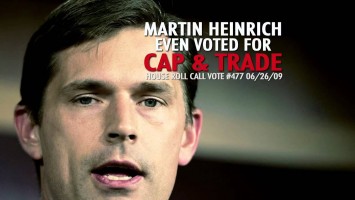

American Clean Energy And Security Act Would Have Boosted The Economy At Minimal Cost To Consumers

The ad’s claim that Heinrich “even voted for cap-and-trade” cites Roll Call Vote #477 on June 26, 2009, in which the House passed the American Clean Energy and Security Act.

Study: Clean Energy Legislation Would Create Jobs, Boost GDP. According to an analysis by the University of California, Berkley: “Comprehensive clean energy and climate protection legislation, like the American Clean Energy and Security Act (ACES) that was passed by the House of Representatives in June, would strengthen the U.S. economy by establishing pollution limits and incentives that together will drive large-scale investments in clean energy and energy efficiency. These investments will result in stronger job growth, higher real household income, and increased economic output than the U.S. would experience without the bill. New analysis by the University of California shows conclusively that climate policy will strengthen the U.S. economy as a whole. Full adoption of the ACES package of pollution reduction and energy efficiency measures would create between 918,000 and 1.9 million new jobs, increase annual household income by $487-$1,175 per year, and boost GDP by $39 billion-$111 billion. These economic gains are over and above the growth the U.S. would see in the absence of such a bill.” [University of California, Berkeley, accessed 5/14/12]

Reuters: Experts Say House-Passed Clean Energy Bill Would Have “Only A Modest Impact On Consumers.” According to Reuters: “A new U.S. government study on Tuesday adds to a growing list of experts concluding that climate legislation moving through Congress would have only a modest impact on consumers, adding around $100 to household costs in 2020. Under the climate legislation passed by the House of Representatives in June, electricity, heating oil and other bills for average families will rise $134 in 2020 and $339 in 2030, according to the Energy Information Administration, the country’s top energy forecaster. The EIA estimate was in line with earlier projections from the nonpartisan Congressional Budget Office which said average families would pay about $175 extra annually by 2020, and the Environmental Protection Agency, which said families would pay at most an extra $1 per day.” [Reuters, 8/5/09]

- CBO: Energy Costs Would Actually Decrease For Low-Income Households. According to the Congressional Budget Office’s analysis of the American Clean Energy and Security Act, if the bill were implemented, “households in the lowest income quintile would see an average net benefit of about $40 in 2020, while households in the highest income quintile would see a net cost of $245.” [CBO.gov, 6/19/09]

Dodd-Frank Is Designed To Protect Taxpayers Against Another Wall Street Meltdown

The ad’s claim that Heinrich “voted for more government red tape” cites Roll Call Vote #413 on June 30, 2010, in which the House passed the Wall Street Reform and Consumer Protection Act.

Dodd-Frank’s Reforms Aim To Prevent Another Financial Collapse. From the Associated Press: “Reveling in victory, President Barack Obama on Wednesday signed into law the most sweeping overhaul of financial regulations since the Great Depression, a package that aims to protect consumers and ensure economic stability from Main Street to Wall Street. The law, pushed through mainly by Democrats in Washington’s deeply partisan environment, comes almost two years after the infamous near financial meltdown in 2008 in the United States that was felt around the globe. The legislation gives the government new powers to break up companies that threaten the economy, creates a new agency to guard consumers and puts more light on the financial markets that escaped the oversight of regulators.” [Associated Press via San Diego Union-Tribune, 7/21/10]

- Dodd-Frank Created Council To Monitor Firms Large Enough To Endanger The Entire Economy. From Reuters: “The new Financial Stability Oversight Council will hold its first meeting on Oct. 1, according to sources familiar with the matter. The council of regulators, which was created by the Dodd-Frank financial regulatory overhaul law enacted in July, is charged with monitoring risks to the financial system. It is chaired by the Treasury secretary and is allowed to identify firms that threaten stability and subject them to tighter oversight by the Federal Reserve.” [Reuters, 9/15/10]

- Seeking To End Bailouts, Dodd-Frank Empowers FDIC To Take Over And Dismantle Failing Financial Institutions Large Enough To Endanger The Whole System. From Reuters: “Aiming to prevent more U.S. taxpayer bailouts, the Dodd-Frank Wall Street reforms of 2010 set up an ‘orderly liquidation process’ for dealing with distressed financial firms. Here is how that process works: If a large, non-bank financial firm is in default or headed that way, regulators can move to put it into ‘orderly liquidation’ if they think its collapse would threaten financial stability. It is an alternative to bankruptcy. […] Once orderly liquidation begins, the firm is placed in receivership. That means the FDIC takes over. It develops a plan for dealing with the firm’s problems, and it provides funds to keep the firm from collapsing. FDIC receivership can last up to five years. […]The FDIC must dismiss the officers and directors responsible for the firm’s problems. Shareholders of the firm get no money until all other claims against the firm are paid. The FDIC itself may not invest in the firm. Creditors owed money by the firm can file a claim to get it back. The FDIC can disallow claims in part or entirely, and must draw up a priority list of who gets what. To settle the firm’s debts, the FDIC can sell the firm’s assets, sell the firm itself, or merge it with another firm.” [Reuters, 2/25/11]

- The Dodd-Frank Act Created The Consumer Financial Protection Bureau (CFPB). From aWall Street Journal explanation of the Dodd-Frank bill’s components: “Consumer Agency: Creates a new consumer Financial Protection Bureau within the Federal Reserve, with rule-making powers and some enforcement control over banks and other financial companies. The new watchdog has authority to examine and enforce regulations for all mortgage-related businesses; banks and credit unions with assets of more than $10 billion in assets; payday lenders, check cashers and certain other non-bank financial firms. Auto dealers are exempted.” [Wall Street Journal, accessed 2/1/12]

Affordable Care Act Savings Do Not ‘Cut’ Medicare Benefits

Affordable Care Act Reduces Future Medicare Spending, But “Does Not Cut That Money From The Program.” According to PolitiFact: “The legislation aims to slow projected spending on Medicare by more than $500 billion over a 10-year period, but it does not cut that money from the program. Medicare spending will increase over that time frame.” [PolitiFact.com, 6/28/12]

- CBO’s July Estimate Updates Medicare Cost Savings To $716 Billion. According to the Congressional Budget Office’s analysis of a bill to repeal the Affordable Care Act, repeal would have the following effects on Medicare spending: “Spending for Medicare would increase by an estimated $716 billion over that 2013–2022 period. Federal spending for Medicaid and CHIP would increase by about $25 billion from repealing the noncoverage provisions of the ACA, and direct spending for other programs would decrease by about $30 billion, CBO estimates. Within Medicare, net increases in spending for the services covered by Part A (Hospital Insurance) and Part B (Medical Insurance) would total $517 billion and $247 billion, respectively. Those increases would be partially offset by a $48 billion reduction in net spending for Part D.” [CBO.gov, 8/13/12]

GOP Plan Kept Most Of The Savings In The Affordable Care Act. According to the Washington Post’s Glenn Kessler: “First of all, under the health care bill, Medicare spending continues to go up year after year. The health care bill tries to identify ways to save money, and so the $500 billion figure comes from the difference over 10 years between anticipated Medicare spending (what is known as ‘the baseline’) and the changes the law makes to reduce spending. […] The savings actually are wrung from health-care providers, not Medicare beneficiaries. These spending reductions presumably would be a good thing, since virtually everyone agrees that Medicare spending is out of control. In the House Republican budget, lawmakers repealed the Obama health care law but retained all but $10 billion of the nearly $500 billion in Medicare savings, suggesting the actual policies enacted to achieve these spending reductions were not that objectionable to GOP lawmakers.” [WashingtonPost.com, 6/15/11, emphasis added]

[NARRATOR:] Want to know the top five ways Martin Heinrich has gone Washington? Number five: Heinrich voted against reducing job-killing regulations. Number four: Heinrich voted against the Keystone Pipeline. Number three: Heinrich even voted for cap-and-trade. Number two: Heinrich voted for more government red tape. And number one: Heinrich voted for the health care law, cutting $716 billion from Medicare. Martin Heinrich has gone Washington. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube.com, 9/19/12]