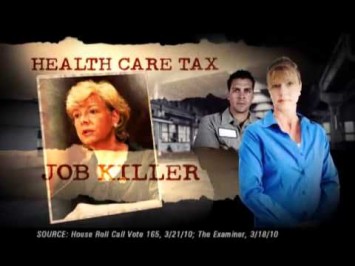

The U.S. Chamber of Commerce accuses Wisconsin Rep. Tammy Baldwin of ‘making it worse’ for Wisconsin families by voting for the Dodd-Frank wall street reform bill and for health care reform, making false accusations about the legislation in the process. For instance, Dodd-Frank regulations target large firms in order to help prevent another financial sector meltdown — not, as the ad claims, small businesses. And the claim that Affordable Care Act — which won’t raise taxes for most Americans – is a job-killer has been debunked.

“More Regulations” Refers To Wall Street Reform Bill To Prevent Another Financial Collapse

The ad cites House Vote #413 on June 30, 2010, in which the House passed its version of the Wall Street Reform bill, as evidence that Rep. Baldwin “voted to slap small businesses with more regulations.”

Small Banks Are Mostly Exempt From The Financial Reforms Passed “In Response To The Near Collapse Of The Financial System.” From the New York Times: “In response to the near collapse of the financial system in 2008, Congress last year passed the Dodd-Frank Act, which imposed restrictions on asset-backed securities, the derivatives industry and proprietary trading — some of Wall Street’s main profit centers. But the law largely exempted about 7,000 community banks and thrift institutions, nearly all of which hold less than $10 billion in assets and a third of which hold less than $100 million.” [New York Times, 5/2/11]

Community Banks Will Benefit From New Rules For Massive Wall Street Firms. From the New York Times: “Despite their protestations, community bankers are quick to praise certain parts of the law. Banks that hold less than $10 billion in assets, or roughly 98 percent of the 7,000 community banks scattered across the country, are immune from new capital and liquidity requirements, for example. The law also imposes curbs on proprietary trading and the derivatives business, restrictions that level the playing field for small lenders competing against giant competitors. But small banks perhaps benefited most from the overhaul of deposit insurance rules. The change, which forces large risk-taking banks to pay a bigger share of deposit insurance premiums, is expected to save small banks more than $4 billion over the next three years, according to Camden Fine, who leads the community bankers group.” [New York Times, 5/23/11, emphasis added]

Community Banks Saw Their Returns Double From 2010 To 2011. From the FDIC’s Quarterly Banking Profile from Q2 2011: “The average return on assets (ROA) rose to 0.85 percent, from 0.63 percent a year earlier. At community banks (institutions with less than $1 billion in assets), the average ROA of 0.57 percent was below the industry average, but more than twice the 0.26 percent registered a year ago.” [FDIC.gov, accessed 2/9/12]

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

- Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

Affordable Care Act Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

GOP Argument That Obamacare Will “Kill Jobs” Has Been Debunked

FactCheck.org: “Job-Killing” Claim Is “Health-Care Hooey.” From FactCheck.org: “The exaggerated Republican claim that the new health care law ‘kills jobs’ was high on our list of the ‘Whoppers of 2011.’ But the facts haven’t stopped Republicans and their allies from making the ‘job-killing’ claim a major theme of their campaign 2012 TV ads. […]All of this is health-care hooey, aimed at exploiting public concern over continuing high unemployment, with little basis in fact. As we’ve said before (a few times), experts project that the law will cause a small loss of low-wage jobs — and also some gains in better-paid jobs in the health care and insurance industries. It’s also expected that more workers will decide to retire earlier, or work fewer hours, when they no longer need employer-sponsored insurance and can obtain it on their own with help from federal subsidies. But that just means fewer people willing to work — and it will free up jobs for those who want them. If anything, that could reduce the jobless rate.” [FactCheck.org, 2/21/12]

AP: Republicans Misuse CBO Statistics To Support “Job-Killing” Claim About Health Care Overhaul. From the Associated Press: “A recent report by House GOP leaders says ‘independent analyses have determined that the health care law will cause significant job losses for the U.S. economy.’ It cites 650,000 lost jobs as Exhibit A, and the nonpartisan Congressional Budget Office as the source of the analysis behind that estimate. But the budget office, which referees the costs and consequences of legislation, never produced that number. What CBO actually said is that the impact of the health care law on supply and demand for labor would be small. Most of the lost jobs would come from people who no longer have to work, or can downshift to less demanding employment, because insurance will be available outside the job. ‘The legislation, on net, will reduce the amount of labor used in the economy by a small amount — roughly half a percent— primarily by reducing the amount of labor that workers choose to supply,’ budget office number crunchers said in a report last year.” [Associated Press via USA Today, 1/24/10]

Health Insurers Poured Money Into Chamber To Attack Reform

Health Insurance Industry Gave Chamber Over $100 Million To Fight Health Care Reform. From the National Journal: “The nation’s leading health insurance industry group gave more than $100 million to help fuel the U.S. Chamber of Commerce’s 2009 and 2010 efforts to defeat President Obama’s signature health care reform law, National Journal’s Influence Alley has learned. During the final push to kill the bill before its March 2010 passage, America’s Health Insurance Plans gave the chamber $16.2 million. With the $86.2 million the insurers funneled to the business lobbying powerhouse in 2009, AHIP sent the chamber a total of $102.4 million during the health care reform debate, a number that has not been reported before now. The backchannel spending allowed insurers to publicly stake out a pro-reform position while privately funding the leading anti-reform lobbying group in Washington. The chamber spent tens of millions of dollars bankrolling efforts to kill health care reform.” [NationalJournal.com, 6/13/12]

[NARRATOR:] It’s time to hold Washington politicians accountable for their records on the economy. Case in point: Tammy Baldwin. [BALDWIN CLIP:] “Hardworking Wisconsin families have already taken it on the chin.” [NARRATOR:] Yes, Tammy, sadly they have. But your votes have made it worse. You voted to slap small businesses with more regulations, and you fought for the government health care tax, which is a job-killer. This November, hold Tammy Baldwin accountable for her record of failure on the economy. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube.com, 7/27/12]