The U.S. Chamber of Commerce attacks Rep. Tim Bishop (D-NY) for voting for the Affordable Care Act and cap-and-trade legislation, misrepresenting the bills’ impact on small businesses and families. In fact, millions of small businesses are eligible for tax credits under the health care law, while clean energy legislation would have boosted the economy at minimal cost to households.

Many Small Businesses Are Eligible For Tax Credits Under The Affordable Care Act

Affordable Care Act Offers Tax Credits To Many Small Businesses. According to a report from Small Business Majority and Families USA: “Congress included in the Affordable Care Act a significant new tax credit for small business owners who provide their workers with health insurance. Under this new tax credit, businesses that have fewer than 25 full-time workers and average wages of less than $50,000 are now eligible to receive a tax credit of up to 35 percent of the cost of the health insurance that they provide for their workers. To qualify for the tax credit, small businesses must cover at least 50 percent of each employee’s health insurance premiums. In 2014, the size of the credit will increase to cover up to 50 percent of the cost of health insurance provided to workers.” [SmallBusinessMajority.org, May 2012]

- More Than 3.2 Million Small Businesses Eligible For ACA Tax Credit. According to a report from Small Business Majority and Families USA: “Our analysis found that more than 3.2 million small businesses, employing 19.3 million workers across the nation, will be eligible for this tax credit when they file their 2011 taxes. In total, these small businesses are eligible for more than $15.4 billion in credits for the 2011 tax year alone, an average of $800 per employee.” [SmallBusinessMajority.org, May 2012]

ACA Requires Businesses With More Than 50 Employees To Provide Affordable Coverage Or Pay A Fee. According to a report from Small Business Majority and FamiliesUSA: “While the Affordable Care Act created this new tax credit to help small business owners and workers, it does not force these small business owners to provide coverage for their workers. There are no employer mandates in the law, and there are no employer responsibility requirements at all for businesses with fewer than 50 workers, which account for 96 percent of all firms in the United States. Starting in 2014, businesses with 50 or more workers that do not offer coverage or that offer only unaffordable coverage to their workers will be assessed a fee if one or more of their workers receives a federal individual premium tax credit to purchase coverage in an exchange.” [SmallBusinessMajority.org, May 2012]

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

- Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

Affordable Care Act Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

American Clean Energy And Security Act Would Have Boosted The Economy At Minimal Cost To Consumers

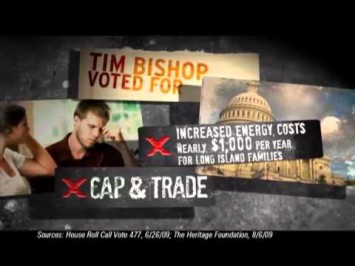

The ad cites Roll Call Vote #477 on June 26, 2009, in which the House passed the American Clean Energy and Security Act, when talking about cap-and-trade.

Reuters: Experts Say House-Passed Clean Energy Bill Would Have “Only A Modest Impact On Consumers.” According to Reuters: “A new U.S. government study on Tuesday adds to a growing list of experts concluding that climate legislation moving through Congress would have only a modest impact on consumers, adding around $100 to household costs in 2020. Under the climate legislation passed by the House of Representatives in June, electricity, heating oil and other bills for average families will rise $134 in 2020 and $339 in 2030, according to the Energy Information Administration, the country’s top energy forecaster. The EIA estimate was in line with earlier projections from the nonpartisan Congressional Budget Office which said average families would pay about $175 extra annually by 2020, and the Environmental Protection Agency, which said families would pay at most an extra $1 per day.” [Reuters, 8/5/09]

CBO Estimated Cost Of ACES In 2020 Would Be $175 Per Household Per Year. From the Congressional Budget Office: ‘”Although the analysis examines the effects of the bill as it would apply in 2020, those effects are described in the context of the current economy that is, the costs that would result if the policies set for 2020 were in effect in 2010. On that basis, CBO estimates that the net annual economywide cost of the cap-and-trade program in 2020 would be $22 billion or about $175 per household.” [CBO.gov, 6/20/09]

- CBO: Energy Costs Would Actually Decrease For Low-Income Households. According to the Congressional Budget Office’s analysis of the American Clean Energy and Security Act, if the bill were implemented, “households in the lowest income quintile would see an average net benefit of about $40 in 2020, while households in the highest income quintile would see a net cost of $245.” [CBO.gov, 6/19/09]

Study: Clean Energy Legislation Would Create Jobs, Boost GDP. According to an analysis by the University of California, Berkley: “Comprehensive clean energy and climate protection legislation, like the American Clean Energy and Security Act (ACES) that was passed by the House of Representatives in June, would strengthen the U.S. economy by establishing pollution limits and incentives that together will drive large-scale investments in clean energy and energy efficiency. These investments will result in stronger job growth, higher real household income, and increased economic output than the U.S. would experience without the bill. New analysis by the University of California shows conclusively that climate policy will strengthen the U.S. economy as a whole. Full adoption of the ACES package of pollution reduction and energy efficiency measures would create between 918,000 and 1.9 million new jobs, increase annual household income by $487-$1,175 per year, and boost GDP by $39 billion-$111 billion. These economic gains are over and above the growth the U.S. would see in the absence of such a bill.” [University of California, Berkeley, accessed 5/14/12]

Health Insurers Poured Money Into Chamber To Attack Reform

Health Insurance Industry Gave Chamber Over $100 Million To Fight Health Care Reform. From the National Journal: “The nation’s leading health insurance industry group gave more than $100 million to help fuel the U.S. Chamber of Commerce’s 2009 and 2010 efforts to defeat President Obama’s signature health care reform law, National Journal’s Influence Alley has learned. During the final push to kill the bill before its March 2010 passage, America’s Health Insurance Plans gave the chamber $16.2 million. With the $86.2 million the insurers funneled to the business lobbying powerhouse in 2009, AHIP sent the chamber a total of $102.4 million during the health care reform debate, a number that has not been reported before now. The backchannel spending allowed insurers to publicly stake out a pro-reform position while privately funding the leading anti-reform lobbying group in Washington. The chamber spent tens of millions of dollars bankrolling efforts to kill health care reform.” [NationalJournal.com, 6/13/12]

[NARRATOR:] Over 64,000 unemployed in Suffolk County, yet Tim Bishop punishes job creators. His record of failure needs to end. He voted for the health care law that will raise taxes on struggling small businesses, and voted for cap-and-trade that would have increased energy costs by nearly $1,000 per year on Long Island families. Tim Bishop is making the economy worse. Vote like your job depends on it. Replace Bishop. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube.com, 10/3/12]