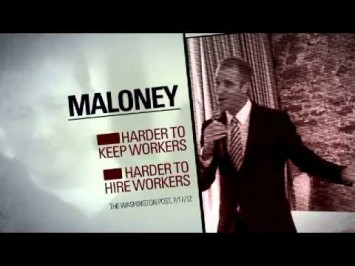

Americans for Tax Reform: “Tax Raising Politician Sean Maloney (NY-18)”

Americans for Tax Reform targets New York congressional candidate Sean Maloney’s (D) support for ending the Bush tax cuts for the wealthy, which the group claims will hurt small businesses and kill jobs. However, conservatives rely on a dubious definition of “small business,” and allowing the top tax bracket to return to its pre-Bush level would not affect many actual employers. In addition, ATR’s charge that phasing out the tax breaks would cause job losses is based on a flawed study that assumes the revenue will not go toward deficit reduction, which is exactly what Maloney and other Democrats have proposed.

Read more after the jump.