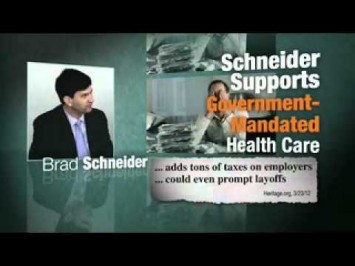

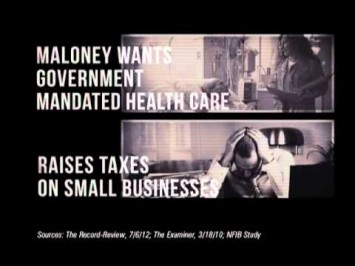

U.S. Chamber Of Commerce: “NY-18 Sean Maloney – Wrong”

The U.S. Chamber of Commerce, a conservative group that received millions of dollars from insurance companies to fight health care reform, has released an ad attacking New York House candidate Sean Maloney for supporting the Affordable Care Act. However, despite the ad’s claims about “more spending and higher taxes,” millions of families and small businesses across the country are now eligible for tax credits because of the health care law. In addition, the ACA reduces the deficit.

Read more after the jump.