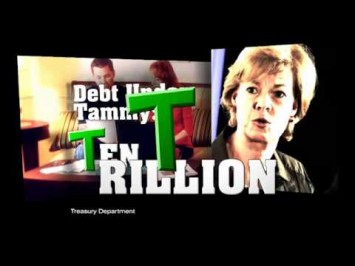

Crossroads GPS is running an ad in Wisconsin, titled “With A T,” emphasizing the trillions of dollars added to the national debt since Rep. Tammy Baldwin (D-WI) took office. But while Crossroads focuses on Baldwin’s support for the “failed” Recovery Act, which helped prevent an even more devastating economic collapse, President Bush’s tax cuts for the wealthy and the recession fueled the increase in debt over the last decade. As a member of the House, Baldwin voted against the tax cuts Bush passed in 2001 and 2003.

“Failed” Stimulus Created Jobs, Boosted GDP, And Cut Taxes

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact.com, 2/17/10]

Investment In Energy Efficient Lights Will Save Hundreds Of Thousands Of Dollars

Because of Crossroads GPS’ unclear sourcing, we originally pointed to a Recovery Act grant that provided Wilmington, Delaware, with $800,600 to replace the city’s traffic lights as a likely referent for the claim that that the stimulus spent $800,000 on a project to replace light bulbs. After we published our fact check, GPS directed PolitiFact to a story about a similar grant to the city of Racine, Wisconsin.

Racine Got Nearly $800,000 To Upgrade Its Energy Efficiency. From PolitiFact: “[W]hile the ad leaves the impression these are ordinary light bulbs, that’s far from the case. As in many other U.S. cities, the Racine money came through the Energy Efficiency and Conservation Block Grant program. At least 30 cities asked for more than $104 million in federal stimulus funds to help them change to LED (light-emitting diodes), replacing high-pressure sodium lights, USA Today reported in March 2009. Racine’s total grant was $795,000, but not all of it was for the street lights. A good chunk of it — about $194,000 — was for energy audits of homes and loans to residents who wanted to save money through weatherization and other energy-saving changes. Another $79,500 was for administration. A total of $521,500 was for the new LED lights, with about half for street lights and half for city government buildings, according to Kathleen Fischer, the city’s assistant finance director. So the Crossroads ad is off on the $800,000 claim as well.” [PolitiFact.com, 8/23/12]

Racine Is Saving Almost 60 Percent On Its Energy Costs. From PolitiFact: “First, Racine is saving 59 percent on energy costs thanks to the lights. That is projected to amount to about $40,000 a year. ‘It was money well spent,’ said Mark Yehlen, commissioner of Public Works. ‘We have realized significant savings.’” [PolitiFact.com, 8/23/12]

- A Similar Investment In Philadelphia Cut Monthly Electricity Costs By Nearly Three-Quarters. From NewsWorks.org: “The city of Philadelphia has completed the transformation to a new type of street lights. A federal grant funded most of the cost of converting traffic lights from incandescent bulbs to energy-efficient LEDs. Streets Commissioner Clarena Tolson says the electricity savings add up. ‘Our costs have gone from $100,000 a month to $27,000 a month, real money that we pay out basically saving us 70 percent,’ Tolson said.” [NewsWorks.org, 4/16/12]

Local LED Light Company Was Able To Grow And Add Jobs, Partly Due To Stimulus-Funded Contracts. From PolitiFact: “What’s more, one of the primary suppliers of LED lights for the Racine project was a Racine-area company, Ruud Lighting, that builds the lights. Ruud has expanded and added jobs while winning contracts to supply LED lights all over the United States to municipalities — many of them using the federal stimulus dollars flowing through the Department of Energy’s block grant program.” [PolitiFact.com, 8/23/12]

Bush Policies And Recession Caused Debt To Skyrocket

Prior To President Obama’s Inauguration, President Bush Had Already Created A Projected $1.2 Trillion Deficit For Fiscal Year 2009. From the Washington Times: “The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn’t enact any new programs. […] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record.” [Washington Times, 1/8/09]

NYT: President Bush’s Policy Changes Created Much More Debt Than President Obama’s. The New York Times published the following chart comparing the fiscal impact of policies enacted under the Bush and Obama administrations:

[New York Times, 7/24/11]

Recession Added Hundreds Of Billions In Deficits By Increasing Spending On Safety Net While Shrinking Tax Revenue. The Center on Budget and Policy Priorities (CBPP) explains: “When unemployment rises and incomes stagnate in a recession, the federal budget responds automatically: tax collections shrink, and spending goes up for programs like unemployment insurance, Social Security, and Food Stamps.” According to CBPP: “The recession battered the budget, driving down tax revenues and swelling outlays for unemployment insurance, food stamps, and other safety-net programs. Using CBO’s August 2008 projections as a benchmark, we calculate that the changed economic outlook alone accounts for over $400 billion of the deficit each year in 2009 through 2011 and slightly smaller amounts in subsequent years. Those effects persist; even in 2018, the deterioration in the economy since the summer of 2008 will account for over $300 billion in added deficits, much of it in the form of additional debt-service costs.” [CBPP.org, 11/18/10; CBPP.org, 5/10/11, citations removed]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CBPP: Bush Tax Cuts And Wars Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

- Rep. Baldwin Opposed The 2001 Bush Tax Cuts. Rep. Baldwin voted “nay” on the Economic Growth and Tax Relief Reconciliation Act of 2001. [H.R. 1836, Vote #149, 5/26/01]

- Rep. Baldwin Opposed The 2003 Bush Tax Cuts. Rep. Rep. Baldwin voted “nay” on the Jobs and Growth Reconciliation Tax Act of 2003. [H.R. 2, Vote #225, 5/23/03]

[NARRATOR:] Big spending in Washington is terrible for Wisconsin’s economy, and Tammy Baldwin hasn’t helped. Baldwin voted for the failed $1 trillion stimulus, including projects like $800,000 to replace light bulbs. Since Baldwin went to Congress our national debt has increased over $10 trillion. That’s ‘trillion’ with a ‘T.’ Tell Tammy: Trillions wasted is too much. Stop the wasteful spending and cut the debt. Support the New Majority Agenda at NewMajorityAgenda.org. [Crossroads GPS via YouTube.com, 8/14/12]