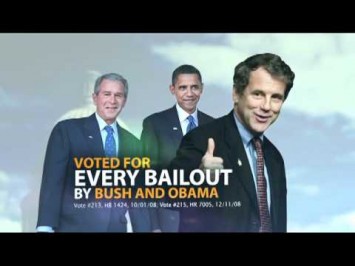

60 Plus Association claims that Sen. Sherrod Brown (D-OH) has “helped our national debt increase by more than $11 trillion” by supporting “every bailout proposed by Bush and Obama,” as well as the Recovery Act and health care law. But necessary actions taken to rescue the economy have had a relatively minor impact on deficits – which were driven upward by President Bush’s policies and the massive recession he left behind – and the Affordable Care Act actually reduces the deficit.

Bush Policies And Recession Fueled Massive Deficits

Prior To President Obama’s Inauguration, President Bush Had Already Created A Projected $1.2 Trillion Deficit For Fiscal Year 2009. From the Washington Times: “The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn’t enact any new programs. […] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record.” [Washington Times, 1/8/09]

NYT: President Bush’s Policy Changes Created Much More Debt Than President Obama’s. The New York Times published the following chart comparing the fiscal impact of policies enacted under the Bush and Obama administrations:

[New York Times, 7/24/11]

Recession Added Hundreds Of Billions In Deficits By Increasing Spending On Unemployment Insurance And Safety Net While Shrinking Tax Revenue. The Center on Budget and Policy Priorities (CBPP) explains: “When unemployment rises and incomes stagnate in a recession, the federal budget responds automatically: tax collections shrink, and spending goes up for programs like unemployment insurance, Social Security, and Food Stamps.” According to CBPP: “The recession battered the budget, driving down tax revenues and swelling outlays for unemployment insurance, food stamps, and other safety-net programs. Using CBO’s August 2008 projections as a benchmark, we calculate that the changed economic outlook alone accounts for over $400 billion of the deficit each year in 2009 through 2011 and slightly smaller amounts in subsequent years. Those effects persist; even in 2018, the deterioration in the economy since the summer of 2008 will account for over $300 billion in added deficits, much of it in the form of additional debt-service costs.” [CBPP.org, 11/18/10; CBPP.org, 5/10/11, citations removed]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CBPP: Bush Tax Cuts And Wars Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

“Failed” Recovery Act Created Jobs, Boosted The Economy

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy. Of that $288 billion, the stimulus has resulted in $119 billion worth of tax breaks so far. ” [PolitiFact.com, 2/17/10]

Affordable Care Act Slows Rising Health Care Costs And Reduces The Deficit

PolitiFact: Affordable Care Act Is Not A “Takeover.” According to PolitiFact: “[T]he law increases regulation. But it greatly relies on the private sector to provide health care. Hospitals will not be taken over by the government, doctors will not become federal employees. The act relies on private insurers to compete and provide health care coverage to an expanded customer base. Employer-based coverage through private companies continues. The ‘government takeover of health care’ is a potent political charge that does not hold up under examination.” [PolitiFact.com, 6/16/12]

Rising Health Care Costs Are Part Of A Long-Term Trend. The following chart from CNNMoney illustrates increasing health care costs between 2002 and 2011:

[Money.CNN.com, 5/11/11]

Without ACA, Health Care Costs Would Rise Even Faster. From CNNMoney: “The individual mandate would help spread health care costs to a larger pool of individuals, thus potentially lowering costs. Should the Supreme Court strike down the Affordable Care Act, consumers can expect that percentage to increase even more as costs rise ‘very fast,’ [Mathematica Policy Research senior fellow Deborah] Chollet said. Without the law’s measures to promote preventative care and spread costs across a larger population, overall costs will rise, she explained. Those without employer-provided health care coverage … will likely pay more for their plans because there will be fewer restrictions on insurers. Individuals could be denied coverage altogether because of a pre-existing health condition or offered coverage only at a very high premium, both of which are prohibited under the Affordable Care Act, Chollet added. Those with insurance through their employer will also pay more to cover the growing number of uninsured, she said.” [Money.CNN.com, 3/29/12]

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

[NARRATOR:] Has Sherrod Brown been fighting for Ohio? Since Brown’s been in Washington, he’s helped our national debt increase more than $11 trillion by voting for every bailout proposed by Bush and Obama. He also voted for the failed $831 stimulus, and for President Obama’s health care takeover that Ohioans overwhelmingly reject. Today, more than 400,000 Ohioans are out of work, families are struggling, and health care costs are skyrocketing. Tell Sherrod Brown: We need real results, not more spending. [60 Plus Association via YouTube.com, 6/5/12]