The American Action Network wants you to know that Rick Nolan stands “for raising taxes and killing jobs” – 700,000 jobs, to be precise. But that number comes from a study that explicitly did not analyze the actual White House proposal for the expiration of the Bush tax cuts. The on-screen claim that Nolan would tax 894,000 small businesses is similarly bogus, as that definition of “small business” includes multi-billion-dollar corporations and both candidates for president. The ad is correct about Nolan’s 1975 votes on gas taxes, but they somehow fail to mention the same bill included tax credits to offset the increase in pump prices.

Ad Cites A Study That Doesn’t Model Obama’s Actual Tax Proposals

American Action Network cites a Washington Post story about an Ernst & Young study commissioned by business associations to support its claim that Nolan supports “destroying 700,000 jobs.”

Ernst & Young Study Didn’t Address President’s Proposals. According to economist Jared Bernstein: “First off, E&Y quite conspicuously fail to simulate what it is the President is proposing, so their main findings shouldn’t be considered in evaluating his proposals. Second, when they get a little closer to what he is proposing, they find it adds jobs.” [JaredBernsteinBlog.com, 8/14/12]

Ernst & Young Study Assumes Revenue From Ending Tax Cuts Will Pay For More Spending But Obama Proposed To Use It For Deficit Reduction. From an analysis by the National Economic Council’s Jason Furman via the White House: “The President has proposed to let the high-income tax cuts expire and use the resulting $1 trillion in savings (over 10 years) as part of a balanced plan to reduce deficits and debt and put the nation on a sustainable fiscal course that includes $2.50 of spending cuts for every $1.00 of revenue. But rather than modeling the President’s proposal to reduce the deficit, the headline numbers in the study explicitly assume that the revenue would be used entirely to finance additional spending. In fact, the study explicitly states, ‘Using the additional revenue to reduce the deficit is not modeled.’” [WhiteHouse.gov, 7/17/12, underlining original]

When The Study Models Ending Top-Tier Tax Cuts While Giving Middle Class Cuts, It Projects An Employment Increase. According to economist Jared Bernstein: “But for all of that, they actually find that when they model something that’s closer to what the President is proposing — getting rid of the Bush tax cuts for high-income families, while providing additional tax cuts to the middle-class — employment grows by 0.4%, or almost 600,000 jobs. When they simulate the wrong scenario of new tax revenues used to support higher spending (column 1, table 2), they estimate that employment would fall by 0.5%. But if the revenue was used to finance across-the-board tax cuts, employment grows.” [JaredBernsteinBlog.com,8/14/12]

“894,000 “? Only If You Count President Obama, Mitt Romney, And Multi-Billion-Dollar Corporations As “Small Businesses”

On-screen text accompanying the narrator’s accusation that “Nolan supports raising taxes on small businesses” claims 894,000 small businesses would be affected, citing an ABC News report.

Tax Policy Center: About 900,000 People Reporting Business Income – Not Necessarily Small Businesses – Would Pay Higher Rates If Bush Tax Cuts On Top Earners Expired. From the Tax Policy Center’s TaxVox blog: “This is what we know: Most small businesses report their income on individual tax returns, either on Schedule C (for self-employment or sole proprietorships), Schedule E (for S corporations) or schedule F (for farms). We don’t know how many of these businesses are really small, but next year about 36 million taxpayers will report income from these sources on their 1040s. Only about 900,000, or 2.5 percent, would pay higher rates if the Bush tax cuts were allowed to expire for those in the top brackets. However, that relative handful of business owners will report $400 billion, or almost 44 percent of all the business income included in individual returns. But for many of those reporting postive [sic] business income, these earnings are a relatively small fraction of their total taxable income. Some may be earning a little something from a side business. Perhaps they own a piece of rental property. Or do a bit of baby sitting. Some may be plumbers or computer technicians who work a day job and pick up a few extra bucks after hours, or corporate accountants trying to start a cupcake business in their free time. On the other hand, some reporting business income would face higher taxes if the top rates returned to their pre-2001 levels of 36 percent and 39.6 percent, up from today’s 33 percent and 35 percent. Ninety percent of high-earners who receive business income will get at least half of their AGI from this source in 2011. A half million top-bracket filers will report net positive business income averaging more than $700,000. These are the people–not the mom-and-pop business owners– who would be hit by the expiration of the top bracket tax cuts. Who are they? Many are doctors, lawyers, and investors. Others are very successful entrepreneurs who may own a chain of grocery stores or dry cleaners, or a lot of real estate.” [TaxPolicyCenter.org,8/5/10, emphasis added]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

Congressional Research Service: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

Ad Exaggerates Gas Tax Provisions Nolan Supported

House Bill Would Have Increased Gas Tax From 4 Cents To 7 Cents, With Subsequent Increases Only Triggered If Fuel Consumption Grew By 1 Percent Per Year. From the Economist article cited by American Action Network: “Any bill that comes out of Congress is bound to proceed from a doctrinal rejection of President Ford’s approach, which is to make foreign crude oil so costly that its import will be discouraged, while encouraging domestic oil and natural gas production by allowing their prices to rise; and to win political acceptance of the resulting higher price levels with a windfall profits tax on the oil industry. The Ullman bill would attack the biggest and potentially most flexible consumer of oil, the motor car, specifically. To the existing federal tax of 4 cents an American gallon on motor fuel it would add 3 cents immediately. If petrol consumption then stayed below the level of 1973, no further tax would be needed; but if it rose 1 per cent above that level, an additional 8 cents would be imposed, and this progressive increase in the excise tax would go up to 23 cents, making 30 cents tax in all, once the increase in consumption over 1973 exceeded 3 per cent.” [The Economist via Nexis, 5/17/75]

The Bill Provided Tax Credits And Exemptions To Offset The Gas Tax’s Impact On Individuals. From the Joint Committee on Taxation: “To reduce the potential adverse economic impact and to reimburse individuals for the tax increase on an amount approximating average use of gasoline, the Ways and Means bill provided credits and exemptions for certain uses of gasoline and special motor fuels. For any increase in the gasoline tax above 3 cents per gallon, a credit was provided for personal use equal to the tax on 40 gallons per month (whether or not this much gasoline was used). This credit was to be reflected in income tax withholding. The Ways and Means bill also provided a 50-percent credit for business use and certain other work-related use, a 75-percent exemption (in lieu of the business credit or deduction) for certain taxicab use, and an exemption for tax-exempt charitable organizations (sec. 501(c) (3)), in the case of both gasoline and special motor fuels. Users exempt from the 3-cent tax were also exempt from the 20-cent increase. The revenues from the 3-cent tax and the net revenues (after credits and refunds) from any additional tax were to be deposited in the Energy Conservation and Conversion Trust Fund. The Ways and Means bill also included a provision to disregard any refundable gasoline tax credit received by an individual for purposes of determining eligibility under a Federal or Federally-assisted welfare program.” [“Analysis of Energy Supply, Conservation, and Conversion: House Bill and Possible Alternatives: Automotive,” Joint Committee on Taxation, 7/22/75, emphasis added]

Supporters Argued Taxing Gasoline Would Make Drivers More Conscious Of Their Consumption, And Offsetting It With Income Tax Credits Would “Almost Eliminat[e]” Adverse Economic Impact. From the Joint Committee on Taxation: “Proponents of a gasoline tax increase respond by noting that there is much discretionary use of gasoline that offers the opportunity for substantial savings if drivers recognize the need for reduced consumption. It is maintained that this is probably true to a greater extent with regard to gasoline used in automobiles than with regard to other petroleum products. If substantially all of the increased gasoline tax revenues are returned to the general public, then the fiscal impact upon the economy and the otherwise adverse impacts on individual automobile drivers can be substantially reduced or almost eliminated. If these revenues are returned through the use of refundable income tax credits that may be integrated into the present withholding system, then they can be brought back into the economy almost as fast as the tax removes them from the economy.” [“Analysis of Energy Supply, Conservation, and Conversion: House Bill and Possible Alternatives: Automotive,” Joint Committee on Taxation, 7/22/75]

Provision Was Expected To Reduce Oil Consumption By Over A Million Barrels Per Day Within A Decade. From the Joint Committee on Taxation: “It is estimated that there would be considerable potential energy savings resulting from increasing the tax on gasoline. This in turn would reduce the United States reliance on imported oil, and lessen the attendant economic and national security risks involved in a major reliance on foreign-source petroleum. For example, the increase in the gasoline tax contained in the Ways and Means bill was estimated to produce energy savings of 1.12 million barrels of oil per day by 1985. Lesser increases in the tax would, of course, result in lesser potential energy savings.” [“Analysis of Energy Supply, Conservation, and Conversion: House Bill and Possible Alternatives: Automotive,” Joint Committee on Taxation, 7/22/75]

House Bill Attempted To Use Narrower, More Efficient Means Of Reducing Fossil Fuel Consumption Than White House Proposal. From the Joint Committee on Taxation: “It is also argued that the consumption of gasoline and of fuel used in industry is more responsive to price increases than in the consumption of heating fuel. To the extent this is true, this would mean that more conservation could be achieved with a given price or tax increase if the increase were tilted toward gasoline and the industrial use of fuel. The main argument in favor of the broad-based administration approach is that there is waste in all uses of oil and gas and that it is both less painful and more equitable to cut back usage in all areas than to concentrate the conservation on only certain uses. The approach taken in H.R. 6860 differs from the administration proposal. As reported by the Ways and Means Committee, the bill included energy conservation and conversion measures designed to reduce selected uses of oil and gas which the Ways and Means Committee felt were most wasteful and could be reduced with the least economic disruption. These include a 23-cent gasoline tax, a tax on auto companies that fail to meet certain fuel economy standards, a tax on the business use of oil and gas as fuel, and a tax credit for home insulation.” [“Analysis of Energy Supply, Conservation, and Conversion: House Bill and Possible Alternatives,” Joint Committee on Taxation, 7/17/75]

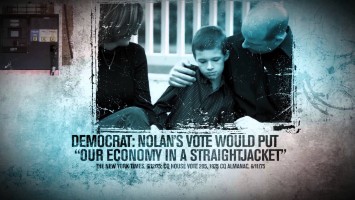

“Straightjacket” – Nolan Voted Against Importing More Foreign Oil

NY Times Article Cited By Ad: The “Economy In A Straightjacket” Line “Was Uttered In Support Of…Increas[ing] The Maximum Volumes Of Oil That Could Be Imported In 1979 And 1980.”From the New York Times article cited by American Action Network: “Mr. Waggoner’s warning about putting ‘our economy in a straightjacket’ was uttered in support of his amendment to increase the maximum volumes of oil that could be imported in 1979 and 1980. The House last night voted to retain import quotas. Heeding Mr. Waggoner, it voted today, 211 to 200, to increase the quotas, lest the country run short of fuel and los production, jobs and income. The vote, although close, and the debate, showed that most members of Congress continue to worry about the economy even as they consider measures to shrink the country’s consumption of energy and need for imported oil.” [New York Times, 6/12/75]

Nolan’s Open To Increasing Gas Tax “If That’s What We Need To Do To Maintain Our Infrastructure.” From the Politico article cited by American Action Network: “Nolan doesn’t doubt Cravaack is ‘an up-and-comer on the transportation committee. ‘ But the three-term former congressman expects to return to the House in 2013 with six years’ seniority, and he intends to seek a spot on the committee and try to parlay his experience into a prominent subcommittee post. He said his policy views run counter to Cravaack’s support of Wisconsin Republican Rep. Paul Ryan’s budget plan, which Democrats believe represents a death knell to infrastructure. ‘I don’t think he understands what the needs for public works and infrastructure are,’ Nolan said, later declaring a rare openness to examining the stagnant gas tax, which Cravaack doesn’t want to touch. ‘I don’t necessarily hold any opposition to looking at the possibility of raising the gas tax if that’s what we need to do to maintain our infrastructure.'” [Politico, 10/10/12]

[NARRATOR:] In the ’70s, Rick Nolan voted for a massive gas tax increase – up to 475 percent. One Democrat said another Nolan vote would put our economy in a straightjacket. Now Nolan says he’d consider raising the gas tax again. Nolan supports raising taxes on small businesses, destroying 700,000 jobs. Defeat radical Rick Nolan – he’s for raising taxes and killing jobs. American Action Network is responsible for the content of this advertising. [American Action Network via YouTube, 10/23/12]