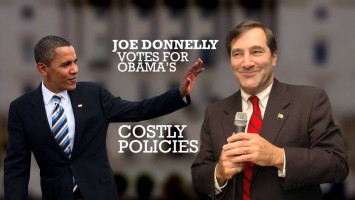

American Future Fund accuses Rep. Joe Donnelly (D-IN) of abandoning “Hoosier values” by supporting “Obama’s costly policies,” such as the Affordable Care Act and the Recovery Act. However, the health care law actually reduces the deficit, and the stimulus bill helped rescue the economy from a deeper recession. Furthermore, AFF suggests that the economy is not improving, but the facts show otherwise: The private-sector has now added 4.7 million jobs in the last 31 months.

Affordable Care Act Reduces The Deficit

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

“$2 Trillion” Refers To Cost Of Insurance Provisions – Not ACA’s Impact On The Deficit

July 2012: CBO’s Updated Estimate For Gross Cost Of ACA Insurance Coverage Provisions Is $1.683 Trillion. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period. That net cost reflects the following: Gross costs of $1,683 billion for Medicaid, CHIP, tax credits, and other subsidies for the purchase of health insurance through the newly established exchanges (and related costs), and tax credits for small employers. […] Those gross costs are offset in part by $515 billion in receipts from penalty payments, the new excise tax on high-premium insurance plans, and other budgetary effects (mostly increases in tax revenues stemming from changes in employer-provided insurance coverage).” [CBO.gov, July 2012, internal citations removed]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

Recovery Act Created Jobs, Boosted GDP, And Cut Taxes

Recovery Act “Succeeded In…Protecting The Economy During The Worst Of The Recession.” From the Center on Budget and Policy Priorities: “A new Congressional Budget Office (CBO) report estimates that the American Recovery and Reinvestment Act (ARRA) increased the number of people employed by between 200,000 and 1.5 million jobs in March. In other words, between 200,000 and 1.5 million people employed in March owed their jobs to the Recovery Act. […] ARRA succeeded in its primary goal of protecting the economy during the worst of the recession. The CBO report finds that ARRA’s impact on jobs peaked in the third quarter of 2010, when up to 3.6 million people owed their jobs to the Recovery Act. Since then, the Act’s job impact has gradually declined as the economy recovers and certain provisions expire.” [CBPP.org, 5/29/12]

At Its Peak, Recovery Act Was Responsible For Up To 3.6 Million Jobs. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRAs [sic] policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO.gov, 11/24/10]

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact.com, 2/17/10]

What We Have To Show For It: 4.7 Million New Private-Sector Jobs

The Private Sector Has Added 4.7 Million Jobs Over 31 Consecutive Months Of Private-Sector Growth. The following chart shows the monthly change in private-sector jobs dating back to January 2008:

Consumer Confidence Is At Its Highest Level Since September 2007. According to Bloomberg News: “Confidence among U.S. consumers unexpectedly jumped in October to the highest level since before the recession began five years ago, raising the odds that retailers will see sales improve. The Thomson Reuters/University of Michigan preliminary October consumer sentiment index increased to 83.1, the highest level since September 2007, from 78.3 the prior month. The gauge was projected to fall to 78, according to the median forecast of 71 economists surveyed by Bloomberg News.” [Bloomberg News, 10/12/12]

Massive Monthly Job Losses Obama Inherited Have Turned To Steady Private-Sector Growth

Bush Recession Was So Severe That Economy Was Still Shedding Over Three-Quarters Of A Million Jobs Per Month Through First Few Months Of President Obama’s Term. According to the Bureau of Labor Statistics, the economy shed 839,000 jobs in January 2009, 725,000 in February 2009, 787,000 in March 2009, and 802,000 in April 2009, for a four-month average of 788,250 lost jobs per month. [BLS.gov, accessed 5/3/12]

Since The Recession Ended In June 2009, The Private Sector Has Added 3.5 Million Jobs While Public-Sector Employment Has Fallen By 569,000. According to the Bureau of Labor Statistics, there were 107,933,000 private-sector jobs in June 2009, and 111,499,000 private-sector jobs in September 2012, an increase of 3,566,000 jobs. The BLS also reports that there were 22,570,000 Americans working in the public sector in June 2009, and 22,001,000 working in the public sector in September 2012, a decrease of 569,000 jobs. The private-sector gains and public-sector losses add up to a total increase of 2,797,000 jobs. The following chart shows the cumulative private-sector job gains and public-sector job losses since the recession officially ended in June 2009:

[BLS.gov, accessed 10/5/12; BLS.gov, accessed 10/5/12; NBER.org, 9/20/10]

- Conservative AEI: The Public Sector Has Shrunk, But Private-Sector Growth Is Above Average. From American Enterprise Institute scholar Mark J. Perry: “In the second quarter of 2012, ‘public sector GDP’ decreased -1.44%, and that was the eighth straight quarter of negative growth for total government spending, averaging -2.88% per quarter over the last two years. In contrast, there have been 12 consecutive quarters of positive growth for private sector GDP averaging 3.07% per quarter in the three years since the recession ended, which is slightly higher than the 2.8% average growth rate in private real GDP over the last 25 years.” [AEI-Ideas.org, 7/31/12]

New Data Shows Positive Net Job Growth Under Obama – Even Including Job Losses In Early 2009

Latest BLS Benchmark Shows “Net Job Growth…During Obama’s First Term.” According to the Huffington Post: “The Labor Department on Thursday morning quietly released a new benchmark for payroll employment in the U.S. It turns out that with the revision, there has been net job growth — not much, but more than nothing — during Obama’s first term. According to the revision, total non-farm payrolls stood at 133.686 million jobs in August, up from 133.561 million in January 2009, when Obama’s first term began. Before the revision, payrolls were at 133.300 million in August. In other words, 125,000 jobs have been created, in total, during Obama’s first term, compared with a prior estimate of a loss of 261,000.” [Huffington Post, 9/27/12]

Bush Policies And Recession – Not “Obama’s Costly Policies” – Caused Debt To Skyrocket

Prior To President Obama’s Inauguration, President Bush Had Already Created A Projected $1.2 Trillion Deficit For Fiscal Year 2009. From the Washington Times: “The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn’t enact any new programs. […] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record.” [Washington Times, 1/8/09]

NYT: President Bush’s Policy Changes Created Much More Debt Than President Obama’s. The New York Times published the following chart comparing the fiscal impact of policies enacted under the Bush and Obama administrations:

[New York Times, 7/24/11]

Recession Added Hundreds Of Billions In Deficits By Increasing Spending On Safety Net While Shrinking Tax Revenue. The Center on Budget and Policy Priorities (CBPP) explains: “When unemployment rises and incomes stagnate in a recession, the federal budget responds automatically: tax collections shrink, and spending goes up for programs like unemployment insurance, Social Security, and Food Stamps.” According to CBPP: “The recession battered the budget, driving down tax revenues and swelling outlays for unemployment insurance, food stamps, and other safety-net programs. Using CBO’s August 2008 projections as a benchmark, we calculate that the changed economic outlook alone accounts for over $400 billion of the deficit each year in 2009 through 2011 and slightly smaller amounts in subsequent years. Those effects persist; even in 2018, the deterioration in the economy since the summer of 2008 will account for over $300 billion in added deficits, much of it in the form of additional debt-service costs.” [CBPP.org, 11/18/10; CBPP.org, 5/10/11, citations removed]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CBPP: Bush Tax Cuts And Wars Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

Spending Growth Under Obama Is Low

January 2009 (Pre-Obama): Federal Spending Projected To Spike To $3.5 Trillion Without Any Policy Changes. In January 2009, the Congressional Budget Office projected: “Without changes in current laws and policies, CBO estimates, outlays will rise from $3.0 trillion in 2008 to $3.5 trillion in 2009.” [Congressional Budget Office, “The Budget and Economic Outlook: Fiscal Years 2009 to 2019,” January 2009]

Accounting For Inflation And President Obama’s Impact On FY 2009, Spending Will Have Grown By Just 1.7 Percent From 2009 To 2012. According to Michael Linden, Director of Tax and Budget Policy at the Center for American Progress:

[I]n January 2009, before President Obama had even taken office, the Congressional Budget Office projected that federal spending would exceed $3.5 trillion for fiscal year 2009, half a trillion more than the government spent in 2008. Again, that was BEFORE President Obama event took office. It’s reasonable to use that number as our best guess at what spending would have been in FY2009 under ANY president. […]

Of course, the CBO’s projections aren’t perfect. They change as the economy changes and as laws change. Fortunately, CBO also tells us in subsequent reports how and why its previous estimates have changed. We can use that to understand how much of the total federal spending in fiscal year 2009 was attributable to legislative changes that occurred AFTER President Obama took office.

The answer is that out of a total of $3.5 trillion actually spent in FY09, only $165 billion, less than 5 percent, was the result of policy changes signed into law by President Obama.

In other words, probably the best baseline against which to judge spending under Obama is $3.5 trillion (the amount actually spent in 2009) minus $165 billion (the added amount Obama himself actually approved): $3.35 trillion. This year, the CBO expects that the federal government will spend $3.6 trillion. After accounting for inflation, that’s a growth rate of just 1.7 percent. By comparison, and using the exact same methodology, spending in President Bush’s first term was up nearly 15 percent. [ThinkProgress.org, 5/25/12]

PolitiFact: Spending Growth Under Obama Is “Second-Slowest” In Recent History. According to PolitiFact: “Obama has indeed presided over the slowest growth in spending of any president [in recent history] using raw dollars, and the growth on his watch was the second-slowest if you adjust for inflation.” [PolitiFact.com, 5/23/12]

[NARRATOR:] Hoosier values: work hard, play by the rules, and don’t spend more than you make. Washington values: waste our hard-earned tax dollars, and then waste some more. Now we’re $16 trillion in debt and borrowing $4 billion every day. Joe Donnelly votes for Obama’s costly policies: a $2 trillion health care law, $831 billion stimulus bill. What can we show for it? 23 million Americans out of work, 46 million on food stamps. Tell Joe Donnelly and President Obama to end wasteful Washington spending. [American Future Fund, 10/25/12]