An ad from Crossroads GPS features clips of President Obama describing his policies and accuses the president of breaking his promises to the American people. However, Crossroads’ attempt to use Obama’s words against him backfires, as the ad repeatedly misrepresents the facts about the president’s record.

While The President Is Attempting To Help Struggling Homeowners, GOP Wants To Let Market “Bottom Out”

Crossroads Leaves Viewers With Misleading Impression Of The State Of The Housing Market. From FactCheck.org: “And the ad’s statistic, while accurate, gives an excessively gloomy impression. As the Wall Street Journal‘s ‘Numbers Guy,’ Carl Bialik, recently noted, estimates of ‘underwater’ mortgages ‘seem overblown’ and paint a darker picture than is actually warranted. Many of those mortgages are not very far underwater, for one thing. Only about 1 in 10 residential mortgages exceed the estimated value of the home by 25 percent or more, according to CoreLogic. That’s a troubling figure to be sure, but not as bad as the Crossroads GPS ad would have viewers believe.” [FactCheck.org, 5/18/12]

Ad Conflates Foreclosure With Underwater Mortgages. From FactCheck.org: “More important, even fewer homes are actually facing foreclosure, the subject of Obama’s promise. The most recent foreclosure report from CoreLogic shows 3.4 percent — closer to 1 in 30 than 1 in 5 — were in foreclosure proceedings in March.” [FactCheck.org, 5/18/12]

Foreclosure Rate Is 15 percent Lower Than Last Year. From FactCheck.org: “[T]he situation is slowly improving. The CoreLogic report shows that the number of actual foreclosures completed in the first three months of this year was 198,000, a decline of nearly 15 percent compared with the same period a year earlier.” [FactCheck.org, 5/18/12]

Department Of Housing And Urban Development: 5.9 Million Mortgage Modifications Initiated Since April 2009. From Businessweek: “While the housing market is showing signs of recovery, many people continue to struggle. Mortgage modifications have been started for more than 5.9 million U.S. homeowners from April 2009 through the first quarter, including 19,940 who began plans in March with President Barack Obama’s Home Affordable Modification Program, the U.S. Department of Housing and Urban Development reported today.” [Businessweek, 5/4/12]

March 2012: Obama Introduced “Cut In Fees On Many Government-Backed Mortgages.” According to Reuters: “President Barack Obama announced on Tuesday a cut in fees on many government-backed mortgages that he said could help millions of homeowners refinance, part of an election-year push to boost the shaky U.S. housing market. Under the plan, a typical borrower with a loan backed by the Federal Housing Administration could save a thousand dollars a year by refinancing into a new FHA loan, the White House said. The fee reductions would be on top of any savings from a lower interest rate. Two million to three million borrowers would be eligible, although the White House said participation would more likely number in the ‘hundreds of thousands.’ […] The lower fees being put in place would be available to borrowers seeking a new loan through FHA’s streamlined refinancing program, and even borrowers who owe more on their mortgage than their homes are worth would be eligible.” [Reuters, 3/6/12]

- Obama Also Announced Mortgage Relief For Troops. According to Stars and Stripes: “Troops victimized by unfair mortgage practices could see hundreds of thousands of dollars in payments, and other homeowners could see mortgage refinancing costs cut in half, under plans outlined by President Barack Obama on Tuesday. […]Under the plan, federal officials will review thousands of military mortgages started since 2006 for any irregularities. Troops or families who were illegally foreclosed upon would receive at least $116,000, plus thousands more in punitive payments from the banks. In addition, troops who were wrongly charged interest in excess of 6 percent on their mortgages — in violation of federal protections for servicemembers — will be eligible for payments four times what they overpaid. [Stars and Stripes, 3/6/12]

February 2012: President Obama Proposed Refinancing Plan For 3.5 Million Americans. According to the Los Angeles Times: “Distancing himself from Republicans on housing issues, President Obama pitched a $5-billion to $10-billion plan to help a key segment of struggling homeowners — those still making monthly payments, but on underwater mortgages. Obama proposed Wednesday to help about 3.5 million people with good credit who are unable to refinance at historically low rates because their homes are worth less than their mortgages. He argued that those homeowners — and the country — couldn’t afford to let the housing market bottom out, as many Republicans, including presidential candidate Mitt Romney, have advocated. In October, Romney told the Las Vegas Review-Journal that the housing market needed to ‘hit the bottom’ before it could recover, and he has since talked about the need for foreclosures to run their course.” [Los Angeles Times, 2/1/12]

- Obama’s Plan “Strongly Opposed” By Congressional GOP. According to the Los Angeles Times: “His administration took steps last fall to help as many as 11 million underwater homeowners whose loans were backed or owned by Fannie Mae, Freddie Mac or the Federal Housing Administration. Now Obama wants to expand that program to the remaining underwater homeowners, whose loans are owned by banks or investors. But the refinancing plan is strongly opposed by many congressional Republicans and faces an uphill climb in an election year. They contended that the administration’s previous housing plans have been unsuccessful and that the market needs to settle on its own.” [Los Angeles Times, 2/1/12]

Administration, Congressional Democrats Have Pressured Government-Sponsored Housing Lenders To Launch Principle Reduction Program For Underwater Mortgages. From the Los Angeles Times: “Fannie Mae officials supported principal reductions for some struggling homeowners in 2009 and believed they would save taxpayer money, but a pilot program set to start a year later was abruptly canceled apparently for ideological reasons, according to internal documents obtained by two House Democrats. The documents contradict congressional testimony in November by Edward DeMarco, the regulator for Fannie Mae, who has opposed principal reductions, said Reps. Elijah Cummings of Maryland and John Tierney of Massachusetts. […] Cummings and Tierney have been part of an aggressive campaign by congressional Democrats, Obama administration officials and housing advocates to get Fannie Mae and Freddie Mac to start a wide-scale program to reduce the principal owed by struggling homeowners to help keep them out of foreclosure and heal the real estate market. DeMarco has strongly resisted that push, leading to calls for him to be fired. He has argued there are less costly ways to assist distressed homeowners and that the FHFA’s must protect the $188 billion in taxpayer money pumped into Fannie and Freddie since they were seized by the government in 2008. […] A December 2009 document estimated that more than half of Fannie Mae’s customers would ‘see some benefit from the project.’ The program would cost $1.7 million, but ‘benefits could total more than $410 million,’ according to the document cited by the lawmakers. But the plans were abruptly canceled in July 2010. And a former Fannie Mae employee told the lawmakers that it was stopped by officials ‘philosophically opposed to writing down principal balances.'” [Los Angeles Times, 5/1/12]

Crossroads Misrepresents President Obama’s Tax-Cutting Record

The ad quotes then-Senator Barack Obama saying, “If you are a family making less than $250,000 a year, you will not see your taxes go up,” citing remarks on July 30, 2008.

Obama: “While We’re Both Proposing Tax Cuts, There’s A Big Difference In Terms Of Who The Tax Cuts Are For.” From the July 30, 2008, speech by then-Senator Obama : “So if Sen. McCain wants to debate taxes, then I’m ready. […] Because while we’re both proposing tax cuts, there’s a big difference in terms of who the tax cuts are for. McCain would cut taxes for those making over $3 million. One quarter of John McCain’s tax cuts would go to people making millions of dollars. I want to cut taxes for middle class families, ordinary folks who are working hard and playing by the rules. And an objective analysis done by a nonpartisan group has shown that my tax cut would benefit middle-class families three times as much as John McCain’s. So let me be clear, because you’re gonna start seeing ads, this is what happens every election season, they’re gonna say ‘Oh he’s a tax-and-spend liberal Democrat, he wants to get in your pocket, he’s gonna spend it on all kinds of crazy pork-barrel projects.’ You know, you’ve seen the ads, they just replace the name each election cycle, but it’s the same ad over and over again. So let me be absolutely clear. If you are a family making less than $250,000 a year—if you are a family making less than $250,000 a year, you will not see your taxes go up. Not your capital gains tax, not your payroll tax, not your income tax, no taxes. Your taxes will not go up.” [Obama Remarks via YouTube.com, 7/30/08]

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

- Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

Affordable Care Act Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

Most Of The “18 Different Taxes” Target Corporations Or The Wealthy; Obama Has Cut Taxes For Middle Class

The ad’s statement that “Obamacare raises 18 different taxes” cites a list published by the Heritage Foundation on January 20, 2011.

FactCheck.org: Crossroads’ Tax Claim Is “Dishonest Nonsense.” According to FactCheck.org: “The ad shows Obama saying in a 2008 campaign speech, ‘If you are a family making less than $250,000 a year, you will not see your taxes go up.’ Then, to the sound of shattering glass, the narrator says, ‘Broken! Obamacare raises 18 different taxes.’ But that’s dishonest nonsense. Only a few of the tax changes in the new health care law will fall on families making under $250,000 a year, or individuals making less than $200,000 for that matter. And they make up only a small part of the $503 billion figure that appears on screen. That 10-year total falls overwhelmingly on individuals who are above those income thresholds — just as Obama promised — or on corporations. […] [O]f the $503 billion in taxes listed by the Heritage document, $210 billion falls specifically on individuals making more than $200,000 a year, or couples making over $250,000. And we count another $190 billion that falls only on businesses, including corporations in general, or in particular on health insurance companies, pharmaceutical manufacturers and importers, makers of medical devices and even producers of biofuels. ” [FactCheck.org, 5/17/12]

- Obama “Repeatedly Cut Taxes” For Middle Class, And Increases “Are Small Compared To Cuts.” According to FactCheck.org: “The truth is that Obama repeatedly cut taxes for such families, first through a tax credit in effect for 2009 and 2010, and beginning in 2011, through a reduction in the payroll tax that is worth $1,000 this year to workers earning $50,000 a year. And while it’s true that some tax increases contained in the new health care law would fall on individuals, they have mostly not taken effect yet and are small compared with the cuts the president already enacted.” [FactCheck.org, 5/17/12, italics original]

Recovery Act Cut Taxes For Most Americans, Totaled $288 Billion In Tax Relief

President Obama Cut Taxes For Up To “95 Percent Of Working Families.” According to FactCheck.org: “The truth here is that Obama has lowered taxes for all workers through a 2 percentage point reduction in the Social Security payroll tax that started in 2011 and is scheduled to continue through the end of 2012. The cut is equal to $1,000 this year for a worker making $50,000 a year — or as much as $2,202 to any worker earning at least the maximum taxable level of wages or salary ($110,100 for 2012). Obama had previously signed a tax cut that benefited nearly all working families and was in effect from 2009 through 2010. The ‘Making Work Pay’ tax credit was part of the stimulus bill he signed shortly after taking office. That credit was worth a maximum of $400 per person, or $800 for couples during those years. It phased out at higher income levels, and so its benefit went entirely to individuals making less than $95,000 a year, or couples making less than $190,000. The White House figures it went to ‘95 percent of working families.’ And even allowing for those who are retired or unemployed, it benefited more than 75 percent of all individuals and families, working or not, according to the nonpartisan Tax Policy Center.” [FactCheck.org, 5/17/12]

Recovery Act Included $288 Billion In Tax Relief. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy.” [PolitiFact, 2/17/10]

GOP Rejected Plan To Extend Tax Cuts For All Americans Except The Super Rich

December 2010: Senate Republicans Blocked Democratic Attempt To Extend Middle-Class Tax Cuts. From CNN: “Two Senate procedural votes on Democratic measures to extend George W. Bush-era tax cuts for people who are not super wealthy failed on Saturday, preventing the measures from moving forward. The votes sought to extend the Bush tax cuts for families making under $250,000 and $1 million, respectively. Both votes garnered the support of 53 senators, but the Democrats needed 60 votes to end debate.” [CNN, 12/5/10]

- Obama Struck Compromise With GOP To Extend All Bush Tax Cuts In Exchange For Extending Jobless Benefits, Cutting Payroll Taxes. From the New York Times: “President Obama announced a tentative deal with Congressional Republicans on Monday to extend the Bush-era tax cuts at all income levels for two years as part of a package that would also keep benefits flowing to the long-term unemployed, cut payroll taxes for all workers for a year and take other steps to bolster the economy. […] In addition, the agreement provides for a 13-month extension of jobless aid for the long-term unemployed. Benefits have already started to run out for some people, and as many as seven million people would potentially lose assistance within the next year, officials said. Congressional Republicans in recent days have blocked efforts by Democrats to extend the jobless aid, saying they would insist on offsetting the $56 billion cost with spending cuts elsewhere. White House officials said they feared a long standoff that would see benefits end for millions of Americans over the holiday season and in the months ahead. But Mr. Obama made substantial concessions to Republicans. In addition to dropping his opposition to any extension of the current income tax rates on income above $250,000 for couples and $200,000 for individuals, he agreed to a deal on the federal estate tax that infuriated many Democrats. The deal would ultimately set an exemption of $5 million per person and a maximum rate of 35 percent — a higher exemption and far lower rate than many Democrats wanted.” [New York Times, 12/6/10]

Under Obama, Taxes Are Historically Low

As Percentage Of GDP, Federal Tax Burden Is At 60-Year Low. According to former Reagan administration official Bruce Bartlett: “Historically, the term ‘tax rate’ has meant the average or effective tax rate — that is, taxes as a share of income. The broadest measure of the tax rate is total federal revenues divided by the gross domestic product. By this measure, federal taxes are at their lowest level in more than 60 years. The Congressional Budget Office estimated that federal taxes would consume just 14.8 percent of G.D.P. this year. The last year in which revenues were lower was 1950, according to the Office of Management and Budget.” [Bartlett Blog Post, NYTimes.com, 5/31/11]

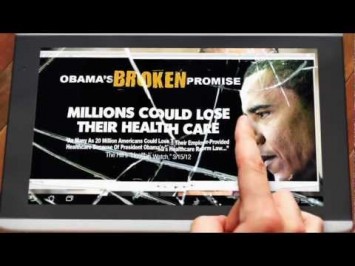

Crossroads Distorts CBO Expectations To Fearmonger About Lost Coverage

The ad’s claim that “millions could lose their health coverage” is supported by on-screen text that reads, “As Many As 20 Million Americas Could Lose Their Employer-Provided Health Care Because Of President Obama’s Health Care Law,” citing The Hill on March 15, 2012.

Up To 30 Million People Are Expected To Gain Coverage Through The Affordable Care Act. From the Congressional Budget Office: “CBO and JCT now estimate that the ACA, in comparison with prior law before the enactment of the ACA, will reduce the number of nonelderly people without health insurance coverage by 14 million in 2014 and by 29 million or 30 million in the latter part of the coming decade, leaving 30 million nonelderly residents uninsured by the end of the period. … The share of legal nonelderly residents with insurance is projected to rise from 82 percent in 2012 to 92 percent by 2022. According to the current estimates, from 2016 on, between 23 million and 25 million people will receive coverage through the exchanges, and 10 million to 11 million additional people will be enrolled in Medicaid and CHIP as a result of the ACA. Between 4 million and 6 million fewer people are estimated to have coverage through an employer, compared with coverage in the absence of the ACA. That number did not change significantly as a result of the Court’s decision.” [CBO.gov, July 2012]

Affordable Care Act Projected To Cause Small Reduction In Employer-Based Coverage, But Could Also Increase Such Coverage. From the Congressional Budget Office: “CBO and JCT continue to expect that the ACA will lead to a small reduction in employment-based health insurance. […] In CBO and JCT’s judgment, a sharp decline in employment-based health insurance as a result of the ACA is unlikely and, if it occurred, would not dramatically increase the cost of the ACA. […] As reflected in CBO’s latest baseline projections, the two agencies now anticipate that, because of the ACA, about 3 million to 5 million fewer people, on net, will obtain coverage through their employer each year from 2019 through 2022 than would have been the case under prior law. […] In the four alternative scenarios examined, the ACA changes the number of people who will obtain health insurance coverage through their employer in 2019 by an amount that ranges from a reduction of 20 million to a gain of 3 million relative to what would have occurred otherwise. According to the CBO’s July update, the number of people expected to lose employer-based coverage “did not change significantly,” and is now estimated at between “4 million and 6 million fewer people.” [CBO.gov, 3/15/12; CBO.gov, July 2012]

“Law Could Just As Well Increase” Workplace Coverage By 3 Million; 20 Million Figure Is Worst-Case Scenario. From The Hill‘s report on the March 15 CBO report: “As many as 20 million Americans could lose their employer-provided coverage because of President Obama’s healthcare reform law, the nonpartisan Congressional Budget Office said in a new report Thursday. The figure represents the worst-case scenario, CBO says, and the law could just as well increase the number of people with employer-based coverage by 3 million in 2019. The best estimate, subject to a ‘tremendous amount of uncertainty,’ is that about 3 million to 5 million fewer people will obtain coverage through their employer each year from 2019 through 2022.” [The Hill, 3/15/12]

CBO: Other Analyses Consistent With Our Best-Guess Scenario. From the CBO report cited by the Chamber: ” Other analysts who have carefully modeled the nation’s existing health insurance system and the changes in incentives for employers to offer insurance coverage created by the ACA have reached conclusions similar to those of CBO and JCT or have predicted smaller declines (or even gains) in employment-based coverage owing to the law. Surveys of employers regarding their plans for offering health insurance coverage in the future have uncertain value and offer conflicting findings.” [CBO.gov, 3/15/12]

CBO: Similar Massachusetts Reforms Have Led To Increase In Employer-Provided Coverage. From the CBO report cited by the Chamber: “One piece of evidence that may be relevant is the experience in Massachusetts, where employment-based health insurance coverage appears to have increased since that state’s reforms, which are similar but not identical to those in the ACA, were implemented.” [CBO.gov, 3/15/12]

Plans In The Insurance Market Are Already Unstable, Causing Eroding Coverage And Higher Premiums. According to Time: “Still, while many employer-based plans will be snared in the regulatory net of the Patient Protection and Affordable Care Act, many of those with this coverage could actually stand to benefit. The new regulations, after all, are designed to protect consumers. If job-based plans have to change — and are not dropped by employers — they will do so in ways that limit what workers have to pay out of pocket and what insurers can refuse to cover. […] Plus, it’s not as though the employer-based insurance market is reliable and stable in its current form. Most employees don’t have any control over the structure of their health insurance. As a result, coverage has been steadily eroding in the past decade, with premium costs for workers increasing 131% from 1999 to 2009, even as the actuarial value of those plans, on average, decreased.” [Time, 6/24/10]

After Bush Policies Fueled Debt Explosion, GOP Chooses Expensive Tax Cuts For The Rich Over Smaller Deficits

Obama Inherited Deficit Over $1 Trillion, Fueled By Recession And Bush Policies That Continue To Have Impact

Prior To President Obama’s Inauguration, President Bush Had Already Created A Projected $1.2 Trillion Deficit For Fiscal Year 2009. From the Washington Times: “The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn’t enact any new programs. […] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record.” [Washington Times, 1/8/09]

NYT: President Bush’s Policy Changes Created Much More Debt Than President Obama’s. The New York Times published the following chart comparing the fiscal impact of policies enacted under the Bush and Obama administrations:

[New York Times, 7/24/11]

Recession Added Hundreds Of Billions In Deficits By Increasing Spending On Safety Net While Shrinking Tax Revenue. The Center on Budget and Policy Priorities (CBPP) explains: “When unemployment rises and incomes stagnate in a recession, the federal budget responds automatically: tax collections shrink, and spending goes up for programs like unemployment insurance, Social Security, and Food Stamps.” According to CBPP: “The recession battered the budget, driving down tax revenues and swelling outlays for unemployment insurance, food stamps, and other safety-net programs. Using CBO’s August 2008 projections as a benchmark, we calculate that the changed economic outlook alone accounts for over $400 billion of the deficit each year in 2009 through 2011 and slightly smaller amounts in subsequent years. Those effects persist; even in 2018, the deterioration in the economy since the summer of 2008 will account for over $300 billion in added deficits, much of it in the form of additional debt-service costs.” [CBPP.org, 11/18/10; CBPP.org, 5/10/11, citations removed]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CBPP: Bush Tax Cuts And Wars Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

Republicans Have Opposed President Obama’s Deficit-Reduction Efforts

Under President Obama’s FY 2013 Budget, Deficit Would Fall Below $1 Trillion For First Time Since Bush Left Office. According to the Congressional Budget Office’s analysis of President Obama’s FY 2013 budget proposal, “the deficit would decline to $977 billion (or 6.1 percent of GDP)” in 2013, and further fall to 3 percent of GDP in 2022. By contrast, according to the Center on Budget and Policy Priorities: “The deficit for fiscal year 2009 — which began more than three months before President Obama’s inauguration — was $1.4 trillion and, at 10 percent of Gross Domestic Product (GDP), the largest deficit relative to the economy since the end of World War II.” [CBO.gov, March 2012; CBPP.org, 5/10/11]

September 2011: Obama Proposed $3 Trillion In Deficit Reduction, “Republicans Swiftly Responded…With Opposition.” According to the Los Angeles Times: “President Obama on Monday made an aggressive pitch for his $3-trillion deficit-reduction strategy, promising to veto any proposal that fails to raise revenues by asking wealthy Americans to ‘pay their fair share.’ […] His plan for lopping $3 trillion from the deficit is on top of the approximately $1 trillion in spending cuts that he signed into law in August, after reaching a deal with Republican congressional leaders to lift the nation’s debt ceiling. On Monday, Republicans swiftly responded to the president’s proposal with opposition. [Los Angeles Times, 9/19/11]

April 2011: GOP Rejected Obama Proposal To Reduce Deficits By $4 Trillion. According to the Boston Globe: “President Obama pledged yesterday to pare the projected deficit by $4 trillion in the next 12 years, vowing to protect the nation’s most vulnerable while pushing again for higher taxes for its richest citizens. […] His call for the end of the Bush tax cuts for incomes above $250,000 for couples reignites a ferocious debate from the fall midterm elections. That element of the speech triggered the most vociferous and immediate opposition from Republicans.” [Boston Globe, 4/14/11]

[NARRATOR:] President Obama’s agenda promised so much. [OBAMA:] “We must help the millions of homeowners who are facing foreclosure.” [NARRATOR:] Promise broken. One in five mortgages are still underwater. [OBAMA:] “If you are a family making less than $250,000 a year, you will not see your taxes go up.” [NARRATOR:] Broken. Obamacare raises 18 different taxes. [OBAMA:] “If you like your health care plan, you’ll be able to keep your health care plan.” [NARRATOR:] Broken. Millions could lose their health care coverage and could be forced into a government pool. [OBAMA:] “Today, I’m pledging to cut the deficit we inherited by half by the end of my first term in office. [NARRATOR:] Broken. Because he hasn’t even come close. We need solutions, not just promises. Tell President Obama to cut the deficit and support the New Majority Agenda. [Crossroads GPS via YouTube.com, 5/16/12]