The U.S. Chamber of Commerce attacks Sen. Sherrod Brown (D-OH) over his “failed record on energy,” citing votes that allegedly harm America’s energy security and increase costs. However, the Chamber misrepresents the votes in question, which involved significant environmental concerns.

Sen. Brown Opposed Bill To “Dramatically Increase” Offshore Drilling

To support its claim that Sen. Brown votes “against American energy security,” the ad cites Senate Vote #28 on March 8, 2012, which rejected the Vitter Amendment to a transportation spending bill.

Vitter Amendment Would Have Opened Up Drilling Lease Sales Off The Coasts Of Florida, California, And Virginia. From the Times Picayune: “Sen. David Vitter, R-La., is pushing an amendment to a transportation spending bill that would dramatically increase offshore oil and gas development. But it remains to be seen whether he’ll get a vote on his plan, which like similar proposals by House Republicans is opposed by major environmental groups. […] House Republicans added a provision to its now-stalled transportation bill that would require additional leases across the Outer Continental Shelf, including off Florida and California, where there’s strong opposition from state and local leaders of both political parties. Vitter’s proposal differs in strategy. It would put into effect a five-year drilling plan announced by President George W. Bush’s administration in 2008 that would have allowed lease sales throughout the Outer Continental Shelf, including off the Florida, California and Virginia coasts. The Obama administration threw out the Bush plan, and has kept leasing off-limits for the Virginia, Florida and California coasts.” [Times-Picayune, 3/5/12]

Vitter Amendment Would Instate Never-Adopted Draft Lease Sale Plan From Bush. From Environment and Energy Daily: “Sen. David Vitter’s amendment to the Senate’s two-year, $109 billion highway bill would force the adoption of the Bush administration’s draft five-year leasing plan, which was rejected by the Obama administration when it came into office. The Vitter measure would implement the Bush plan, which would have allowed 10 leases sales in several planning areas that were formerly under executive and congressional moratoriums, beginning in 2013.” [Environment and Energy Daily via Nexis, 3/7/12]

Bush’s Plan Was A Draft And Was Never Reviewed For Environmental Concerns. From a Natural Resources Defense Council Blog Post: “This proposed program never received a legal environmental review, and as a draft proposal, was never meant to be the be-all end-all program for leasing, even under the former Administration. By mandating this draft program be implemented, Senator Vitter’s amendment would not only drastically increase drilling off of all of our coasts, it would mandate drilling with absolutely zero consideration of environmental safeguards for our coasts and the communities who depend on healthy and clean oceans.” [NRDC.org, 3/1/12, emphasis original]

Sen. Brown Opposed Accelerated Timeline For Pipeline Project

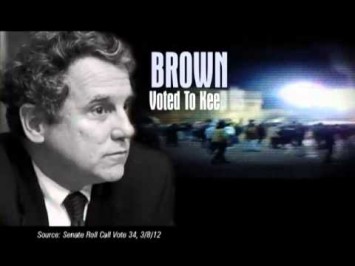

To support the claim that Sen. Brown voted “against American energy security” and “to keep us more dependent on foreign oil from unstable regimes,” the ad cites Roll Call Vote #34 on March 8, 2012, in which the Senate rejected an amendment to approve the Keystone XL pipeline project.

Senate Rejected GOP Effort To Expedite Construction Of Keystone Pipeline. According to CNN: “The Senate narrowly rejected a Republican-sponsored measure Thursday that would have bypassed the Obama administration’s current objections to the Keystone XL pipeline and allowed construction on the controversial project to move forward immediately. […] The proposed 1,700-mile long pipeline expansion, intended to carry crude oil from Canada’s oil sands to the U.S. Gulf Coast, has become a political lightning rod. Supporters, including the oil industry, say it’s a vital job creator that will lessen the country’s dependence on oil imported from volatile regions. Opponents say the pipeline may leak, and that it will lock the United States into a particularly dirty form of crude that might ultimately end up being exported anyway. […] President Barack Obama rejected a bid in January to expedite the pipeline, arguing that a decision deadline imposed by Congress did not leave sufficient time to conduct necessary reviews. [CNN.com, 3/8/12]

Keystone XL Would Pump Heavy Crude Mixed With Toxic Chemicals Over One Of Largest Aquifers In U.S. From NPR: “The difference between Canadian Tar Sands oil and Oklahoma light sweet crude is like the difference between Coca-Cola and cake batter. So to make it easier for Canadian oil to flow thousands of miles south to Cushing, it has to be mixed with chemicals to thin out. ‘They won’t tell us what’s in the oil to make it flow,’ says Randy Thompson, a Nebraskan cattle rancher who’s opposed Keystone XL. He’s successfully spearheaded a campaign to halt the construction of Keystone XL through the ecologically sensitive Sandhills of Nebraska that lie atop one of America’s largest underground aquifers. ‘We know they’re toxic chemicals. So this is a severe concern for a lot of us people out here,’ Thompson says. ‘A lot of us people out here, we gotta drink this water. Be nice to know what the hell they’re pumping through it.’ TransCanada claims that its proposed Keystone XL line will be the safest of its kind ever built. ‘I believe we can absolutely build pipelines with new technology that are getting closer and closer to being leak free,’ Jones says.” [NPR.org, 2/26/12]

- Despite Decline In Incidents, Still Over 100 “Significant Spills” Per Year From U.S. Pipelines. From the New York Times: “Federal records show that although the pipeline industry reported 25 percent fewer significant incidents from 2001 through 2010 than in the prior decade, the amount of hazardous liquids being spilled, though down, remains substantial. There are still more than 100 significant spills each year — a trend that dates back more than 20 years. And the percentage of dangerous liquids recovered by pipeline operators after a spill has dropped considerably in recent years.” [New York Times, 9/9/11]

- Over 5,600 Incidents Releasing 110 Million Gallons From Pipelines Since 1990. From the New York Times: “Since 1990, more than 5,600 incidents were reported involving land-based hazardous liquid pipelines, releasing a total of more than 110 million gallons of mostly crude and petroleum products, according to analysis of federal data. The pipeline safety agency considered more than half — at least 100 spills each year — to be ‘significant,’ meaning they caused a fire, serious injury or fatality or released at least 2,100 gallons, among other factors.” [New York Times, 9/9/11]

Keystone Pipeline Would Not Lower Gas Prices Or Create Many Jobs

Amount Of Oil Provided To U.S. Markets By Keystone XL Would Save Consumers Just 3 Cents Per Gallon. From Businessweek: “The gas price argument rests on the bump in supply the Keystone XL will bring to market. Keystone XL would deliver around 830,000 barrels a day. Not all of that would be used in the U.S., however: The pipeline delivers to a tariff-free zone, so there’s a financial incentive to export at least some of this oil. This is especially true because area refineries are primed to produce diesel, for which there’s less stateside demand. But let’s say two-thirds of the capacity—half a million barrels a day—of Keystone oil stays in the U.S. That’s a convenient estimate on which to gauge the impact of Keystone oil, because it’s the supply increase the U.S. Energy Information Administration, which provides independent data on energy markets, expected in a recent study of the expiration of offshore drilling bans. In 2008, it studied what 500,000 barrels more per day would save consumers at the pump: 3¢ a gallon.” [Businessweek, 2/17/12]

- TransCanada Itself Says Keystone XL Could Raise Gas Prices For Midwestern U.S. From an op-ed by journalist and environmental activist Bill McKibben in The Hill: “But in the case of the Keystone pipeline, it turns out there’s a special twist. At the moment, there’s an oversupply of tarsands crude in the Midwest, which has depressed gas prices there. If the pipeline gets built so that crude can easily be sent overseas, that excess will immediately disappear and gas prices for 15 states across the middle of the country will suddenly rise. Says who? Says the companies trying to build the thing. Transcanada Pipeline’s rationale for investors, and their testimony to Canadian officials, included precisely this point: removing the ‘oversupply’ and the resulting ‘price discount’ would raise their returns by $2 to $4 billion a year.” [McKibben Op-Ed, The Hill, 2/21/12]

State Dept. Estimates Keystone Would Create Just 20 Permanent Jobs. From Businessweek: “Clearly, the construction of the pipe, most of it below ground, will be a huge undertaking. The estimated number of people it will employ in the process, however, has fluctuated wildly, with TransCanada raising the number from 3,500, to 4,200, to 20,000 temporary positions and suggesting the line will employ several hundred on an on-going basis. The U.S. State Department, which made its own assessment because the pipeline crosses the U.S.-Canada border, estimates the line will create just 20 permanent jobs. One advantage of a pipeline, after all, is that it’s automated.” [Businessweek, 2/17/12]

Keystone Would Create Fewer Than 25,000 Total Jobs Per Year For Just Two Or Three Years. From a Cornell University Global Labor Institute study of KXL’s economic impacts: “[W]e calculate that the actual spending relevant to the US economy, and the figure from which US new job creation projections should be calculated, is around $3 to $4 billion, not $7 billion. […] Fortunately, the job projections submitted by developers of other major pipeline projects provide a useful guide for estimating potential impacts for KXL. On this basis, for the purposes of estimating total employment impacts, it is reasonable to assume a multiplier of approximately 11 person-years per $1 million pipeline project capital costs. […] Given a multiplier of 11 person-years per $1 million, this translates into total employment impacts of 33,000 to 44,000 person-years. So a reasonable estimate of the total incremental US jobs from KXL construction is about one-third of the figure estimated in the Perryman study and used by industry to advocate for the construction of KXL. Moreover, any job impacts associated with KXL construction would be spread over 2 and more likely 3 years. So the annual impacts are at most about 22,000 person-years of employment per year, for two years. But the annual impacts could also be as low as 11,000 person-years per year, for three years.” [“Pipe Dreams? Jobs Gained, Jobs Lost By The Construction Of Keystone XL,” Cornell University Global Labor Institute, September 2011, internal citations removed]

Sen. Brown Supported Environmental Standards Projected To Save Thousands Of Lives Every Year

The ad’s claim that Brown voted for “costly regulations” that “could cause electricity rates to skyrocket” cites Roll Call Vote #139 on June 20, 2012, in which the Senate rejected a resolution disapproving the EPA’s Mercury and Air Toxic Standards.

EPA Estimates Mercury Rule Will Prevent “Up To 11,000 Premature Deaths” Per Year. According to FactCheck.org: “The EPA’s Mercury Air Toxics Standards for the first time will regulate heavy metal emissions at coal-fired power plants, which produce the largest amount of mercury in the air. The EPA finalized the rule in December under the Clean Air Act, giving the industry until 2015 to comply. The agency says the rule will prevent each year up to 11,000 premature deaths, 4,700 heart attacks and more than 500,000 sick days. The EPA says the associated health benefits will be worth $37 billion to $90 billion a year.” [FactCheck.org, 7/18/12]

EPA Estimates The Rule Will Temporarily Raise Average Customer’s Monthly Electricity Costs By $3-4. From a Congressional Research Service report on the “Utility MACT” rule: “The average consumer will see an increase of 3.1% ($3-$4 per month) in the cost of electricity in 2015 due to the rule, according to EPA, falling to less than 1% by 2030.” [“EPA’s Utility MACT: Will the Lights Go Out?”, CRS via EENews.net, 1/9/12]

- FactCheck.org: Claim That Regulation Will Cause Electricity Costs To “Skyrocket” Goes “Too Far.” According to FactCheck.org; “A conservative group goes too far in TV ads that claim a new EPA regulation on coal power plants will make Ohio’s electric bills ‘skyrocket.’ Utility officials say it’s too soon to determine how big the impact will be. Nationally, projections from the Energy Information Administration show only a slight fluctuation in the residential price of electricity over the long run. The EIA factored in the regulation in its projections. There’s reason to believe there might be more of an impact in price in Ohio, but it’s too early to predict what that would be.” [FactCheck.org, 7/18/12]

[NARRATOR:] The more energy we produce at home, the less we have to depend on others. So why does Sherrod Brown vote against American energy security? Brown voted to keep us more dependent on foreign oil from unstable regimes. And Brown voted for costly regulations, which could cause electricity rates to skyrocket or force layoffs. Stop Sherrod Brown and his failed record on energy. [U.S. Chamber of Commerce via YouTube.com, 9/18/12]