An ad from the U.S. Chamber of Commerce cites the Affordable Care Act, Wall Street Reform, and the Bush tax cuts to build the case that Rep. John Tierney (D-MA) has “one of the worst voting records for small businesses.” But Tierney voted against various efforts to extend provisions of the Bush tax cuts because Republican plans routinely involved giveaways for the wealthy at the expense of the deficit, while the health care reform law includes tax credits for small businesses and Dodd-Frank targets large firms, not small banks.

Many Small Businesses Are Eligible For Tax Credits Under The Affordable Care Act

The ad cites House Vote #165 on March 21, 2010, in which the House passed the Affordable Care Act, and House Vote #887 on November 7, 2009, in which the House passed an earlier version of the health care reform law titled the Affordable Health Care for America Act.

Affordable Care Act Offers Tax Credits To Many Small Businesses. According to a report from Small Business Majority and Families USA: “Congress included in the Affordable Care Act a significant new tax credit for small business owners who provide their workers with health insurance. Under this new tax credit, businesses that have fewer than 25 full-time workers and average wages of less than $50,000 are now eligible to receive a tax credit of up to 35 percent of the cost of the health insurance that they provide for their workers. To qualify for the tax credit, small businesses must cover at least 50 percent of each employee’s health insurance premiums. In 2014, the size of the credit will increase to cover up to 50 percent of the cost of health insurance provided to workers.” [SmallBusinessMajority.org, May 2012]

- More Than 3.2 Million Small Businesses Eligible For ACA Tax Credit. According to a report from Small Business Majority and Families USA: “Our analysis found that more than 3.2 million small businesses, employing 19.3 million workers across the nation, will be eligible for this tax credit when they file their 2011 taxes. In total, these small businesses are eligible for more than $15.4 billion in credits for the 2011 tax year alone, an average of $800 per employee.” [SmallBusinessMajority.org, May 2012]

ACA Requires Businesses With More Than 50 Employees To Provide Affordable Coverage Or Pay A Fee. According to a report from Small Business Majority and FamiliesUSA: “While the Affordable Care Act created this new tax credit to help small business owners and workers, it does not force these small business owners to provide coverage for their workers. There are no employer mandates in the law, and there are no employer responsibility requirements at all for businesses with fewer than 50 workers, which account for 96 percent of all firms in the United States. Starting in 2014, businesses with 50 or more workers that do not offer coverage or that offer only unaffordable coverage to their workers will be assessed a fee if one or more of their workers receives a federal individual premium tax credit to purchase coverage in an exchange.” [SmallBusinessMajority.org, May 2012]

GOP Argument That Obamacare Is “Job-Killing” Has Been Debunked

FactCheck.org: “Job-Killing” Claim Is “Health-Care Hooey.” From FactCheck.org: “The exaggerated Republican claim that the new health care law ‘kills jobs’ was high on our list of the ‘Whoppers of 2011.’ But the facts haven’t stopped Republicans and their allies from making the ‘job-killing’ claim a major theme of their campaign 2012 TV ads. […]All of this is health-care hooey, aimed at exploiting public concern over continuing high unemployment, with little basis in fact. As we’ve said before (a few times), experts project that the law will cause a small loss of low-wage jobs — and also some gains in better-paid jobs in the health care and insurance industries. It’s also expected that more workers will decide to retire earlier, or work fewer hours, when they no longer need employer-sponsored insurance and can obtain it on their own with help from federal subsidies. But that just means fewer people willing to work — and it will free up jobs for those who want them. If anything, that could reduce the jobless rate.” [FactCheck.org, 2/21/12]

- AP: Republicans Misuse CBO Statistics To Support “Job-Killing” Claim About Health Care Overhaul. From the Associated Press: “A recent report by House GOP leaders says ‘independent analyses have determined that the health care law will cause significant job losses for the U.S. economy.’ It cites 650,000 lost jobs as Exhibit A, and the nonpartisan Congressional Budget Office as the source of the analysis behind that estimate. But the budget office, which referees the costs and consequences of legislation, never produced that number. What CBO actually said is that the impact of the health care law on supply and demand for labor would be small. Most of the lost jobs would come from people who no longer have to work, or can downshift to less demanding employment, because insurance will be available outside the job. ‘The legislation, on net, will reduce the amount of labor used in the economy by a small amount — roughly half a percent— primarily by reducing the amount of labor that workers choose to supply,’ budget office number crunchers said in a report last year.” [Associated Press via USA Today, 1/24/10]

Health Insurers Poured Money Into Chamber To Attack Reform

Health Insurance Industry Gave Chamber Over $100 Million To Fight Health Care Reform. From the National Journal: “The nation’s leading health insurance industry group gave more than $100 million to help fuel the U.S. Chamber of Commerce’s 2009 and 2010 efforts to defeat President Obama’s signature health care reform law, National Journal’s Influence Alley has learned. During the final push to kill the bill before its March 2010 passage, America’s Health Insurance Plans gave the chamber $16.2 million. With the $86.2 million the insurers funneled to the business lobbying powerhouse in 2009, AHIP sent the chamber a total of $102.4 million during the health care reform debate, a number that has not been reported before now. The backchannel spending allowed insurers to publicly stake out a pro-reform position while privately funding the leading anti-reform lobbying group in Washington. The chamber spent tens of millions of dollars bankrolling efforts to kill health care reform.” [NationalJournal.com, 6/13/12]

Dodd-Frank Regulations Target Large Firms, Not Small Businesses

The ad cites House Vote #413 on June 30, 2010, in which the House passed the Wall Street Reform and Consumer Protection Act.

Small Banks Are Mostly Exempt From The Financial Reforms Passed “In Response To The Near Collapse Of The Financial System.” From the New York Times: “In response to the near collapse of the financial system in 2008, Congress last year passed the Dodd-Frank Act, which imposed restrictions on asset-backed securities, the derivatives industry and proprietary trading — some of Wall Street’s main profit centers. But the law largely exempted about 7,000 community banks and thrift institutions, nearly all of which hold less than $10 billion in assets and a third of which hold less than $100 million.” [New York Times, 5/2/11]

Community Banks Will Benefit From New Rules For Massive Wall Street Firms. From the New York Times: “Despite their protestations, community bankers are quick to praise certain parts of the law. Banks that hold less than $10 billion in assets, or roughly 98 percent of the 7,000 community banks scattered across the country, are immune from new capital and liquidity requirements, for example. The law also imposes curbs on proprietary trading and the derivatives business, restrictions that level the playing field for small lenders competing against giant competitors. But small banks perhaps benefited most from the overhaul of deposit insurance rules. The change, which forces large risk-taking banks to pay a bigger share of deposit insurance premiums, is expected to save small banks more than $4 billion over the next three years, according to Camden Fine, who leads the community bankers group.” [New York Times, 5/23/11, emphasis added]

Community Banks Saw Their Returns Double From 2010 To 2011. From the FDIC’s Quarterly Banking Profile from Q2 2011: “The average return on assets (ROA) rose to 0.85 percent, from 0.63 percent a year earlier. At community banks (institutions with less than $1 billion in assets), the average ROA of 0.57 percent was below the industry average, but more than twice the 0.26 percent registered a year ago.” [FDIC.gov, accessed 2/9/12]

Wall Street Reform Law Is Designed To Protect Taxpayers Against Another Wall Street Meltdown

Dodd-Frank’s Reforms Aim To Prevent Another Financial Collapse. From the Associated Press: “Reveling in victory, President Barack Obama on Wednesday signed into law the most sweeping overhaul of financial regulations since the Great Depression, a package that aims to protect consumers and ensure economic stability from Main Street to Wall Street. The law, pushed through mainly by Democrats in Washington’s deeply partisan environment, comes almost two years after the infamous near financial meltdown in 2008 in the United States that was felt around the globe. The legislation gives the government new powers to break up companies that threaten the economy, creates a new agency to guard consumers and puts more light on the financial markets that escaped the oversight of regulators.” [Associated Press via San Diego Union-Tribune, 7/21/10]

- Dodd-Frank Created Council To Monitor Firms Large Enough To Endanger The Entire Economy. From Reuters: “The new Financial Stability Oversight Council will hold its first meeting on Oct. 1, according to sources familiar with the matter. The council of regulators, which was created by the Dodd-Frank financial regulatory overhaul law enacted in July, is charged with monitoring risks to the financial system. It is chaired by the Treasury secretary and is allowed to identify firms that threaten stability and subject them to tighter oversight by the Federal Reserve.” [Reuters, 9/15/10]

- Seeking To End Bailouts, Dodd-Frank Empowers FDIC To Take Over And Dismantle Failing Financial Institutions Large Enough To Endanger The Whole System. From Reuters: “Aiming to prevent more U.S. taxpayer bailouts, the Dodd-Frank Wall Street reforms of 2010 set up an ‘orderly liquidation process’ for dealing with distressed financial firms. Here is how that process works: If a large, non-bank financial firm is in default or headed that way, regulators can move to put it into ‘orderly liquidation’ if they think its collapse would threaten financial stability. It is an alternative to bankruptcy. […] Once orderly liquidation begins, the firm is placed in receivership. That means the FDIC takes over. It develops a plan for dealing with the firm’s problems, and it provides funds to keep the firm from collapsing. FDIC receivership can last up to five years. […]The FDIC must dismiss the officers and directors responsible for the firm’s problems. Shareholders of the firm get no money until all other claims against the firm are paid. The FDIC itself may not invest in the firm. Creditors owed money by the firm can file a claim to get it back. The FDIC can disallow claims in part or entirely, and must draw up a priority list of who gets what. To settle the firm’s debts, the FDIC can sell the firm’s assets, sell the firm itself, or merge it with another firm.” [Reuters, 2/25/11]

- The Dodd-Frank Act Created The Consumer Financial Protection Bureau (CFPB). From aWall Street Journal explanation of the Dodd-Frank bill’s components: “Consumer Agency: Creates a new consumer Financial Protection Bureau within the Federal Reserve, with rule-making powers and some enforcement control over banks and other financial companies. The new watchdog has authority to examine and enforce regulations for all mortgage-related businesses; banks and credit unions with assets of more than $10 billion in assets; payday lenders, check cashers and certain other non-bank financial firms. Auto dealers are exempted.” [Wall Street Journal, accessed 2/1/12]

Tierney Voted Against Extending Deficit-Busting Tax Cuts For The Wealthy, But Voted To Preserve Middle-Class Cuts

To support the claim that Tierney is “trying to raise taxes on small-business job creators,” the ad cites House Vote #182 on May 9, 2003, in which the House passed the 2003 Bush tax cuts, and House Vote #621 on December 8, 2005, House Vote #135 on May 10, 2006, and House Vote #647 on December 17, 2010, all of which pertain to the Bush tax cuts.

Tierney’s 2005 Vote Was Against Extending Dividend And Capital Gains Cuts That Would Benefit The Wealthy At The Expense Of The Deficit. From the New York Times: “The House passed the last and biggest part of $95 billion in tax cuts on Thursday, a move that reflected the willingness to place tax cuts above the risk of higher deficits in years to come. Voting 234 to 197, almost purely along party lines, the House approved $56 billion in tax cuts over five years, one day after it passed other tax cuts totaling $39 billion over five years. The biggest provision would extend President Bush’s 2001 tax cut for stock dividends and capital gains for two years at a cost of $20 billion. […] Tax analysts agree that the overwhelming bulk of dividends goes to the top 5 percent of income earners.” [New York Times, 12/9/05]

Tierney’s 2006 Vote Was Against Extending Capital Gains Cuts And Alternative Minimum Tax. From the New York Times: “House and Senate Republicans reached agreement Tuesday on a $69 billion bill that would extend President Bush’s tax cuts for investors for two more years and temporarily block a big jump in the alternative minimum tax. […] The deal agreed upon Tuesday covers the tax cut for investors, the alternative minimum tax and the extension of an expiring tax cut on foreign profits earned by American corporations.” [New York Times, 5/10/06]

- 2006 Tax Cut Extension Projected To Overwhelmingly Benefit Top Earners. From the New York Times: “Opponents of the tax cut for investors, which reduced the rate on dividends and capital gains to 15 percent, said the new tax bill would overwhelmingly benefit the very wealthiest taxpayers. The Tax Policy Center, a joint venture of the Brookings Institution and the Urban Institute, recently estimated that the top 10 percent of income-earners would get 81.8 percent of the benefit from lower taxes on investment profits and 73 percent of the benefit from freezing the alternative minimum tax.” [New York Times, 5/10/06]

2010 Bill Extended Tax Cuts For All Income Brackets. From The Hill: “The House gave final approval late on Thursday night to a temporary extension of the George W. Bush-era tax rates, delivering a significant but politically bruising victory to President Obama. The $858 billion legislation now heads to the president’s desk for his signature. It extends the Bush tax cuts across the board for two years, slashes the employee payroll tax by 2 percent for one year, renews the estate tax and extends unemployment insurance benefits for 13 months.” [The Hill, 12/17/10]

- Tierney: GOP “Held Hostage Critical Benefits,” And Tax Cut Extension Will Add To Deficit While Enriching Wealthy. From a Tierney press release: “Unfortunately, Senate Republicans held hostage critical benefits for millions of unemployed Americans, the continuation of tax cuts for every American who earns up to $250,000, among other worthwhile measures in the President’s proposal. They did so in order to force a continuation of the ‘Bush tax cuts’ for amounts over $250,000 as well – essentially giving a very small percent of earners tens of billions of dollars in breaks that will be borrowed and piled onto the debt. Additionally, I strongly opposed the provisions in the bill pertaining to the estate tax. Republican Senators, and then House members, insisted that people with great wealth – just 6,600 individuals – pay no taxes on the first $10 million owned at death and then only at a rate of 35 percent for amounts over $10 million. All together, this misguided bill added billions to our deficit in order to enrich only two to three percent of the population, and too much of that spending does nothing to create jobs or improve our economy. […] Late last night, I voted against the final bill. There were some very good provisions in it, including the extension of unemployment benefits and targeted tax relief to middle-class Americans and small businesses struggling to make ends meet, and my voting record in support of such items is clear. However, in final consideration of the tax bill as a whole, I expect it will have a negative impact on our economic security and our government’s efforts to support all Americans, and it sets a negative precedent for similar compromises in the years to come.” [Tierney Press Release, 12/17/10]

Tierney Recently Voted To Extend Bush Tax Cuts for Those Earning Under $250,000. According to the New York Times, “The House on Wednesday easily approved a one-year extension of all the Bush-era tax cuts set to expire in January, but in the Senate, presidential politics are complicating efforts to extend a tax credit for wind power. The House votes pitted a straight extension of all the expiring Bush tax cuts against a Democratic plan, passed by the Senate, that would allow taxes on income, capital gains and dividends to rise on earnings over $250,000, increasing revenues by around $100 billion. It was not close. The Democratic plan failed 170-257, with 19 Democrats voting no. The Republican plan passed 256-171, again with 19 Democrats throwing in their support.” Tierney voted for the Democratic plan and against the Republican one. [New York Times, 8/2/12; H.R. 8, Vote #543, 8/1/12; H.R. 8, Vote #545, 8/1/12]

Few Top Income Taxpayers Are Actual “Small Businesses”

CBPP: “Only 2.5 Percent Of Small Business Owners Face The Top Two Rates.” According to the Center on Budget and Policy Priorities: “Allowing the top two marginal tax rates to return to pre-2001 levels as scheduled next year would affect very few small businesses, a recent Treasury Department study found. The study shows that only 2.5 percent of small business owners face the top two rates.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservatives Rely On Definition Of “Small Business” That Counts President Obama And Mitt Romney. According to the Center on Budget and Policy Priorities: “The claims that allowing the Bush tax cuts for high-income people to expire would seriously harm small businesses rest on an exceedingly broad, and misleading, definition of ‘small business.’ The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.” [Center on Budget and Policy Priorities, 7/19/12, internal citations removed]

- Conservative Definition Of “Small Businesses” Includes Multi-Billion-Dollar Corporations Like Bechtel And PricewaterhouseCoopers. According to the Center for American Progress: “‘That’s 750,000 small businesses in America, the most productive, the ones that are the most successful, getting hit by a tax increase on top of everything else that’s happened to them in the last 18 months of this administration,’ said Senate Minority Leader Mitch McConnell (R-KY). But McConnell’s number is only accurate if you take an incredibly expansive view of what constitutes a small business. Included in that 750,000 is the Bechtel Corporation, the largest engineering firm in the country. It is the fifth-largest privately owned company in the United States, posting gross revenue in 2008 of $31.4 billion. […] The auditing firm PricewaterhouseCoopers, which has operations in more than 150 countries, fits the bill as well.” [Center for American Progress, 10/21/10, emphasis added]

- Former Bush Economist Alan Viard: GOP’s Definition Of Small Businesses Is A “Fallacy.” As reported by the Washington Post: “Which is why Republicans continually define pass-through entities of all sizes as small businesses, a position [former Bush White House economist Alan] Viard called a ‘fallacy.’ ‘How can it be that 3 percent of owners are accounting for 50 percent of small business income? Those firms they’re owning can’t be all that small,’ Viard said. ‘And that’s true. They’re very large.’” [Washington Post, 9/17/10]

Joint Committee On Taxation: “3.5 Percent Of All Taxpayers With Net Positive Business Income” Fall Into Top Tax Bracket. According to the Joint Committee on Taxation: The staff of the Joint Committee on Taxation estimates that in 2013 approximately 940,000 taxpayers with net positive business income (3.5 percent of all taxpayers with net positive business income) will have marginal rates of 36 or 39.6 percent under the president’s proposal, and that 53 percent of the approximately $1.3 trillion of aggregate net positive business income will be reported on returns that have a marginal rate of 36 or 39.6 percent. [Joint Committee On Taxation, 6/18/12]

Those In The Top Bracket Still Benefit From Middle-Income Tax Cuts. According to the Center on Budget and Policy Priorities:

Furthermore, as Figure 2 shows, under the proposal to allow tax cuts on income above $250,000 ($200,000 for single filers) to expire, taxpayers in the top two brackets would still keep sizeable tax cuts on the first $250,000 of their income ($200,000 for single filers).

[Center on Budget and Policy Priorities, 7/19/12]

Bush Tax Cuts For The Wealthy Drove Up The Deficit Without Boosting The Economy Or Creating Jobs

NYT: Even Prior To 2007 “Great Recession,” Period Following Bush Tax Cuts Had “Slowest Average Annual Growth Since World War II.” From David Leonhardt of the New York Times:

Why should we believe that extending the Bush tax cuts will provide a big lift to growth? Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7. […]

[New York Times, 11/18/10, emphasis added]

Median Household Income Fell For The First Time On Record Following The Bush Tax Cuts. From the Center for American Progress: “Looking at median household incomes is even more telling than median wage growth because it gives a better sense of a family’s total resources. Whereas a high median wage might be offset by fewer hours worked, median income is an overall measure of income. The Bush economic cycle saw the first decline in median household incomes of any cycle since 1967, when the Census Bureau began tracking household data.” CAP also included the following chart:

[Center for American Progress, February 2009]

Washington Post: “A Lost Decade For American Workers.” As reported by the Washington Post: “The past decade was the worst for the U.S. economy in modern times, a sharp reversal from a long period of prosperity that is leading economists and policymakers to fundamentally rethink the underpinnings of the nation’s growth. It was, according to a wide range of data, a lost decade for American workers. […] There has been zero net job creation since December 1999. No previous decade going back to the 1940s had job growth of less than 20 percent.”

[Washington Post, 1/2/10, emphasis added]

Over The Coming Decade, The Bush Tax Cuts Are The Primary Cause Of Federal Budget Deficits. The Center on Budget and Policy Priorities prepared a chart showing the deficit impact of the Bush tax cuts (orange), the Iraq and Afghanistan wars, the recession itself, and spending to rescue the economy:

[CBPP.org, 5/10/11]

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

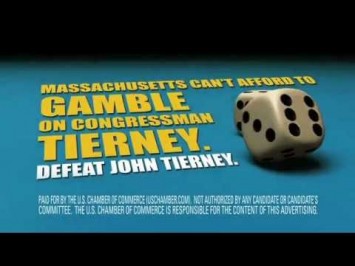

[NARRATOR:] Washington is a mess and Congressman John Tierney is part of the problem. Congressman Tierney has been hostile to Massachusetts job creators. One of the worst voting records for small businesses. Government mandates. More red tape. Job-killing regulations. And Tierney is trying to raise taxes on small-business job creators along the way. Massachusetts can’t afford to gamble another term with Congressman Tierney in Washington. The U.S. Chamber is responsible for the content of this advertising. [U.S. Chamber of Commerce via YouTube.com, 10/5/12]