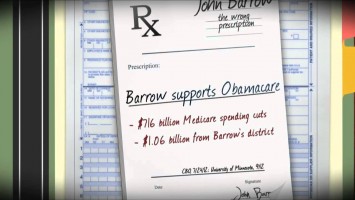

60 Plus Association: “Ron Barber: Washington Insider”

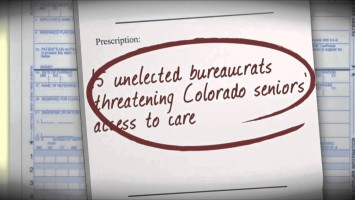

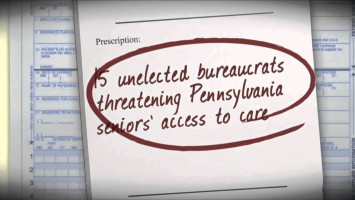

Trying to paint him as a “Washington insider,” the 60 Plus Association attacks Rep. Ron Barber (D-AZ), who won a special election this year to replace injured Rep. Gabrielle Giffords after the Tucson shooting. The ad takes issue with a raise Barber received as Giffords’ district director, even though his salary wasn’t uniquely high among district directors for Arizona’s House delegation, and with Barber’s support for the Affordable Care Act, even though repealing the law would have negative consequences for millions of people. Barber is no D.C. insider, however; prior to working for Giffords, he spent 30 years working for a state agency that helped Arizonans with developmental disabilities become independent and running a small business with his wife.

Read more after the jump.