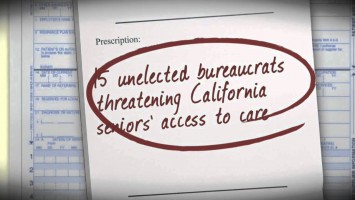

The Week In Conservative Attack Ads

It’s no surprise that conservative outside groups are ramping up their ad spending as November approaches. Counting spots released last Friday afternoon, we fact-checked 36 conservative attack ads this week, our highest one-week tally yet. The large total was driven by an increased focus on House races, which accounted for two-thirds of the ads we answered.

Once again, Karl Rove’s groups dominated the airwaves. As it does most weeks, American Crossroads issued a new attack on President Obama, this one attempting to undermine clear signs that the economy is picking up. Meanwhile, Crossroads GPS targeted eight House candidates go to along with six Senate candidates, which notably included Maine independent Angus King.

Read more after the jump.