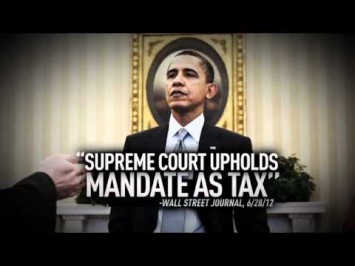

After the Supreme Court upheld the Affordable Care Act’s requirement that most Americans obtain health insurance or pay a penalty, commonly known as the “individual mandate,” American Crossroads pounced with a new ad accusing President Obama of raising taxes on the middle class. Unfortunately, the ad leaves out some crucial facts: The mandate will not have a direct impact on the vast majority of Americans – aside from helping keep their premiums down – and Obama has cut taxes for working Americans by far more than the cost of forgoing insurance under the health care law.

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

Affordable Care Act Also Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

The Truth About The Individual Mandate

Individual Mandate Takes Effect In 2014. According to the Congressional Budget Office: “Beginning in 2014, the Patient Protection and Affordable Care Act (Public Law 111-148), in combination with the Health Care and the Education Reconciliation Act of 2010 (Public Law 111-152), requires most residents of the United States to obtain health insurance and imposes a financial penalty for being uninsured. That penalty will be the greater of a flat dollar amount per person that rises to $695 in 2016 and is indexed by inflation thereafter (the penalty for children will be half that amount and an overall cap will apply to family payments) or a percentage of the household’s income that rises to 2.5 percent for 2016 and subsequent years (also subject to a cap).” [CBO.gov, 4/30/10]

Individual Mandate Lowers Premiums For Everyone, But Few Americans Will Face Penalties

Individual Mandate Doesn’t Directly Affect Vast Majority Of Americans. According to the Urban Institute: “[I]f the ACA were in effect today, 94 percent of the total population (93 percent of the nonelderly population) or 250.3 million people out of 268.8 million nonelderly people—would not face a requirement to newly purchase insurance or pay a fine.” [Urban.org, March 2012]

- Most People Potentially Subject To The Individual Mandate Will Be Eligible For Subsidies Or Assistance. According to the Urban Institute: “About 26.3 million Americans who are currently uninsured will be required to newly obtain coverage or pay a fine. In this group, 8.1 million people will be eligible to receive free or close-to-free insurance through Medicaid or CHIP and can avoid the mandate penalties if they do so; hence our finding that 18.2 million Americans (6 percent of the total population, 7 percent of the nonelderly population) will be required to newly purchase coverage or face a penalty. Of that 18.2 million, 10.9 million people will be eligible to receive subsidies toward private insurance premiums in the newly established health insurance exchanges, but will have to make partial contributions toward their coverage. About 7.3 million people—2 percent of the total population (3 percent of the population under age 65)—are not offered any financial assistance under the ACA and will be subject to penalties if they do not obtain coverage.” [Urban.org, March 2012]

- CBO: “About Four Million People Will Pay The Penalty.” In 2010, the Congressional Budget Office and Joint Committee on Taxation estimated that “about 4 million people will pay the penalty” for not owning insurance in 2016. [CBO.gov, 4/30/10]

Individual Mandate “Leads To Lower Premiums And More Stable Insurance Markets.” According to the Urban Institute: ““In addition, the consumer protections introduced by the ACA, which will guarantee issue of insurance products and prohibit premium variations due to health status and claims experience, could lead some of those currently healthy and insured in these markets to leave them in the absence of the coverage requirement.By encouraging the currently insured healthier individuals to stay in these markets and attracting newly insured healthy individuals into them as well, the individual responsibility requirement leads to lower premiums and more stable insurance markets than would be the case without it. We find that premiums in the nongroup market would be 10 to 20 percent higher on average without the individual coverage requirement.” [Urban.org, March 2012]

Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

President Obama Has Repeatedly Cut Taxes For Middle Class

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy. Of that $288 billion, the stimulus has resulted in $119 billion worth of tax breaks so far.” [PolitiFact.com, 2/17/10]

Obama Has Cut Taxes For Up To “95 Percent Of Working Families.” According to FactCheck.org: “Obama has lowered taxes for all workers through a 2 percentage point reduction in the Social Security payroll tax that started in 2011 and is scheduled to continue through the end of 2012. The cut is equal to $1,000 this year for a worker making $50,000 a year — or as much as $2,202 to any worker earning at least the maximum taxable level of wages or salary ($110,100 for 2012). Obama had previously signed a tax cut that benefited nearly all working families and was in effect from 2009 through 2010. The ‘Making Work Pay’ tax credit was part of the stimulus bill he signed shortly after taking office. That credit was worth a maximum of $400 per person, or $800 for couples during those years. It phased out at higher income levels, and so its benefit went entirely to individuals making less than $95,000 a year, or couples making less than $190,000. The White House figures it went to ‘95 percent of working families.’ And even allowing for those who are retired or unemployed, it benefited more than 75 percent of all individuals and families, working or not, according to the nonpartisan Tax Policy Center.” [FactCheck.org, 5/17/12]

[PRESIDENT OBAMA:] “If you are a family making less than $250,000 a year, you will not see your taxes go up.” [NARRATOR:] Unless you can’t afford health insurance, because uninsured Americans face a $700 tax under Obamacare, increasing every year. Now it’s official: Obama increased taxes on struggling families. The middle class takes another hit. President Obama breaks another promise. [American Crossroads via YouTube.com, 7/2/12]