Americans for Prosperity is running an ad that portrays President Obama’s landmark health care law as a huge tax increase. In reality, most families that earn under $250,000 will not see their taxes go up under Affordable Care Act, which also provides tax credits for millions of working Americans. Meanwhile, the ad’s description of the law as a “$2 trillion health care takeover” is completely bogus – ACA reduces the deficit and relies heavily on the private sector to give millions of people better access to quality insurance.

Affordable Care Act Does Not Raise Taxes On Most Americans – And Includes Tax Credits For Millions

Affordable Care Act “Will Provide More Tax Relief Than Tax Burden” For Middle Class. According to the Washington Post fact checker Glenn Kessler: “The health law, if it works as the nonpartisan government analysts expect, will provide more tax relief than tax burden for middle-income Americans.” [WashingtonPost.com, 7/6/12]

FactCheck.org: “A Large Majority Of Americans Would Not See Any Direct Tax Increase From The Health Care Law.” According to FactCheck.org: “It’s certainly true that the health care law would raise taxes on some Americans, particularly those with higher incomes. The law includes a Medicare payroll tax of 0.9 percent on income over $200,000 for individuals or $250,000 for couples, and a 3.8 percent tax on investment income for those earning that much. The Joint Committee on Taxation estimated that the biggest chunk of revenue — $210.2 billion — comes from those taxes. There are other taxes in the health care law — including an excise tax on the manufacturers of certain medical devices and on indoor tanning services. The health care law included $437.8 billion in tax revenue over 10 years, according to the Joint Committee on Taxation‘s calculations. Republicans tend to add in fees on individuals who don’t obtain health insurance (which the Supreme Court now agrees can be considered taxes) and businesses that don’t provide it to bump that up to about $500 billion. Some taxes, such as those on medical devices, may or may not be passed on to consumers in the form of higher prices, but a large majority of Americans would not see any direct tax increase from the health care law.” [FactCheck.org, 6/28/12]

- Individual Penalty Payments “Tiny” Compared To President Obama’s Previous Tax Cuts. According to FactCheck.org, the increased revenue from penalty payments by individuals who do not obtain health insurance represents “a tiny future increase compared with the tax cuts Obama has already delivered, including an estimated $120 billion in 2012 alone from the 2 percentage point cut in payroll taxes.” [FactCheck.org, 5/17/12]

Affordable Care Act Also Includes Tax Credits For Millions Of Americans. According to Families USA: “We found that an estimated 28.6 million Americans will be eligible for the tax credits in 2014, and that the total value of the tax credits that year will be $110.1 billion. The new tax credits will provide much-needed assistance to insured individuals and families who struggle harder each year to pay rising premiums, as well as to uninsured individuals and families who need help purchasing coverage that otherwise would be completely out of reach financially. Most of the families who will be eligible for the tax credits will be employed, many for small businesses, and will have incomes between two and four times poverty (between $44,100 and $88,200 for a family of four based on 2010 poverty guidelines).” [FamiliesUSA.org, September 2010]

President Obama Has Repeatedly Cut Taxes For Middle Class

Recovery Act Included $288 Billion In Tax Cuts. From PolitiFact: “Nearly a third of the cost of the stimulus, $288 billion, comes via tax breaks to individuals and businesses. The tax cuts include a refundable credit of up to $400 per individual and $800 for married couples; a temporary increase of the earned income tax credit for disadvantaged families; and an extension of a program that allows businesses to recover the costs of capital expenditures faster than usual. The tax cuts aren’t so much spending as money the government won’t get — so it can stay in the economy. Of that $288 billion, the stimulus has resulted in $119 billion worth of tax breaks so far.” [PolitiFact.com, 2/17/10]

Obama Has Cut Taxes For Up To “95 Percent Of Working Families.” According to FactCheck.org: “Obama has lowered taxes for all workers through a 2 percentage point reduction in the Social Security payroll tax that started in 2011 and is scheduled to continue through the end of 2012. The cut is equal to $1,000 this year for a worker making $50,000 a year — or as much as $2,202 to any worker earning at least the maximum taxable level of wages or salary ($110,100 for 2012). Obama had previously signed a tax cut that benefited nearly all working families and was in effect from 2009 through 2010. The ‘Making Work Pay’ tax credit was part of the stimulus bill he signed shortly after taking office. That credit was worth a maximum of $400 per person, or $800 for couples during those years. It phased out at higher income levels, and so its benefit went entirely to individuals making less than $95,000 a year, or couples making less than $190,000. The White House figures it went to ‘95 percent of working families.’ And even allowing for those who are retired or unemployed, it benefited more than 75 percent of all individuals and families, working or not, according to the nonpartisan Tax Policy Center.” [FactCheck.org, 5/17/12]

Affordable Care Act Reduces The Deficit

CBO: The Affordable Care Act Will Reduce Deficits By Over $200 Billion From 2012-2021. According to Congressional Budget Office Director Douglas Elmendorf’s testimony before the House on March 30, 2011: “CBO and JCT’s most recent comprehensive estimate of the budgetary impact of PPACA and the Reconciliation Act was in relation to an estimate prepared for H.R. 2, the Repealing the Job-Killing Health Care Law Act, as passed by the House of Representatives on January 19, 2011. H.R. 2 would repeal the health care provisions of those laws. CBO and JCT estimated that repealing PPACA and the health-related provisions of the Reconciliation Act would produce a net increase in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues. Reversing the sign of the estimate released in February provides an approximate estimate of the impact over that period of enacting those provisions. Therefore, CBO and JCT effectively estimated in February that PPACA and the health-related provisions of the Reconciliation Act will produce a net decrease in federal deficits of $210 billion over the 2012–2021 period as a result of changes in direct spending and revenues.” [“CBO’s Analysis of the Major Health Care Legislation Enacted in March 2010,” CBO.gov, 3/30/11]

- July 2012 Report Affirmed Projection That ACA Will Reduce Deficits. According to a Congressional Budget Office Report titled “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision”: “CBO and JCT have not updated their estimate of the overall budgetary impact of the ACA; previously, they estimated that the law would, on net, reduce budget deficits.” [CBO.gov, July 2012]

Health Care Reform Is Not A “Takeover”

PolitiFact: “Takeover” Charge “Does Not Hold Up Under Examination.” According to PolitiFact: “[T]he law increases regulation. But it greatly relies on the private sector to provide health care. Hospitals will not be taken over by the government, doctors will not become federal employees. The act relies on private insurers to compete and provide health care coverage to an expanded customer base. Employer-based coverage through private companies continues. The ‘government takeover of health care’ is a potent political charge that does not hold up under examination.” [PolitiFact.com, 6/16/12]

Federal Government’s Share Of U.S. Health Spending Is Projected To Grow Very Slowly Under ACA. According to Kaiser Family Foundation president Drew Altman: “Measured by the government’s share of health care spending, there is no sign of a government takeover of the health care system.” The following chart, based on analysis by the Center on Medicare and Medicaid Services, shows the projected share of U.S. health spending by the states, the federal government, and the private sector in 2010 and 2020:

[KFF.org, 8/1/11]

Repeal Would Have Negative Consequences For Millions

Up To 6.6 Million Young Adults Would Lose Health Care Coverage Through Their Parents’ Plans. From the Los Angeles Times: “President Obama’s healthcare law helped as many as 6.6 million young adults stay on or get on their parents’ health plans in the first year and a half after the law was signed, a new survey indicates. […] Earlier surveys by the federal government found that the number of people ages 19 to 25 without insurance declined after the law was signed, reversing years of erosion in health coverage for young adults.” [Los Angeles Times, 6/8/12]

70,000 Americans With Pre-Existing Conditions Would Lose Insurance Coverage. According to the Department of Health and Human Services, as of May 31, 2012, 73,333 people were enrolled in the Pre-Existing Condition Insurance Plan (PCIP) created by the Affordable Care Act. [HealthCare.gov, 7/13/12]

5.2 Million People Would Have To Pay More For Prescription Drugs. From the Centers for Medicare and Medicaid: “As a result of the Affordable Care Act, over 5.2 million seniors and people with disabilities have saved over $3.9 billion on prescription drugs since the law was enacted. The Centers for Medicare & Medicaid Services (CMS) also released data today showing that in the first half of 2012, over 1 million people with Medicare saved a total of $687 million on prescription drugs in ‘donut hole’ coverage gap for an average of $629 in savings this year. […] Coverage for both brand name and generic drugs in the gap will continue to increase over time until 2020, when the coverage gap will be closed.” [CMS.gov, 7/25/12]

Over 35 Million Seniors Would Lose Access To Free Preventive Services. The Centers for Medicare and Medicaid Services [CMS] report that 35,106,598 people were enrolled in Medicare Part B in 2011. CMS also reports:

Beginning January 1, 2011, the Affordable Care Act eliminated Part B coinsurance and deductibles for recommended preventive services, including many cancer screenings and key immunizations. The law also added an important new service — an Annual Wellness Visit with a health professional — at no cost to beneficiaries.

According to preliminary numbers, at least 25,720,996 million Americans took advantage of at least one free preventive benefit in Medicare in 2011, including the new Annual Wellness Visit. This represents 73.3% of Medicare fee-for-service beneficiaries, including 2,404,792 African-American beneficiaries, 537,110 Hispanic beneficiaries, 104,393 American Indian beneficiaries, and 508,398 Asian-American beneficiaries. [CMS.gov, 2/15/12]

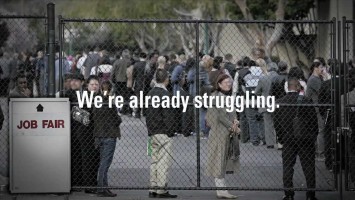

[NARRATOR:] President Obama promised us his health care law… [PRESIDENT OBAMA:] “…is absolutely not a tax increase.” [NARRATOR:] Now we know that’s not true. Obama’s health care law is actually one of the largest tax increases in history. Shouldn’t Obama’s priorities have been creating jobs and ending reckless spending? Instead, he focused on a $2 trillion health care takeover that we have to pay for. How can we afford this tax? We’re already struggling. Tell Obama: Repeal the health care law and pass patient-centered reform. [Americans for Prosperity via YouTube.com, 6/29/12]