Club for Growth Action claims that former U.S. Surgeon General Richard Carmona, who is running for the Senate in Arizona, “has no problem with raising taxes.” But the conservative group’s claim relies on an out-of-context quote, in which Carmona explained that he would support repealing the Bush tax cuts for the wealthiest Americans as long as “you protect the middle and lower class.” According to nonpartisan analysts, ending tax breaks for top earners would reduce the deficit without harming the economy.

Carmona Supports Tax Reform That Protects The Middle Class

The ad’s claim that “Carmona says he has no problem with raising taxes” is accompanied with onscreen text reading: “I don’t have a problem with that.”

Carmona: “I Don’t Have A Problem” With Repealing Tax Breaks For Top Earners As Long As “You Protect The Middle And Lower Class.” Asked whether or not he would “vote to repeal the Bush tax cuts,” former U.S. Surgeon General Richard Carmona said: “That’s a tough one. Here is the issue on the Bush tax cuts right now. If we– It’s a very complex issue, if we repeal them now, who gets hurt the most? If we just tax everybody, who’s going to get hurt the most? It’s the poor people and the middle class, okay. People who are making a good living they may pay a little more but their house is not going to be in jeopardy, they are still going to make their car payments, they are still going to take vacation. So I think what makes sense right now is if you did repeal it, repeal it so that you protect the middle and lower class, if you will, okay. But on the other hand, if others at the higher level get taxed temporarily, I don’t have a problem with that. But what really is needed is we need comprehensive tax reform.” [Carmona Remarks via PhoenixNewTimes.com, 9/17/12]

CBPP: Bush Tax Cuts Are Driving The Debt. According to the Center on Budget and Policy Priorities:

The complementary chart, below, shows that the Bush-era tax cuts and the Iraq and Afghanistan wars — including their associated interest costs — account for almost half of the projected public debt in 2019 (measured as a share of the economy) if we continue current policies.

[Center on Budget and Policy Priorities, 5/20/11]

CRS: Allowing Tax Cuts For The Rich To Expire Will Reduce Deficits “Without Stifling The Economic Recovery.” According to Reuters: “Letting tax rates for the wealthy rise will not put a short-term damper on the economic recovery, according to a report by the non-partisan research arm of the U.S. Congress. […] Republicans want the cuts continued for all income groups while Democrats favor letting them expire for the most affluent Americans. ‘If the economy is still weak, a temporary extension (of all the rates) will not harm the economy,’ despite adding to the deficit, the CRS report said, citing CRS economist Thomas Hungerford. But allowing the rates to rise just for the wealthy could help ‘reduce budget deficits in the short term without stifling the economic recovery.’” [Reuters, 7/19/12]

Repealing The Affordable Care Act Would Have Negative Consequences For Millions

Up To 6.6 Million Young Adults Would Lose Health Care Coverage Through Their Parents’ Plans. From the Los Angeles Times: “President Obama’s healthcare law helped as many as 6.6 million young adults stay on or get on their parents’ health plans in the first year and a half after the law was signed, a new survey indicates. […] Earlier surveys by the federal government found that the number of people ages 19 to 25 without insurance declined after the law was signed, reversing years of erosion in health coverage for young adults.” [Los Angeles Times, 6/8/12]

70,000 Americans With Pre-Existing Conditions Would Lose Insurance Coverage. According to the Department of Health and Human Services, as of May 31, 2012, 73,333 people were enrolled in the Pre-Existing Condition Insurance Plan (PCIP) created by the Affordable Care Act. [HealthCare.gov, 7/13/12]

5.2 Million People Would Have To Pay More For Prescription Drugs. From the Centers for Medicare and Medicaid: “As a result of the Affordable Care Act, over 5.2 million seniors and people with disabilities have saved over $3.9 billion on prescription drugs since the law was enacted. The Centers for Medicare & Medicaid Services (CMS) also released data today showing that in the first half of 2012, over 1 million people with Medicare saved a total of $687 million on prescription drugs in ‘donut hole’ coverage gap for an average of $629 in savings this year. […] Coverage for both brand name and generic drugs in the gap will continue to increase over time until 2020, when the coverage gap will be closed.” [CMS.gov, 7/25/12]

Over 35 Million Seniors Would Lose Access To Free Preventive Services. The Centers for Medicare and Medicaid Services [CMS] report that 35,106,598 people were enrolled in Medicare Part B in 2011. CMS also reports:

Beginning January 1, 2011, the Affordable Care Act eliminated Part B coinsurance and deductibles for recommended preventive services, including many cancer screenings and key immunizations. The law also added an important new service — an Annual Wellness Visit with a health professional — at no cost to beneficiaries.

According to preliminary numbers, at least 25,720,996 million Americans took advantage of at least one free preventive benefit in Medicare in 2011, including the new Annual Wellness Visit. This represents 73.3% of Medicare fee-for-service beneficiaries, including 2,404,792 African-American beneficiaries, 537,110 Hispanic beneficiaries, 104,393 American Indian beneficiaries, and 508,398 Asian-American beneficiaries. [CMS.gov, 2/15/12]

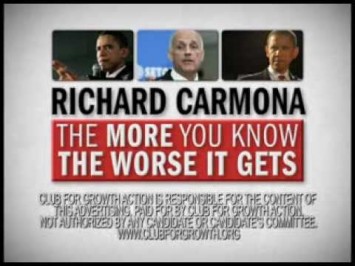

[NARRATOR:] How well do you know Richard Carmona? Do you know that Carmona says he has no problem with raising taxes? Do you know Carmona supports the Obama health care plan? Do you know that a vote for Carmona is a vote to put liberals in charge of the U.S. Senate? Richard Carmona: The more you know, the worse it gets. Club for Growth Action is responsible for the content of this advertising. [Club for Growth Action via YouTube.com, 10/2/12]