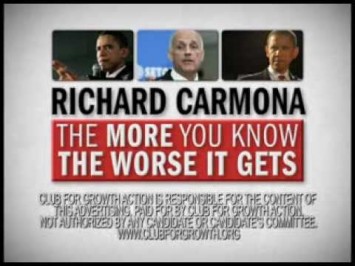

Club For Growth Action: “Know”

Club for Growth Action claims that former U.S. Surgeon General Richard Carmona, who is running for the Senate in Arizona, “has no problem with raising taxes.” But the conservative group’s claim relies on an out-of-context quote, in which Carmona explained that he would support repealing the Bush tax cuts for the wealthiest Americans as long as “you protect the middle and lower class.” According to nonpartisan analysts, ending tax breaks for top earners would reduce the deficit without harming the economy.

Read more after the jump.